- Cardano, at press time, was range-bound but it cleared a significant short-term resistance

- Daily active addresses have held up well, despite the price’s downtrend since April

As a seasoned crypto investor with a knack for spotting trends and understanding market behavior, I find myself intrigued by the current state of Cardano [ADA]. Despite its range-bound price action, it has managed to clear a significant short-term resistance, which could be a promising sign. The daily active addresses have held up well, even during the downtrend since April, suggesting robust network participation.

💥 EUR/USD Faces Historic Test Amid Trump Tariff Turmoil!

Market chaos looms — top analysts release an urgent forecast you must see!

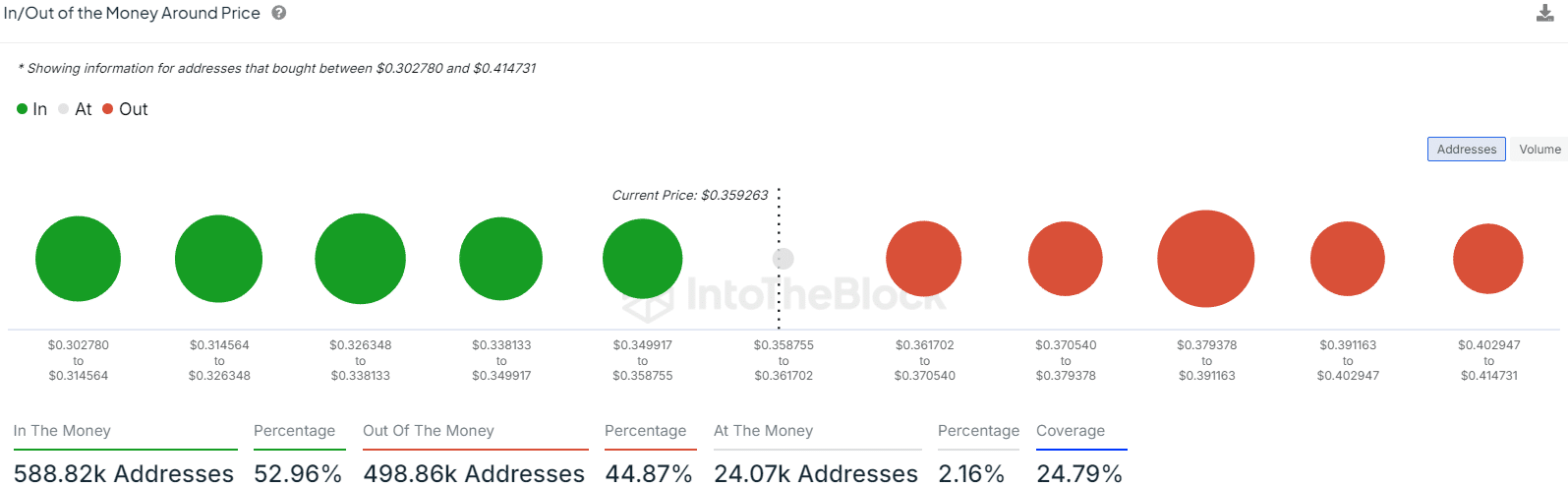

View Urgent ForecastPreviously, it was unveiled that about 76.59% of Cardano [ADA] owners found themselves in an unfavorable position, being “out of the money.” However, these figures seemed more promising when considering the holders who were near the coin’s market price at the time of the report.

