- Examining the Cardano price prediction as ADA defends its $1 support.

- Massive liquidity at $1.0 and $1.25 could be ADA’s price magnets.

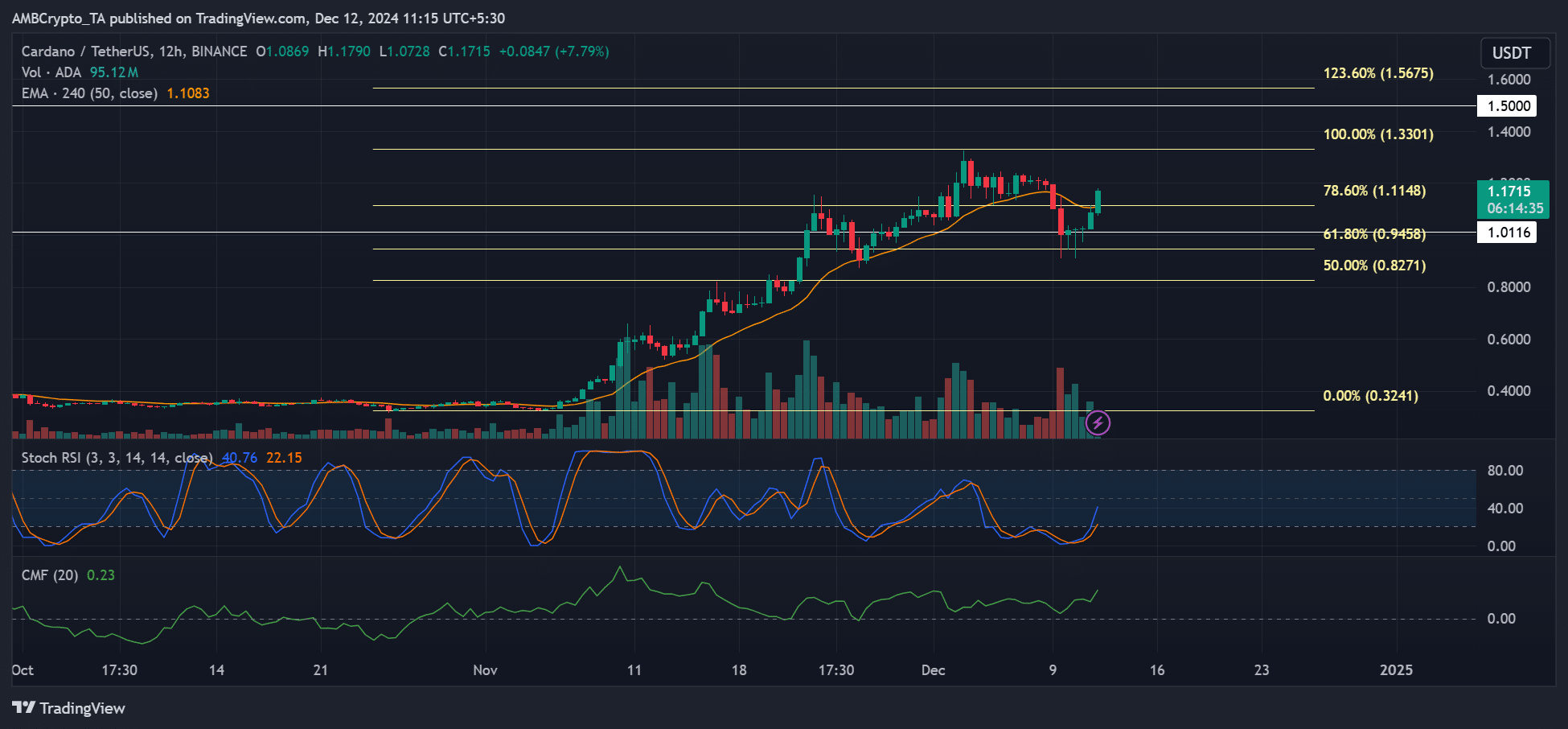

As a seasoned researcher with over two decades of experience in the crypto market, I have seen my fair share of bull runs and bear markets. The recent resurgence of Cardano [ADA] has caught my attention, given its remarkable rebound from the $0.50 mark to nearly $1.3.

Following the recent weekly reset, I’ve observed a resurgence in altcoins as Bitcoin‘s dominance (BTC.D) decreased from 57.8% to 56%. Notably, Cardano [ADA] has experienced an influx of fresh capital, resulting in approximately a 30% recovery for the coin at present.

ADA’s strong rebound

In simpler terms, the price bounceback managed to regain the 4-hour Exponential Moving Average, strengthening a brief upward market trend.

On the other hand, it’s crucial for bulls to take note of essential aspects. A robust trend might boost the likelihood of reaching the latest peak of $1.3, and potentially even the upcoming goal at $1.5.

