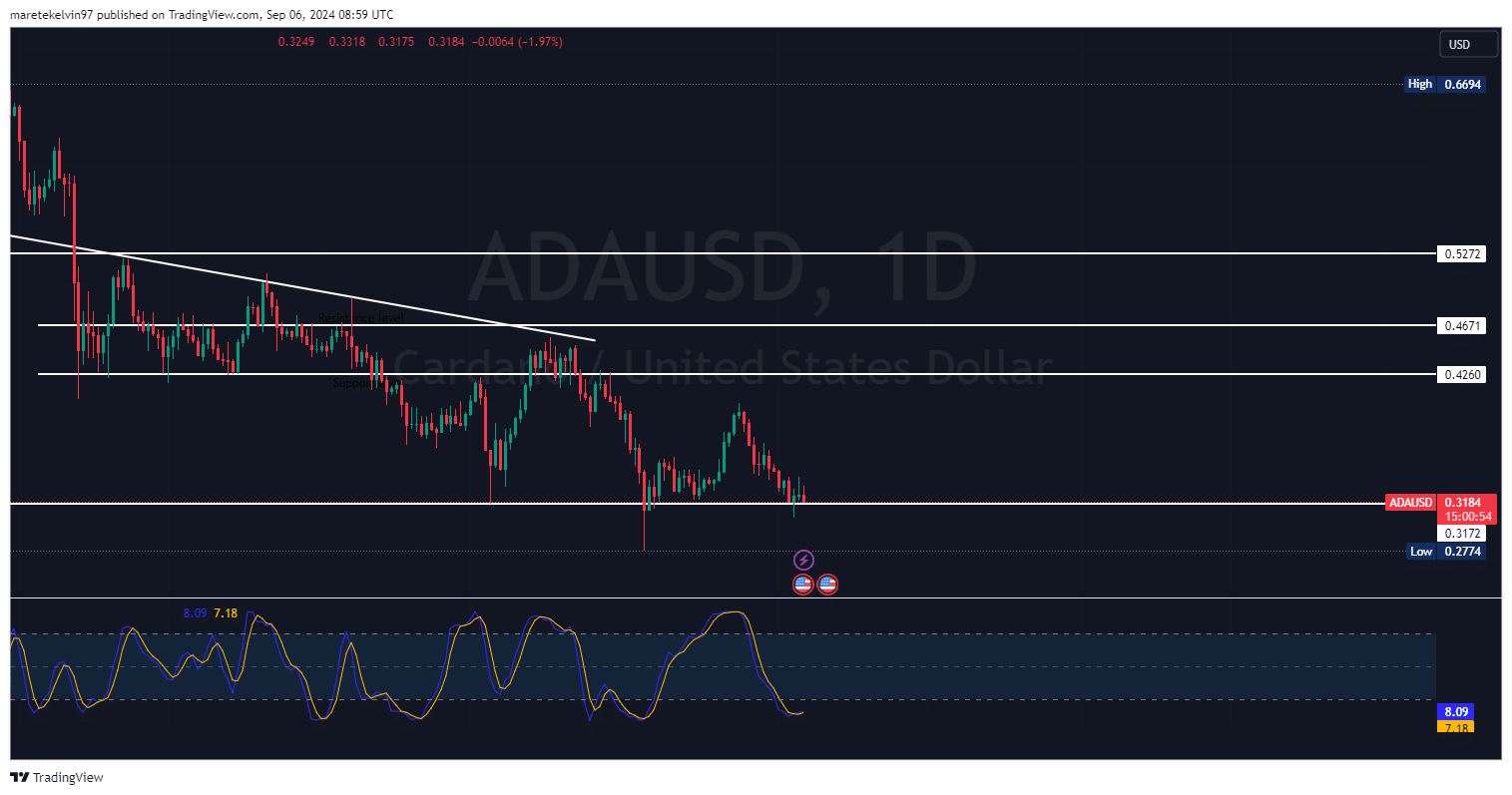

- Cardano was trading near a critical support level at $0.3172.

