On a gray Monday, Cardano’s price sank, shrugging off the monumental feat that was—the bridging of Bitcoin, that most stubborn of coins, to Cardano’s own stubborn blockchain. The world gasped, or at least pretended to, while Cardano (ADA) slipped to $0.6595. Down 12.3% since April’s smile, off by half since the giddy heights of early 2024. All of this, just as Bitcoin, the altcoins, and even the torpid stock market tumbled together, apparently haunted by the spectral fear of a 100% tariff on foreign films. Yes, that’s right: blockchains bent at the knee because someone threatened to rebirth American cinema. Where is Eisenstein when we need him?

But the “ADA-geddon” came on the heels of a digital revolution: Cardano, forever the underdog in the alley, is now snarling at the big table of Bitcoin staking. BitcoinOS, with the pride of a shoemaker-turned-prince, declared its triumph: the first bridgeless transfer of BTC between Bitcoin and Cardano. The crowd went wild—well, as wild as cryptographers on Twitter go.

It began in the mines: one poor Bitcoin was locked on Layer 1, bound in the invisible chains of BitSNARK. Transformed—no, wrapped—into xBTC, a shiny, cryptographic trinket, designed to look as luscious as wETH for those that fancy Ethereum’s decadent quirks.

With trembling hands and a wizard’s hat, developers then dispatched their shiny 1xBTC from the Bitcoin wallet to Sundial’s Cardano purse. And—lo!—not a single bridge or greasy custodian in sight… only true decentralization, the digital equivalent of riding bareback into the sunset on a blockchain steed.

Cardano, meanwhile, dreams big: perhaps this magic trick will stuff more assets into its digital mattress, boosting network might and on-chain fortune. Or maybe it just wants bragging rights at the next cypherpunk gathering in a leaky Moscow tavern.

BOSes – we did it.🟧🧙♂️

On May 4 2025, we successfully demoed the first bridgeless transfer of BTC between Bitcoin and Cardano mainnet. 🟠🤝🔵

Performed with @SundialProtocol and @adahandle, using our all-new unchained token standard.🔓

Here’s what happened. 🧵👇

— BitcoinOS (@BTC_OS) May 5, 2025

The universe of Bitcoin staking mushrooms as every DeFi architect rushes to wring productivity from the world’s idlest coins. DeFi Llama, oracle of this strange new land, counts 58 protocols with nearly $10 billion locked—Babylon, Lombard, Solv—each with delusions of grandeur and dreams of making bitcoins leap and dance.

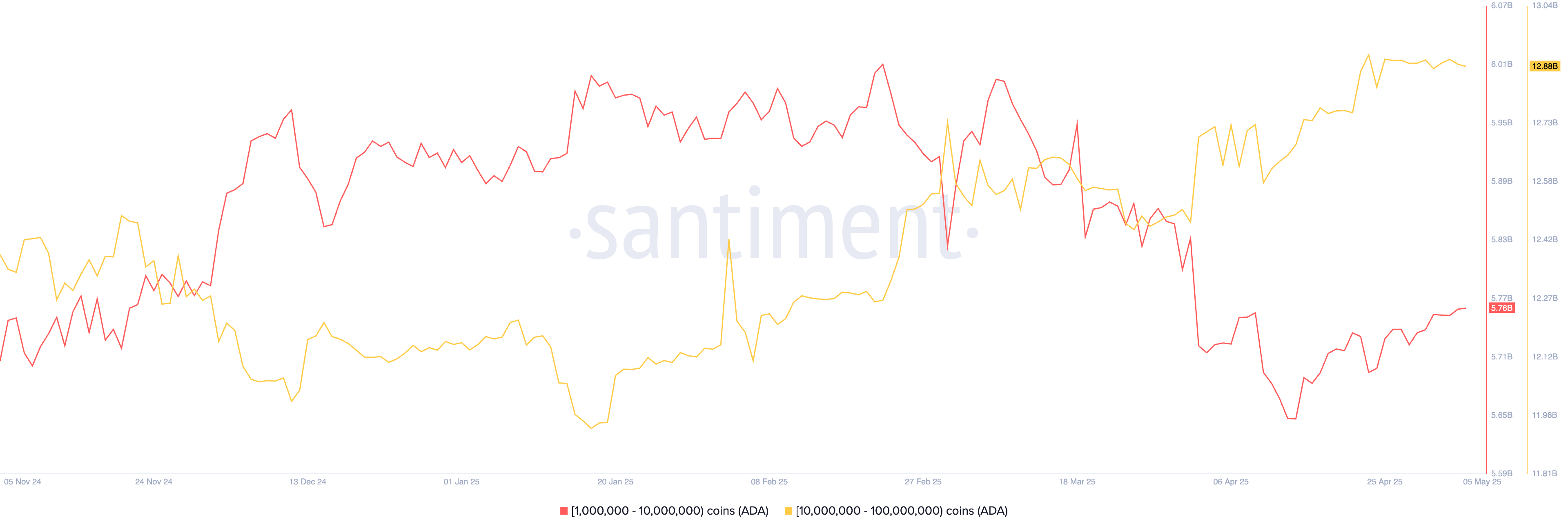

As for Cardano, there’s a twist fit for a Gorky tale: the “whales”—those mighty wallet-holders—are accumulating ADA even as its price stumbles. Between 1 million and 10 million ADA, these captains of industry have grown their stash to 5.76 billion from last month’s trifling 5.65 billion. Wallets with 10 million to 100 million ADA? They’re now clutching 12.8 billion, because why not double down when things look bleak? Truly, optimism is the last refuge of the rich.

Cardano price technical analysis

The daily chart, as somber as a factory floor at midnight, reveals ADA slinking from the $1.328 high of November to a mournful $0.657. A descending channel forms—a prison or merely shelter from the storm? Attempts to leap above the upper wall have failed, buyers as timid as mice scared of their own shadows.

The price now cowers below the 61.8% Fibonacci retracement, and beneath the cold blue 100-day Exponential Moving Average. Even the Relative Strength Index, exhausted by endless struggle, has slid meekly under neutral 50. Should ADA remain below the channel and outside the EMA’s embrace, it will shuffle under pressure, dreaming of past glories. If the bearish wind blows harder, a further drop to $0.50 awaits—another chapter in the long novel of crypto tragedy (with a possible surprise ending, but who reads all the way to the end these days?).

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-05-05 19:35