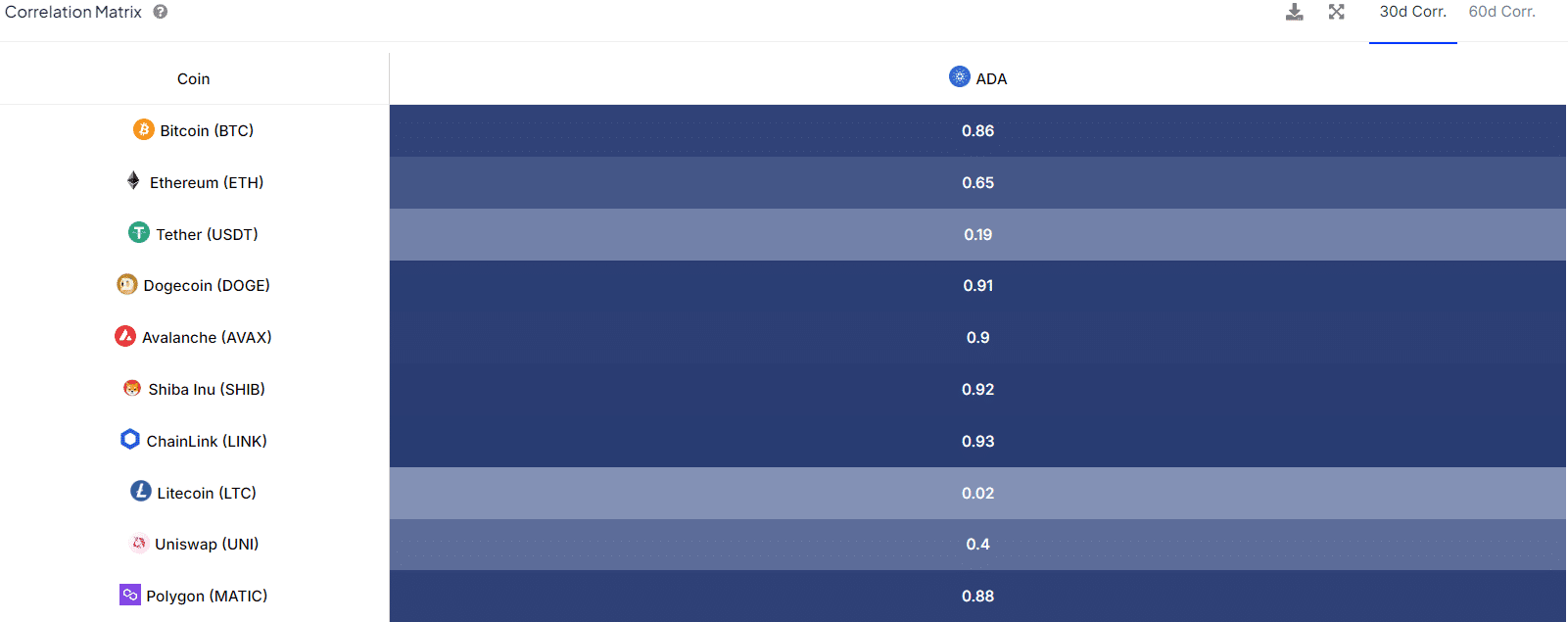

A strong correlation of 0.86 between Bitcoin (BTC) and Cardano (ADA) suggests that ADA traders should also monitor the movements of the leading cryptocurrency closely. While there’s a positive correlation with Ethereum (ETH), it is weaker, which could be considered slightly good news given ETH’s subpar performance in recent times.

