- Cardano price to surge to $0.49 resistance zone from the building bullish momentum.

- Metrics indicate a growing bullish trend from increased whale activity and social volumes.

As a seasoned crypto investor with a keen eye for market trends, I’m bullish on Cardano (ADA) in the near term based on the building momentum and growing bullish trend indicated by various metrics.

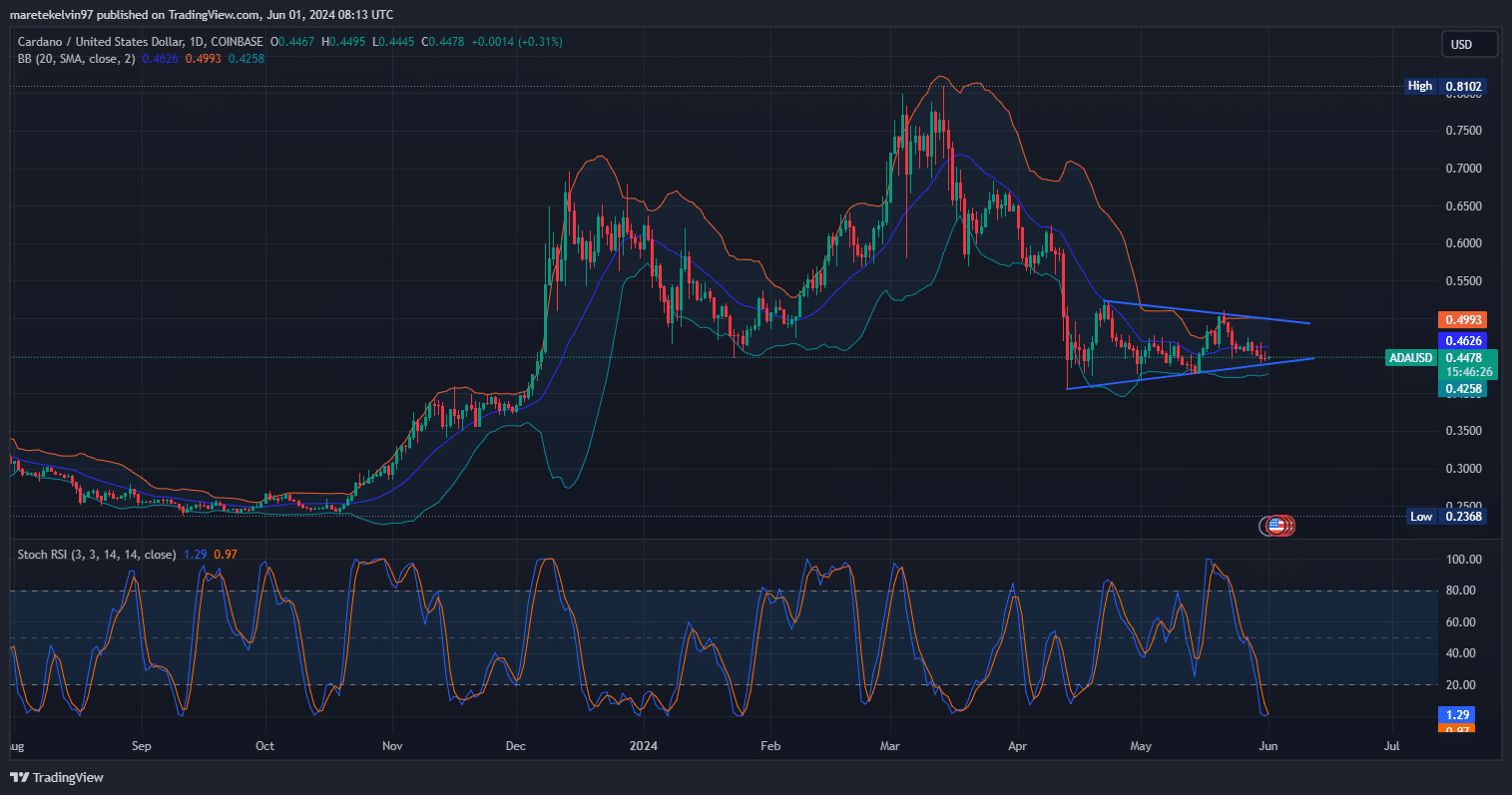

In simpler terms, the cost of Cardano (ADA) has been stabilizing in an evenly balanced manner over the past three months. At present, the price is hovering near a significant support point, approximately $0.44. Buyers are making efforts to boost the price at this critical juncture and prevent any further declines.

If the purchasing power pushes Cardano’s price over the moving average line of its Bollinger bands, it could lead to a rise towards the resistance level of the symmetrical triangle, which has previously been tested on two occasions within the last three months.

If the purchasing force fails to lift the price above the moving average, it’s possible that the selling force will cause the price to fall below the support level, approximately at $0.44. Afterward, it might continue downward to challenge the next resistance, around $0.42.

The Stochastic RSI at 1.9 indicates an oversold in the market signaling a bullish momentum.

At present, based on CoinMarketCap’s data, Cardano is valued at $0.44. This represents a minimal 0.04% rise within the past 24 hours but a more substantial 3.44% drop over the last week.

The market volume stands at 35.7 billions ADA a 1.62% increase in the last 24 hours.