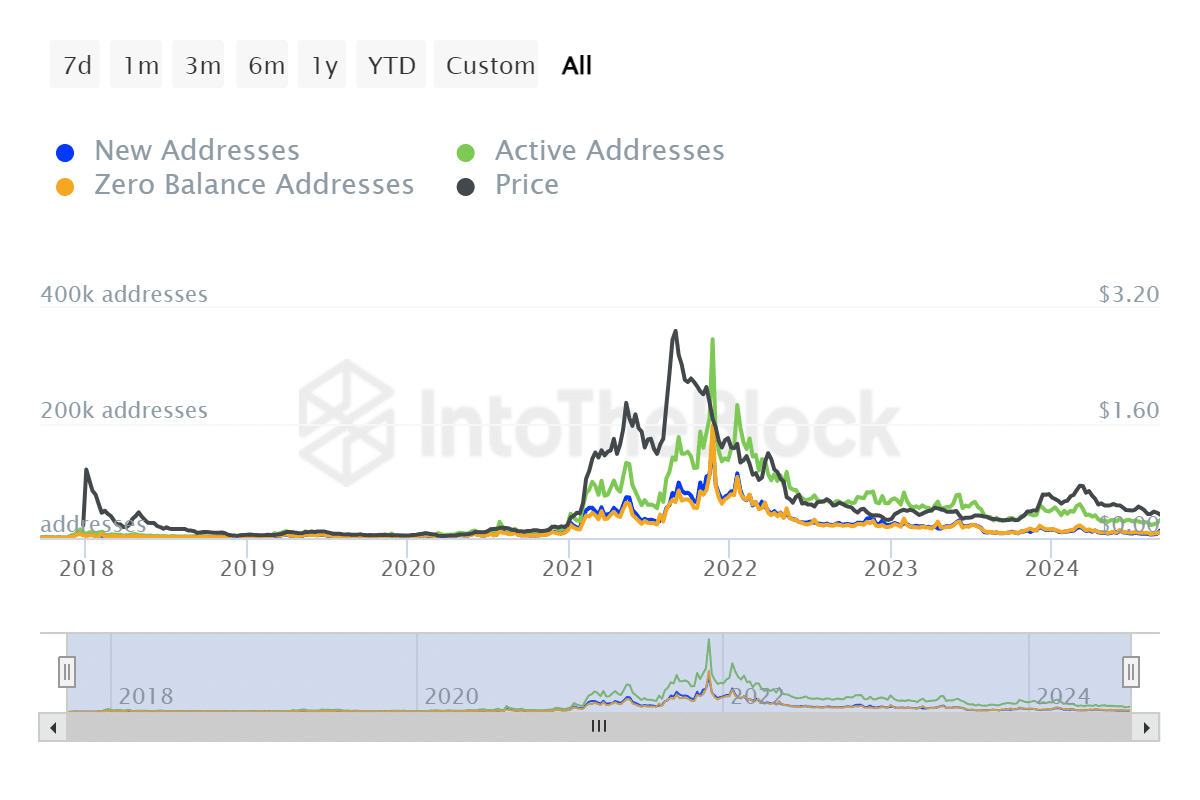

- Metrics signaled a growing market interest.

As a seasoned analyst with years of experience in the cryptocurrency market, I see Cardano [ADA] at a critical juncture. The price dip over the past week has been concerning, but the growing interest and whale activity suggest that we might be on the brink of a turnaround.

In the last day, the value of Cardano’s [ADA] has dropped by approximately 1.47%. Over the course of the last week, however, there has been a more significant decrease of around 11.04%.

Currently, the total value of all shares in circulation is approximately $11.7 billion, a decrease of about 1.40% as reported by CoinMarketCap.

At the current moment, the trading volume significantly increased by 29.46%, reaching $320.634 million, suggesting heightened market activity during this price decline.

Key support level is still solid

Currently, at the present moment, Cardano was found close to an important resistance point approximately at $0.3172. Historically, this point has carried significance, potentially serving as a region where prices might rebound.

On the contrary, ADA‘s current price is under a falling trendline, potentially indicating increased selling pressure if this support level breaks.

If the price falls beneath the current support level, it may trigger a downtrend continuing towards the next potential support at $0.2774.

