-

ADA declines with 7.43% in & days With a strong bearish trend.

Key indicators suggest a continued bearish bias as ADA attempts to create another support level.

As an experienced analyst, I’ve closely monitored Cardano (ADA) and its recent price movements. Over the last 30 days, ADA has declined significantly, with a 7.43% drop in the last seven days. The current trend is undeniably bearish, as indicated by various key indicators.

Over the past month, the value of Cardano (ADA) has dropped. In the last week alone, there’s been a 7.43% decrease in price. At the moment of writing, ADA was being exchanged for $0.4074 with an enhanced trading volume of 15.32%, totaling $213 million within the previous 24 hours.

According to coinmarketcap, ADA has a market cap of $14.5b, a 1.13% increase in 24 hrs.

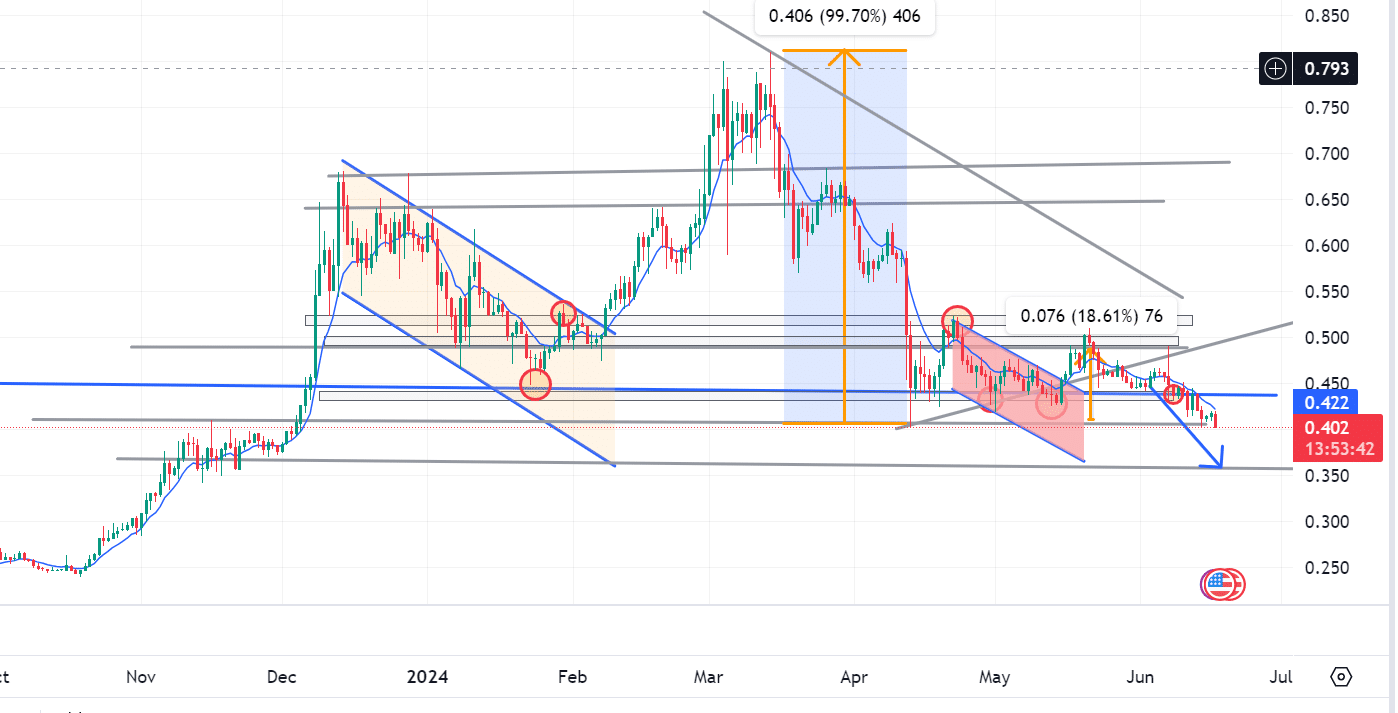

As an analyst, based on my analysis at AMBcrypto, I can tell you that I believe the price of ADA may experience a downturn. Should it fall below the support level of $0.406, this could establish a new, lower support level for the cryptocurrency.

As an analyst, I would interpret the market’s current trend as bearing a persistent negative outlook, or in other words, a deep-rooted bearish bias. This stance is likely to persist until a significant level of support appears around $0.356, at which point the market dynamics may shift.

As a crypto investor, I’ve noticed that a potential reversal could take place around the $0.403 mark. If this occurs, we might expect prices to bounce back up towards $0.487. However, it’s important to keep in mind that the current market trend is bearish and shows no signs of letting up just yet.