Cardano whales move in

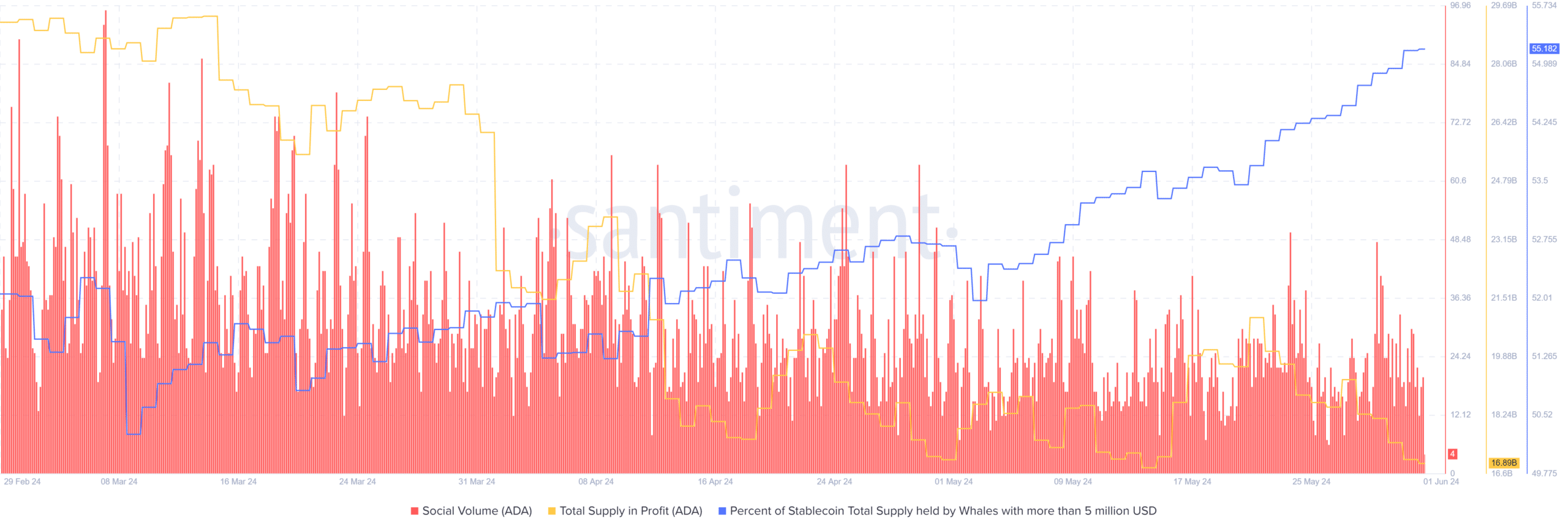

Based on AMBCrypto’s interpretation of Santiment’s data, there were notable increases in social activity surrounding ADA during early June, late March, mid-April, and late May.

These peaks signify increased engagement and heightened social buzz around ADA, potentially resulting in a price spike.

In simpler terms, the Total Supply’s downward trend on the profit chart has been evident for the past three months. At the same time, the amount of Total Supply owned by Whales, with a fortune exceeding $5 million, has consistently grown over the last three months.

This suggests a strategic whales’ position for future buy options.

Over the past three months, there has been a noticeable uptick in social activity surrounding ADA, accompanied by declining profits for smaller investors and growing hoards of large investors. This trend creates a potential buying opportunity that could build significant pressure towards the resistance level of the symmetric triangle formation.

Read Cardano (ADA) Price Prediction 2024-25

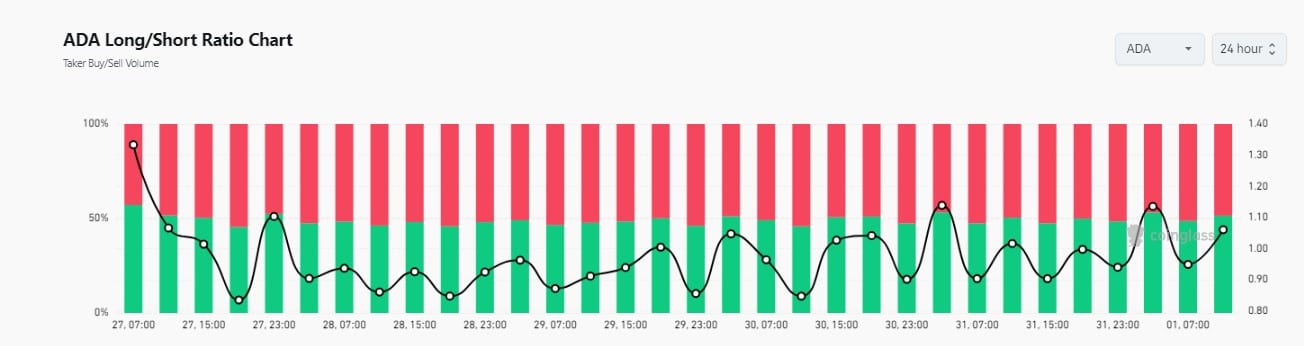

Based on an in-depth examination of Long/Short Ratio data from Coinglass, AMBCrypto uncovered that the cryptocurrency market is highly volatile, featuring frequent fluctuations in investor sentiment.

As a crypto investor, I’m constantly engaged in buying and selling cryptocurrencies alongside my peers. However, it’s important to note that none of us holds complete market control. Whales, or large-scale investors, can significantly influence the market trend by their activities, especially when the bullish momentum is gaining ground.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

2024-06-02 04:07