If the trend from 2021 reoccurs, reaching the $1.5 mark might become more of a question of ‘when’ rather than ‘if’, given ADA’s persistent efforts to maintain its support at $1.

In 2021, the value of ADA remained around $1 to $1.5 for a prolonged period, then rose significantly towards $3. If this pattern persists, there may be an opportunity to capitalize at approximately $1.5.

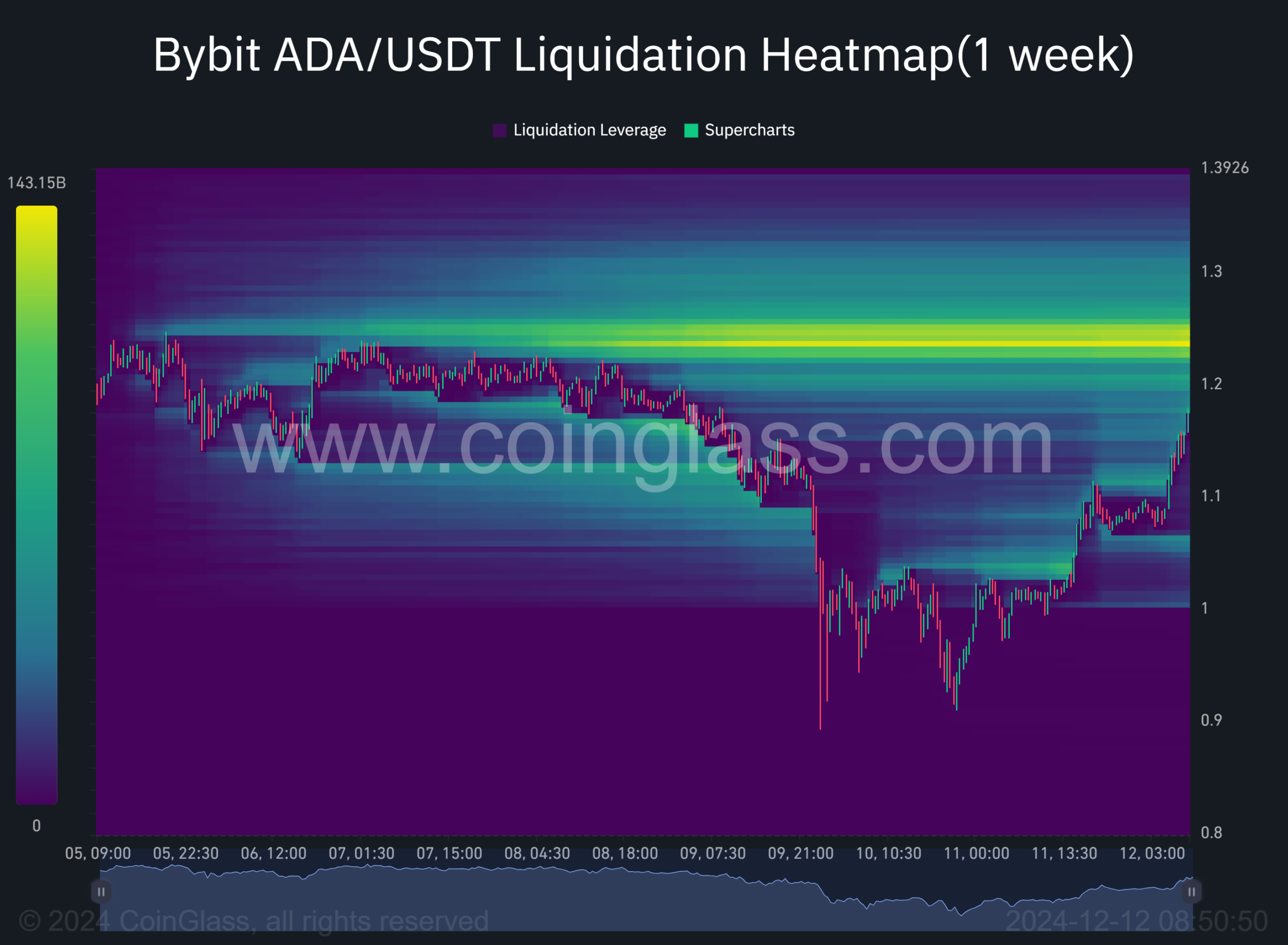

However, at $1.24, there’s a large group of traders who have shorted the position with leverage, creating a significant liquidity pool. This could potentially influence the price movement, yet if it doesn’t manage to breakthrough, it might halt the progression instead.

Cardano key levels

Based on data from Bybit’s liquidation map as per ADA, there were approximately $143 billion in short positions with high leverage (represented by bright orange levels), situated within the range of $1.23 to $1.25 on a weekly chart.

