- Cardano broke out past its 4-month-old range high

- A move towards $0.422, driven by liquidity, seemed likely to occur soon

As a seasoned analyst with over two decades of experience in the cryptosphere, I’ve seen my fair share of market trends and fluctuations. The recent breakout by Cardano [ADA] from its 4-month range is a testament to the ever-evolving nature of this dynamic market.

Over the past week, Cardano (ADA) managed to break through its price range and saw an impressive surge of 43.3%, rising from Monday’s lows to reach $0.4587. Notably, a recent analysis has shown that the number of large transactions involving whales has also increased by approximately 32%.

Such a hike in whale activity reflected a spike in interest in Cardano and higher demand. Here, it’s also worth pointing out that trading volume has been significantly above average during this rally.

Cardano dips are for buying

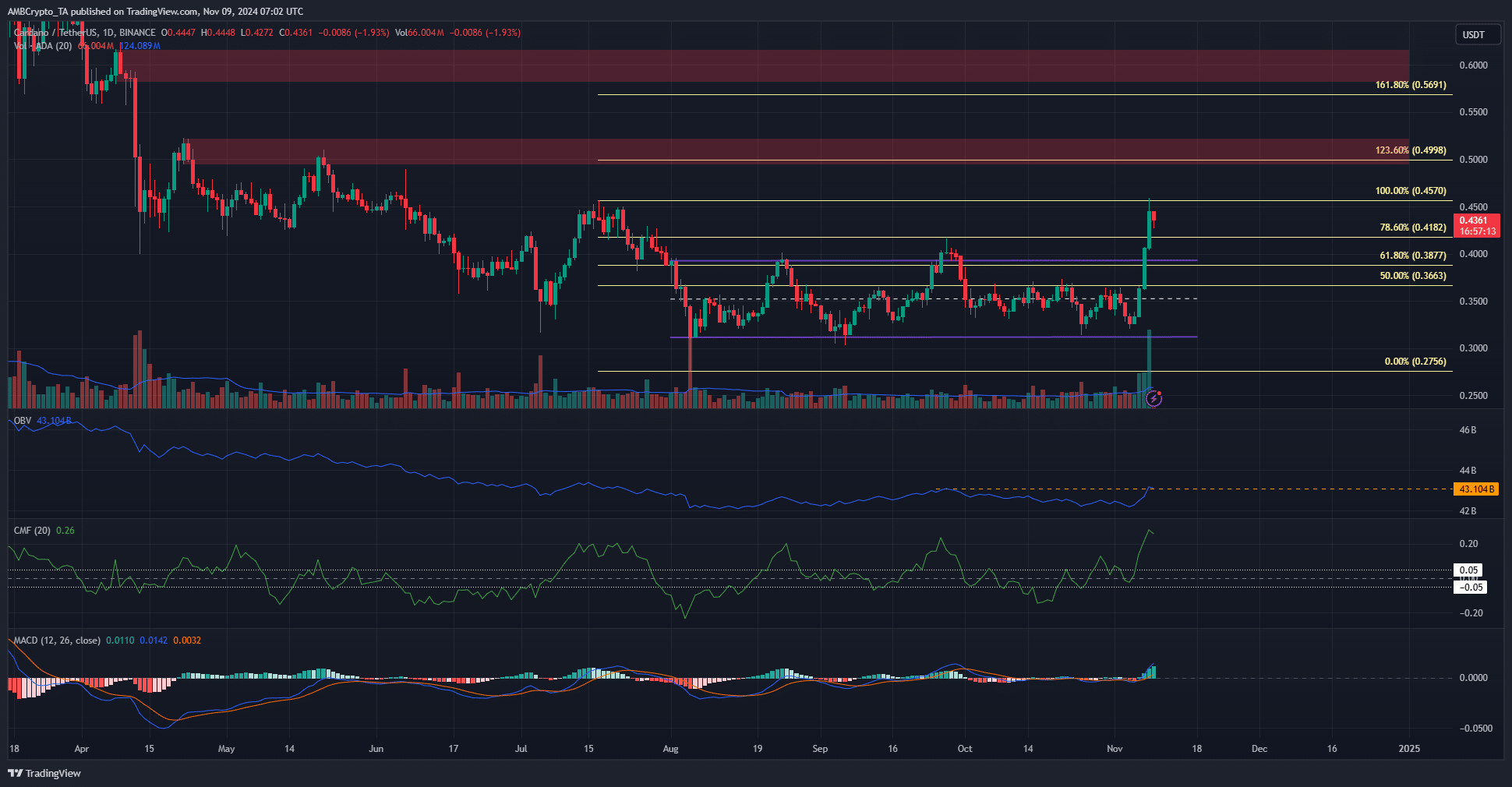

Starting in August, Cardano’s trading activity has been confined within a specific band, stretching from approximately $0.313 to $0.394. However, towards the end of September, it attempted to surpass this range’s upper limit and reached around $0.418, only to encounter resistance. At the same time, Bitcoin [BTC] also encountered a barrier when trying to break through its $66.2k ceiling.