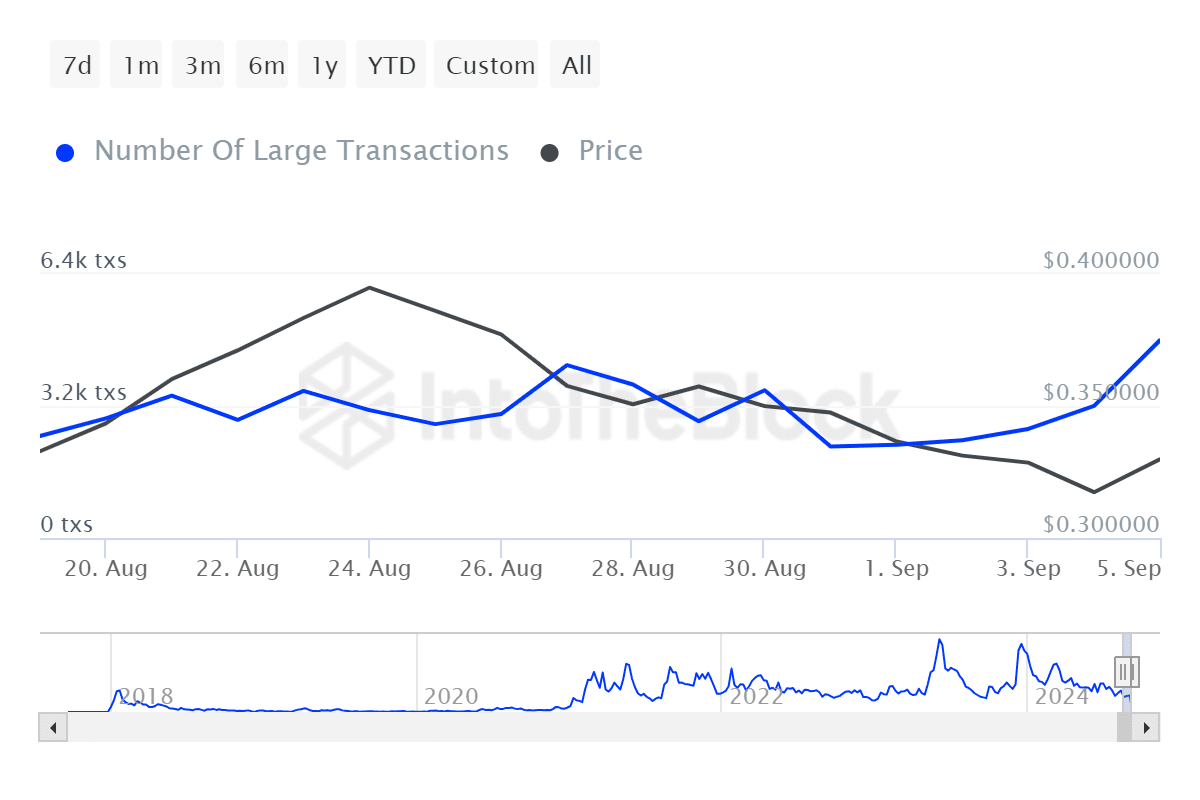

Whales on the move

Over the past day, I’ve noticed a significant jump of 8.56% in larger transactions within the crypto market. This could suggest that seasoned investors might be readying their positions, anticipating possible price fluctuations.

As I observe the recent spike in whale activity, I find myself hoping that this trend persists, especially if it’s accompanied by accumulation at more affordable price points. This could potentially bring a sense of balance and stability to the market.

Moreover, the notable surge by 109.41% in active wallets implies that Cardano is experiencing a surge in popularity, potentially fueling speculation and increasing both investor interest and transactional activities.

