-

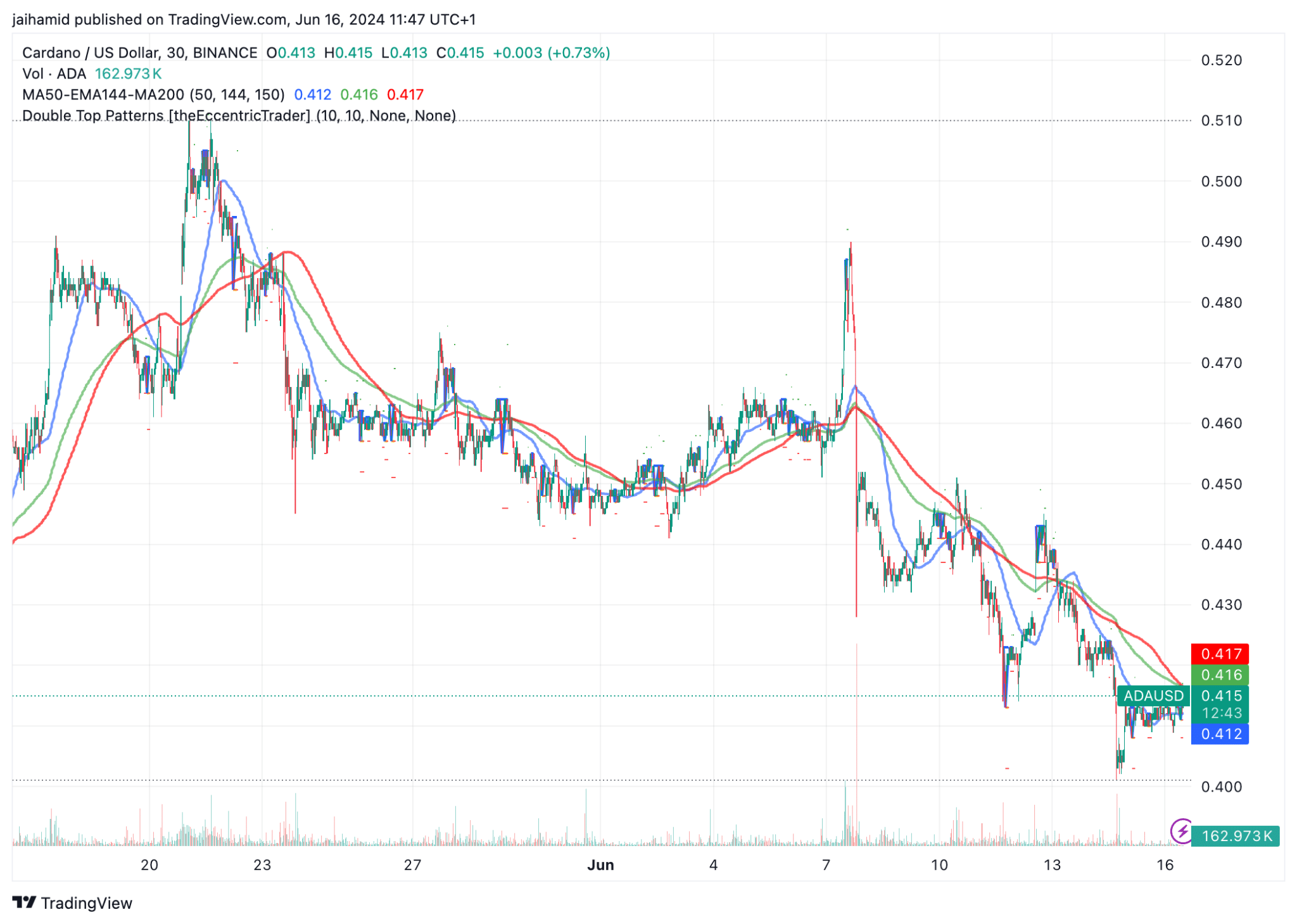

ADA’s price trended bearishly, with consistent lower highs and numerous double-top formations.