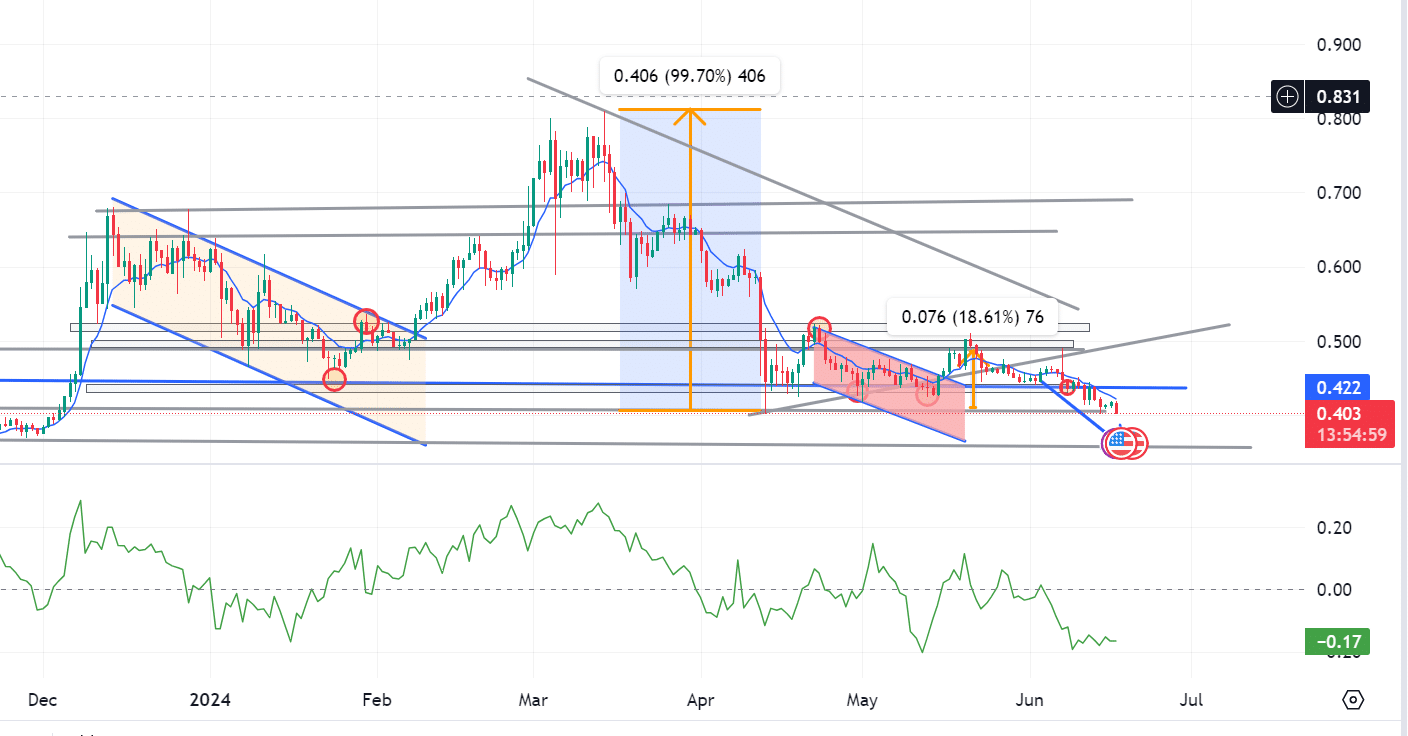

At the current moment, the Cumulative Moving Fundamental (CMF) value for ADA stands at -0.15. This signifies increasing selling pressure for the asset. Typically, when the CMF is negative, it’s an indicator of a strong downtrend that could persist further.

With a higher selling pressure, prices decrease as there are more sell-offs than buying.