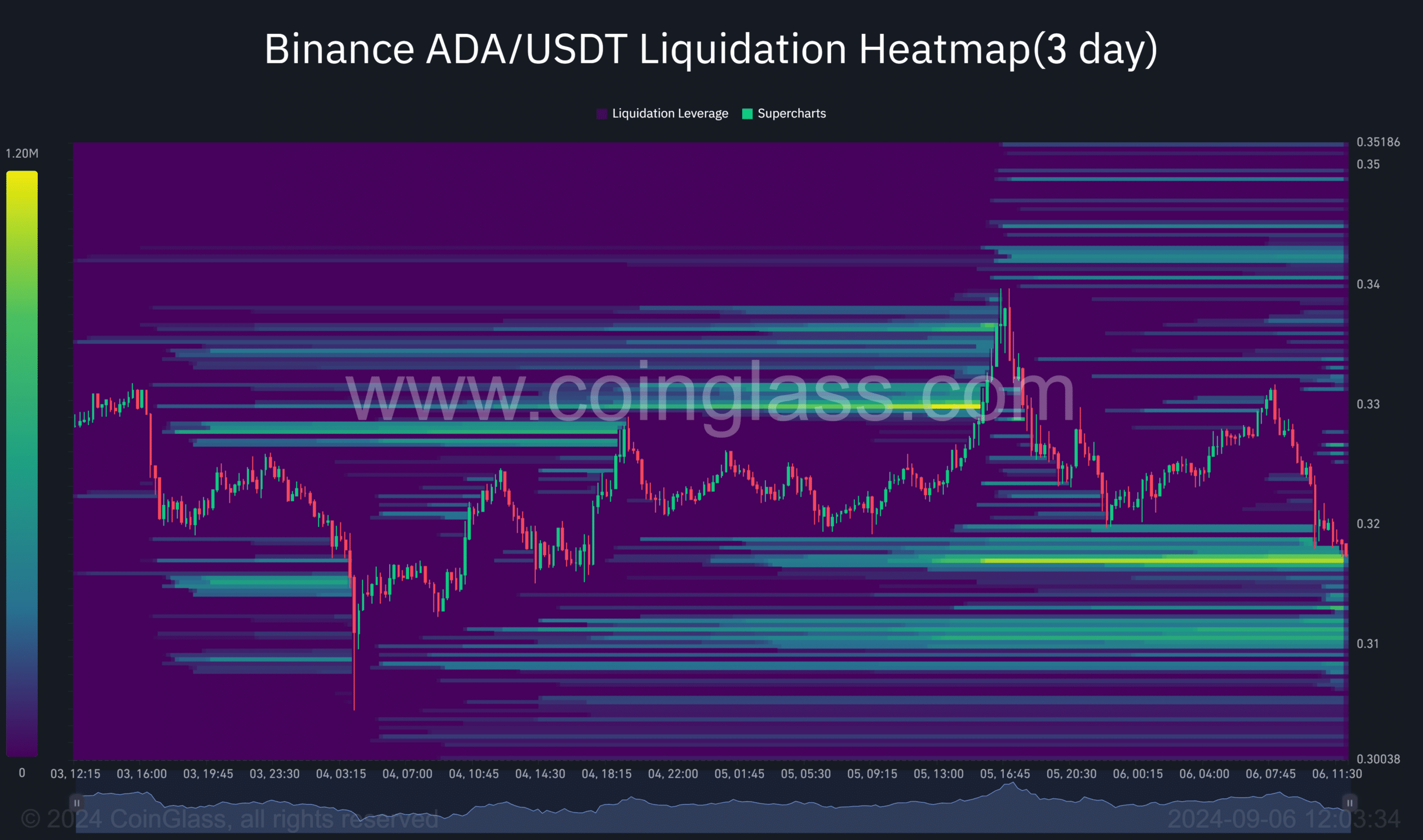

Cardano liquidation risks

Currently, a significant selling reserve valued at approximately 990,000 units of Cardano has been identified. This could indicate a possible escalation of sell-offs should the prices continue to fall.

Analysis of liquidation heatmap data from Coinglass indicates a predominantly bearish trend, potentially pulling prices down towards the $0.3169 mark prior to a potential bullish surge.

Technical indicators hinted at a potential market reversal

Technically speaking, the Stochastic Relative Strength Index for Cardano suggests it’s currently in an overbought region, but a possible bullish reversal could be imminent.

Read Cardano’s [ADA] Price Prediction 2024–2025

If buyers enter the market, this situation could indicate a potential price rebound, as they might be taking advantage of undervalued conditions.

Unless Cardano (ADA) experiences a substantial upward shift surpassing its present support level of $0.3172, the general trend is expected to remain bearish, with potential resistance levels lying ahead.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-09-07 09:11