Outlining key levels for Cardano

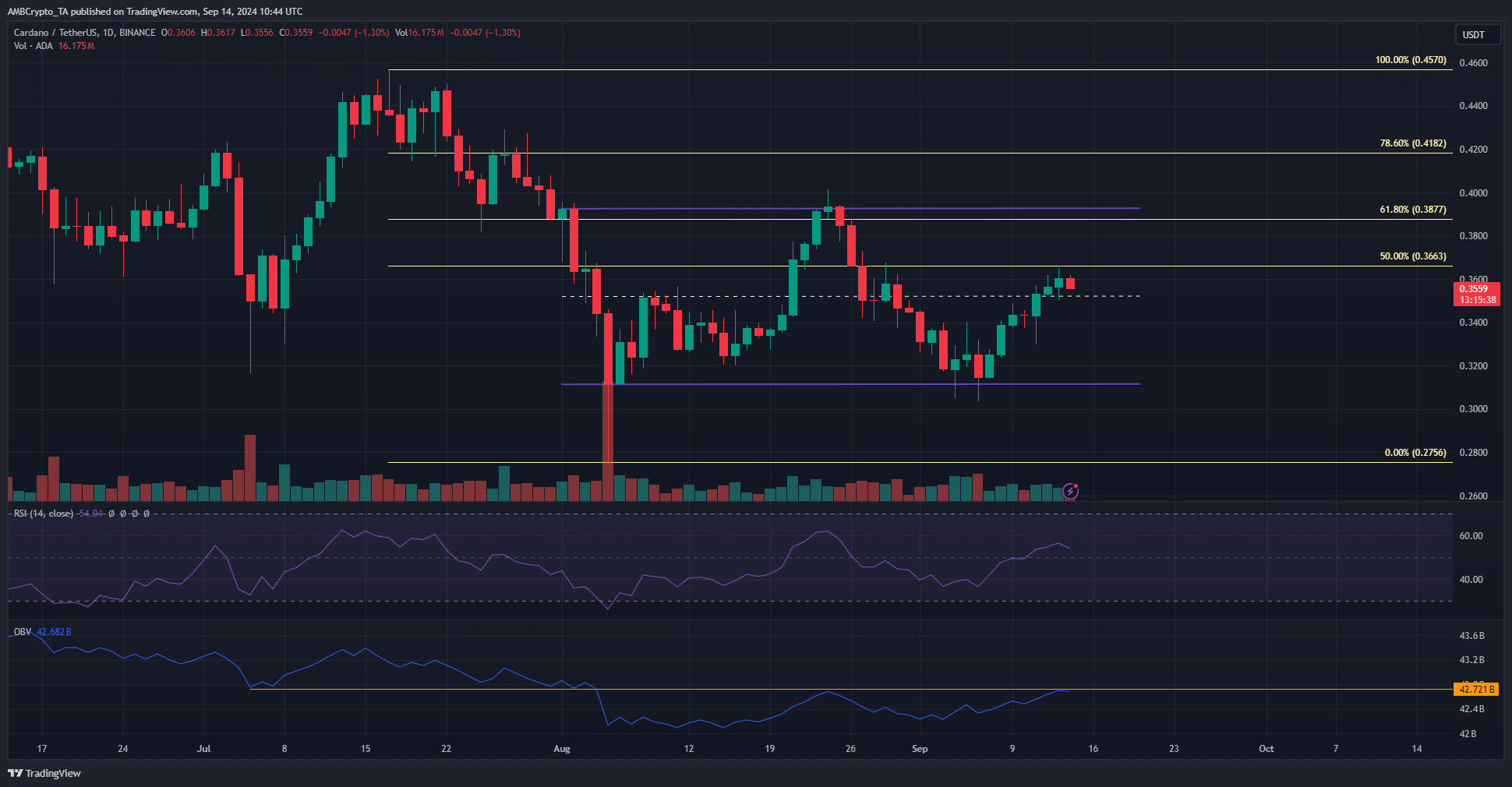

Lately, Cardano’s price movement has been rather lackluster, with a trading range between $0.311 and $0.393 in effect since early August. The middle point of this range, at $0.352, was breached a few days back. However, the bulls might find it advantageous to hold the line as potential support when the price retests it.

Over the last month, the OBV (On-Balance Volume) has been gradually increasing and appears close to reaching a new peak. Additionally, the daily RSI (Relative Strength Index) suggests a shift in bullish momentum. As a result, traders of ADA may expect an uptrend that could potentially push its price up towards $0.39 – $0.4 on the charts.

As an analyst, I’ve examined the current market situation and identified some crucial short-term price levels. Specifically, the ranges between $0.326 and $0.338, as well as $0.35 and $0.358, appear to serve as strong support zones. Conversely, the area around $0.379 to $0.391 is a significant resistance or supply zone. These levels align quite nicely with the observed price movement patterns on the chart.