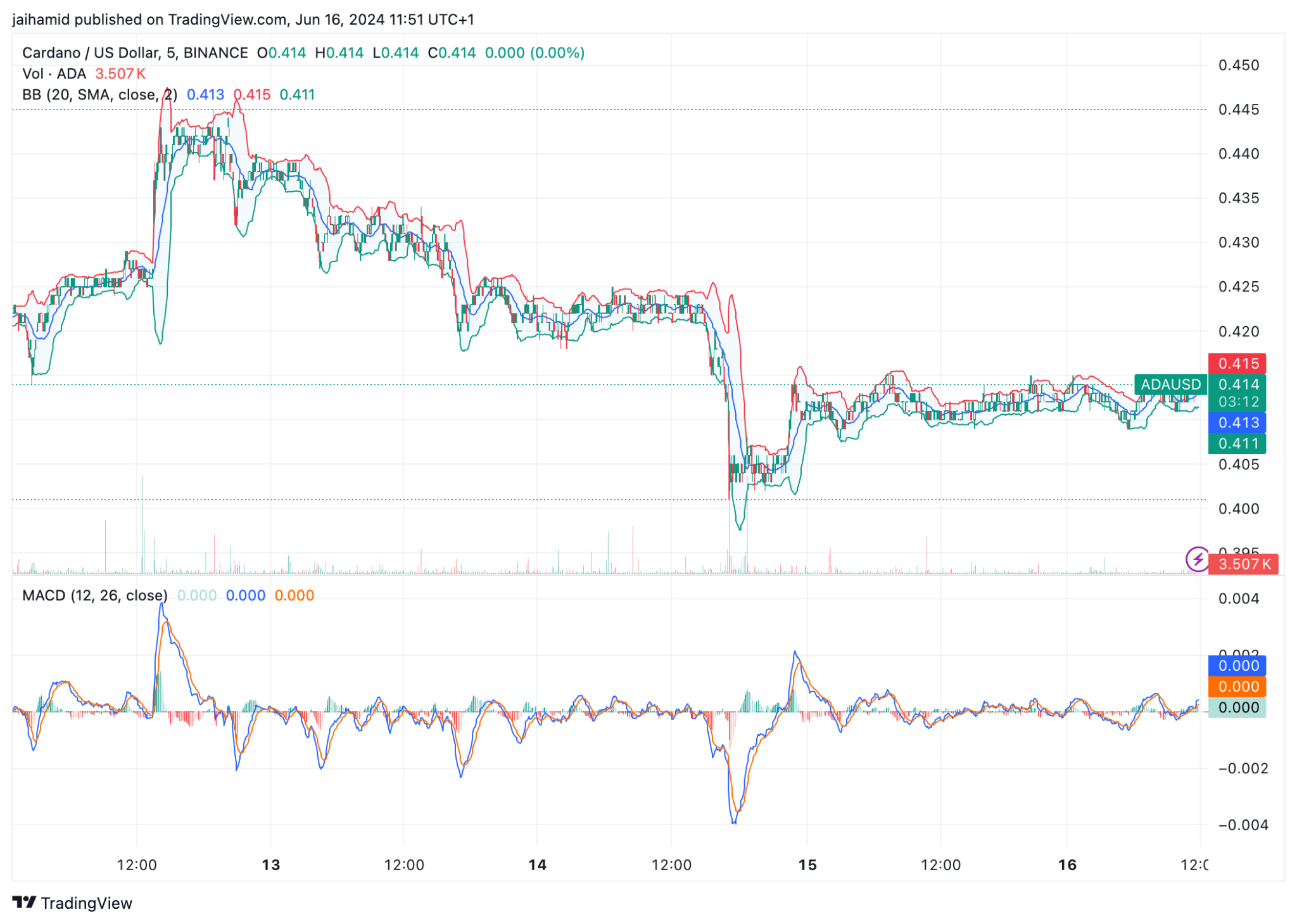

A tight Bollinger Bands and a flat MACD point to low volatility.