This massive liquidity could attract price, but whether it will blast above it remains to be seen.

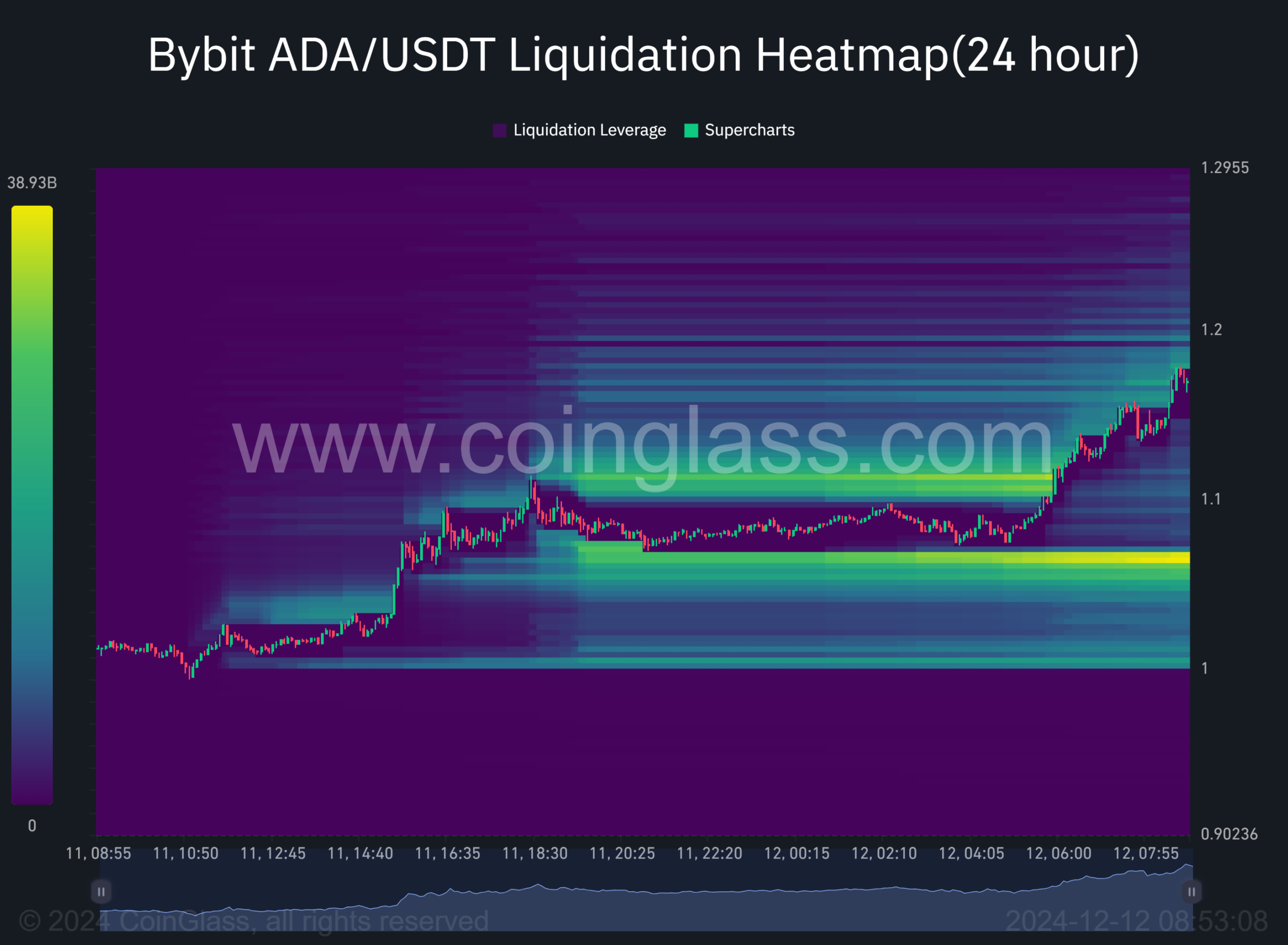

On a 24-hour timeframe, there was substantial trading volume (over $40 billion) accumulated in long positions that were heavily leveraged at the price point of $1.0.

As a researcher, examining the liquidation heatmap, I identified the $1.0 and $1.25 price points as crucial support and resistance levels.

Read Cardano [ADA] Price Prediction 2024-2025

Given that price often correlates with liquidity, we can see that the nearest potential selling point for the current market activity lies between $1.23 and $1.25.

The cost might rise to either $1.25 or $1.3 initially, but then may drop back down to $1.0. Yet, if there’s a strong push upward beyond $1.3 due to a short squeeze, it could potentially reach $1.5.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-12-12 16:07