On-chain metrics reveal potential market bottom

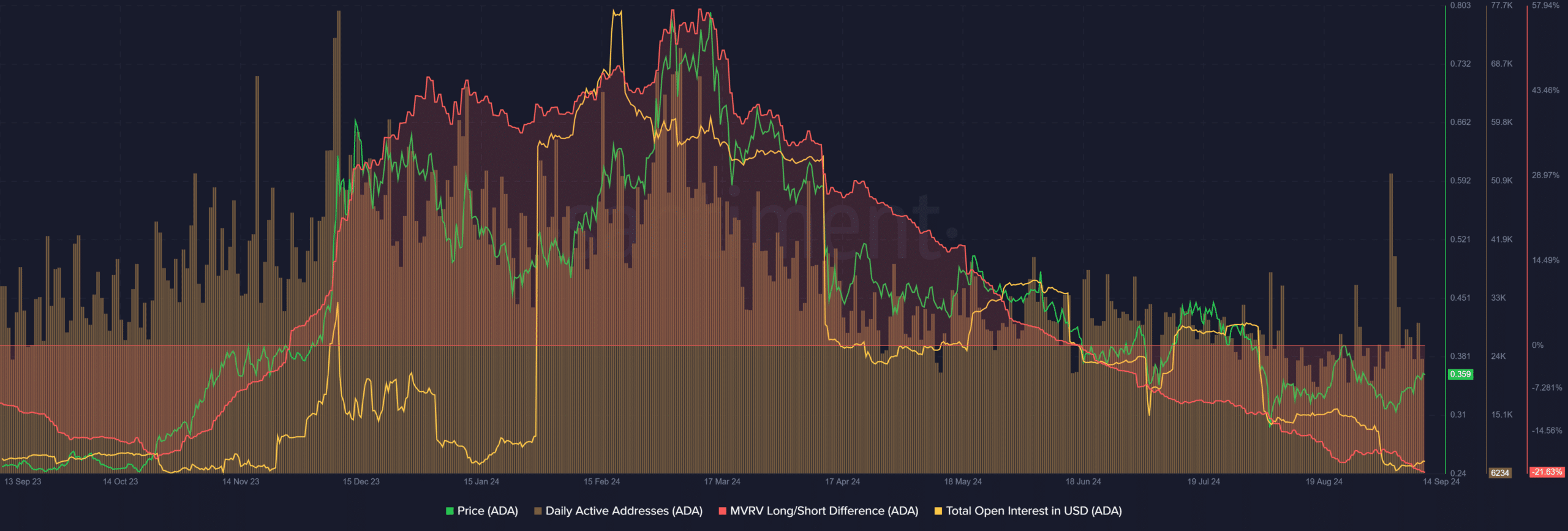

In simpler terms, the gap between the Market Value to Realized Value (MVRV) for a 365-day period and a 60-day period is what we call the MVRV long/short difference. When this difference is negative, it indicates that long-term holders are currently experiencing larger losses compared to short-term holders.

As a crypto investor, I’ve noticed a significant dip – it’s fallen below the low it reached in October 2023. This could be an indication that we might be seeing a potential market reversal for Cardano. Interestingly, the daily active address metric has remained fairly consistent since April, even amidst this price downtrend.

In simpler terms, if the market mood becomes optimistic and prices start to rise, active engagement in the network could yield benefits. However, the decreasing number of open trades suggests that speculators are still hesitant about a significant upward trend.

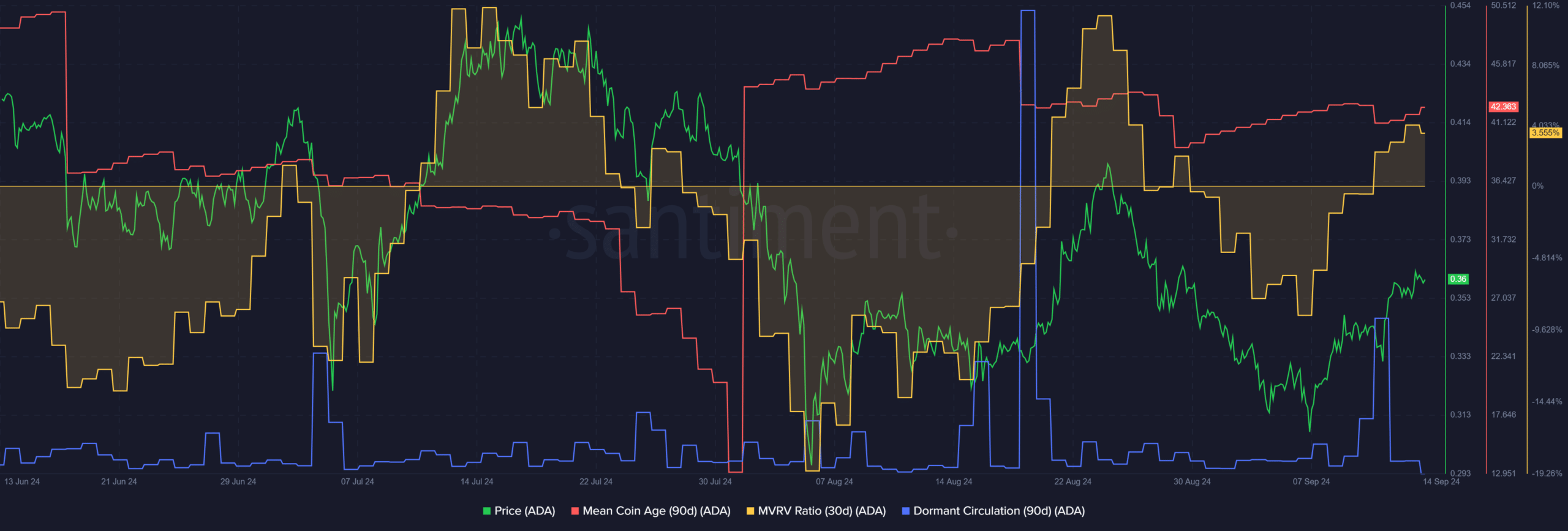

Currently, despite Cardano potentially being close to a long-term market minimum, it might appear slightly overpriced in the short term. At this moment, the Market Value to Realized Value (MVRV) ratio over the past 30 days is positive, suggesting there could be selling pressure due to profit-taking activities among investors.

Is your portfolio green? Check the Cardano Profit Calculator

Additionally, the average age of the circulating coins did not show a clear upward trend, but it has gradually increased over the last three weeks. Furthermore, a surge in circulation on September 11 remained dormant, causing a temporary drop in price, however, Cardano (ADA) swiftly bounced back from this dip.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-09-14 18:18