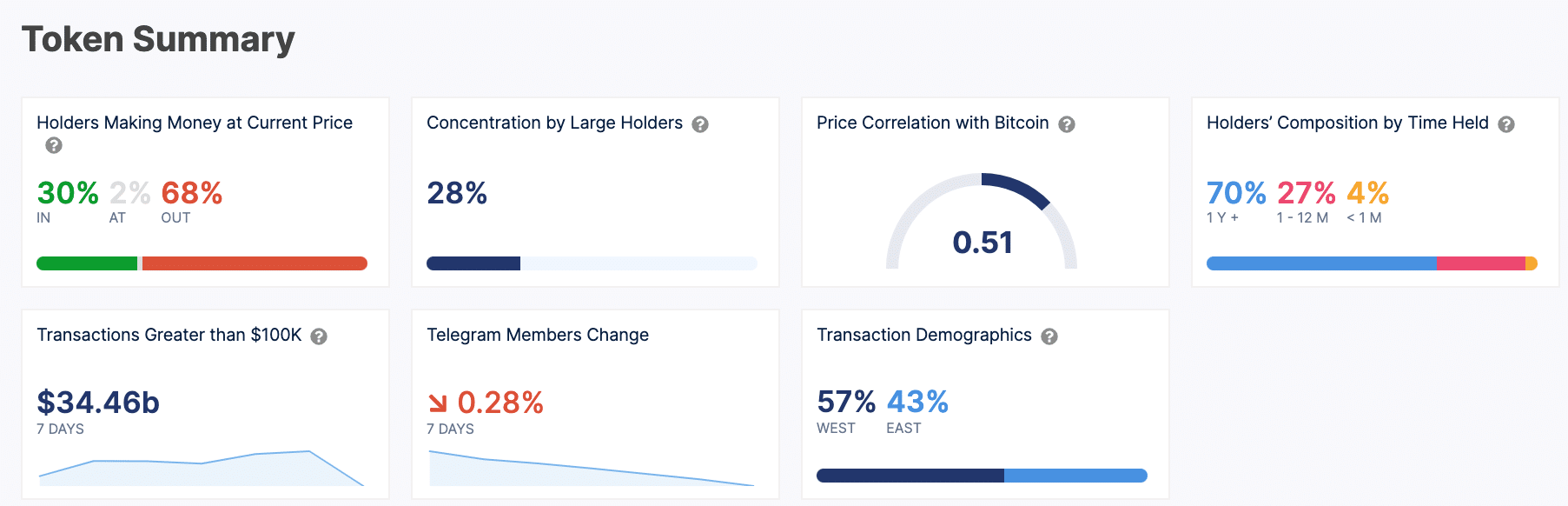

As an experienced analyst, I’ve closely monitored Cardano (ADA) and its price trend over the past month. Despite bearish sentiments and consistent lower highs, ADA has shown signs of strong support from on-chain data and an increase in total value locked (TVL) in DeFi applications. However, a significant portion of the market is currently experiencing losses, with only 30% of holders in profit.

Although Cardano‘s [ADA] performance over the last month has been lackluster, there are indications of robust backing based on on-chain data.

Additionally, the Decentralized Finance (DeFi) network has experienced a significant increase in the amount of assets deposited within it, surpassing previous record highs set during the 2021 cryptocurrency boom.

Based on the data from IntoTheBlock, approximately 70% of ADA investors are presently facing losses, as just over 30% currently enjoy profits.

As an analyst, I would observe that approximately one quarter of ADA‘s supply is in the hands of large investors. This degree of concentration among big players implies a notable level of control over the token’s price movements. Consequently, such influence could potentially increase the likelihood of price stability, but also heighten the risks of manipulation.

Of ADA’s large scale investors

Over the last 7 days, the significant trade volume of approximately $34.46 billion in large deals indicates substantial institutional or major investor activity within ADA. This activity could represent both purchases and sales, signaling considerable involvement in the cryptocurrency market by influential players.

At the current moment, the price of ADA was on a downward slope, marked by progressively lower peak prices since early June. This price decrease mirrored the prevailing pessimistic market outlook.

The Bollinger Bands on this chart are relatively tight, often suggesting low volatility.

The price of ADA hovers near the middle line on its moving average chart, indicating weak buying or selling pressure and suggesting a period of sideways movement.

The MACD indicator was hovering at the zero line, reflecting a neutral stance by the moving averages.

Multiple double-top patterns appeared on the following chart, often interpreted as signs of bearish reversals.

As an analyst, I would interpret the situation from a first-person perspective as follows: The current price of ADA falls short of all the moving averages, indicating a potential bearish trend. These moving averages act as crucial benchmarks, and when the price hovers below them, it usually signifies that the market momentum is shifting downward.

ADA’s price has fluctuated between higher resistance points and lower support levels.

As a crypto investor, I’ve noticed that every time ADA tries to bounce back, it encounters resistance and can’t seem to set a new all-time high. Instead, it forms a pattern of lower peaks, which are characteristic of a double-top formation.

It’s worth noting that the RSI often fluctuates between 50 and 60, reflecting a market that is relatively neutral but slightly biased towards bullish trends.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-17 08:07