ADA market sentiments

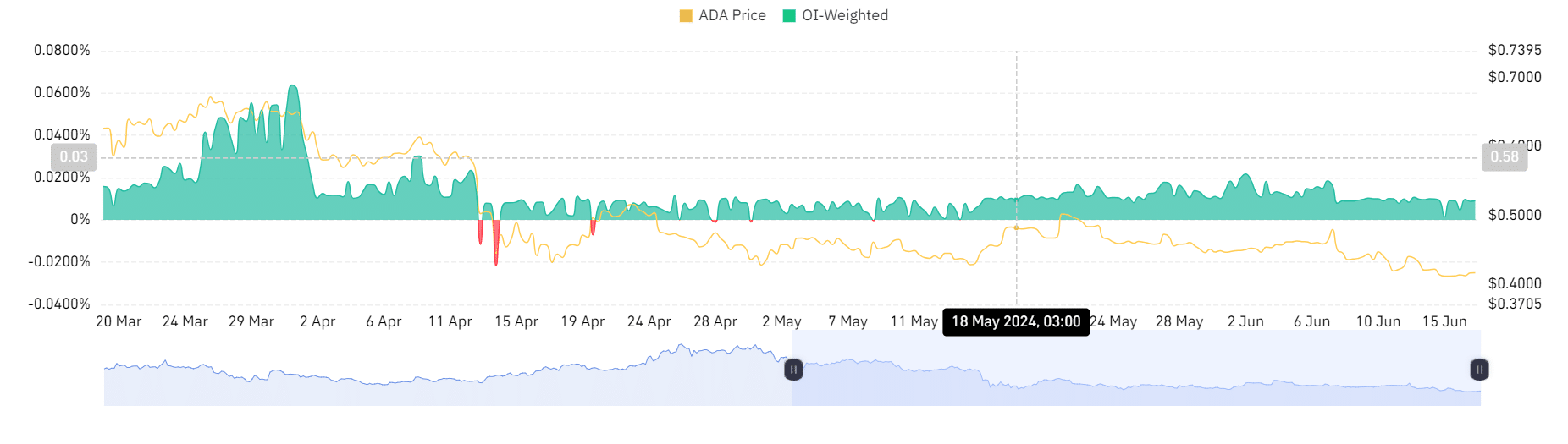

Based on Coinglass’s report, the ADA-adjusted funding rate has decreased. Normally, a decrease in funding rates means that short sellers are paying more to hold their positions compared to long holders. This can be interpreted as a bearish sign, indicating a pessimistic outlook for the market.

When futures are trading at a discount to the spot, it puts downward pressure on prices.

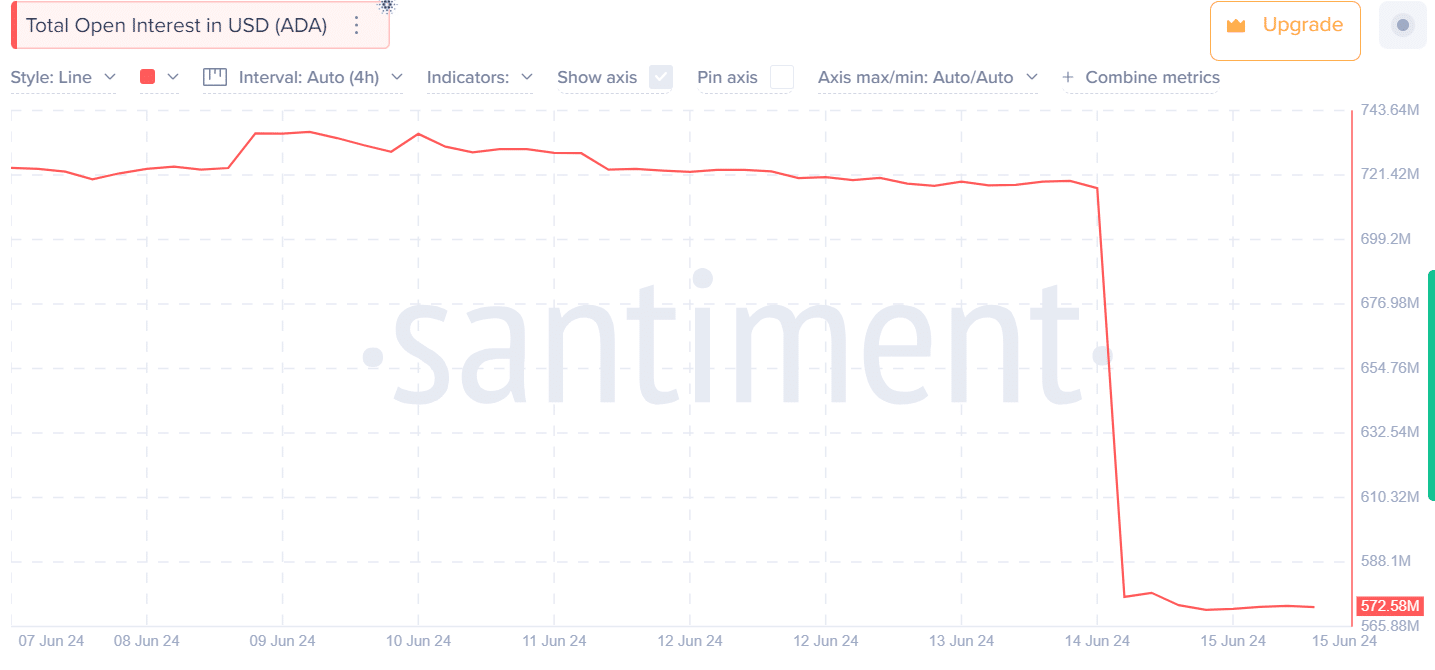

As a researcher studying the cryptocurrency market, I’ve observed that according to Santiment’s data, the total open interest in Adana (ADA) expressed in US dollars has decreased. This reduction in open interest implies fewer trades taking place in futures markets. Consequently, the order books for ADA become thinner due to the lack of substantial buy and sell orders.

As a crypto investor, I’ve noticed that shifts in market sentiment can result in heightened volatility when it comes to trading volumes. This volatility often suggests a bearish trend, with many investors being forced to sell due to various reasons, such as stop-loss orders being triggered or margin calls being issued.

How far can ADA fall?

Several signs point to a downward trend for ADA, with a break below the $0.403 support mark likely reinforcing this bearish outlook.

With a shift in structure or the introduction of a new tier, the market is expected to undergo a turnaround.

In this scenario, a possible price reversal could drive the market up to $0.489, establishing a new resistance point at $0.505. Nevertheless, as long as the market structure continues its downward trend, the overall sentiment will stay bearish.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-06-17 23:03