In the latter part of October, ADA experienced a dip that took it down to its lowest price levels. On November 4th, both the Chaikin Money Flow (CMF) and Moving Average Convergence Divergence (MACD) indicated there were no substantial investments flowing in and a bearish trend was present.

After significant weekly price increases, the indicators have flipped, indicating a positive trend for the token. The CMF stands at +0.26, which is higher than it has been since February. This suggests strong bullish momentum, as supported by the MACD. Furthermore, the OBV is about to surpass its local highs from August, signaling further potential growth.

Liquidity hunt is likely before the next impulse move

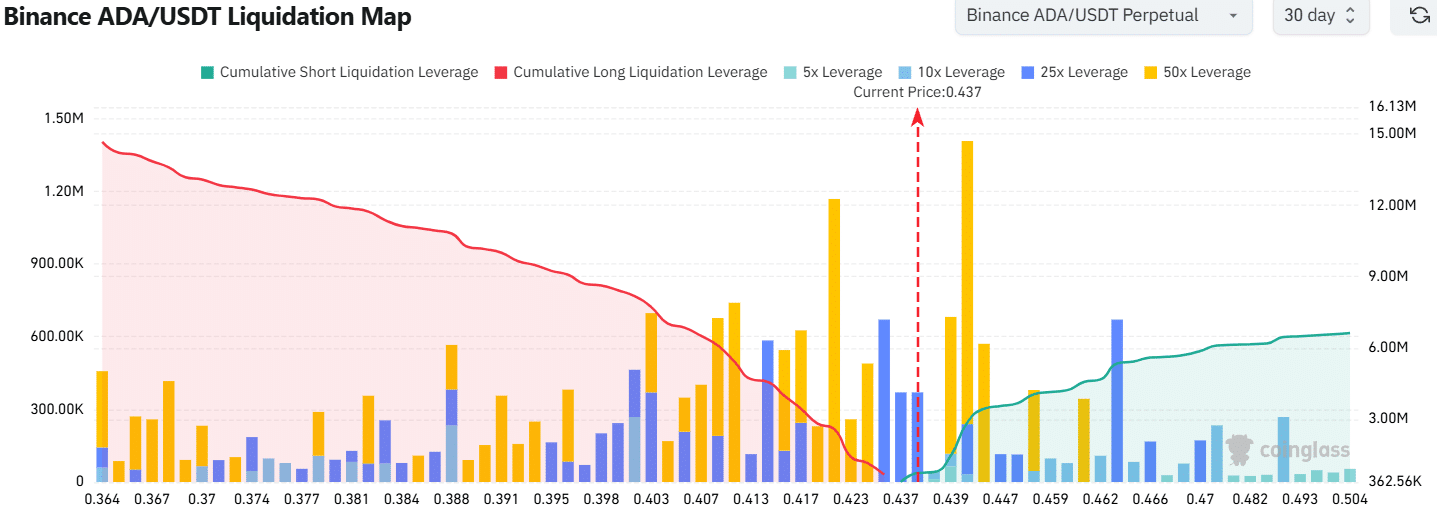

The liquidation map outlined the $0.422 and $0.44 levels as places with a considerable concentration of liquidation levels. The cumulative short liquidations at $0.44 were higher. Additionally, a bounce to $0.44 would entice more traders to go long, building up liquidity to the south.

Is your portfolio green? Check the Cardano Profit Calculator

After that, dropping to around $0.422 or even lower might draw in more liquidity before Cardano makes its next significant move. Based on technical analysis, it seems inevitable that it will surge beyond $0.457 soon, with potential long-term goals of $0.5 and $0.57.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-09 22:15