- Cardano has a short-term bearish structure after falling below the $0.4 level.

- Despite mounting sell pressure, there’s a chance of a price move toward $0.5 in the coming weeks.

As a seasoned financial analyst with years of experience in following the cryptocurrency market, I have seen my fair share of bearish and bullish trends. And based on the current price action and technical indicators of Cardano (ADA), I believe we are currently in a short-term bearish structure.

Recently, the price of Cardano (ADA) dipped below a significant level of support, according to a previous analysis. This move shed light on the prevailing market sentiment, suggesting that bearish forces were strongly in control. However, it’s essential to understand the extent of their dominance.

At AMBCrypto, we delved deeper into the price trends and examined the size of the liquidity reserves for ADA to predict its potential direction. Here’s our analysis along with suggestions for traders looking to make informed decisions.

Daily breaker block fails to halt the sellers

At the $0.4 mark, a significant level for buying was detected and labeled as a demand area for Cardano (ADA). Over the recent trading period, it momentarily acted as a support, but it has since weakened and no longer holds at present.

A daily session close below $0.402 will be a bearish signal.

As an analyst, I’ve observed that following the rupture of a prolonged falling wedge pattern, there was an expectation for a robust uptrend in Cardano’s price. However, my analysis of the DMI (Directional Movement Index) indicated a contrary trend, revealing a powerful bearish movement with both the -DI (negative directional indicator) and ADX (averaged directional index) falling below the 20 threshold.

In simpler terms, the Opposite Day Bands (OBV) failed to advance past a significant resistance point, and the Changing Money Flow (CMF) dipped below the negative threshold of -0.05, revealing substantial selling pressure in the markets. The Relative Strength Index (RSI) registered a value below the neutral 50 level, suggesting that the downward price momentum was gaining traction.

An argument for the bearish trend to reverse

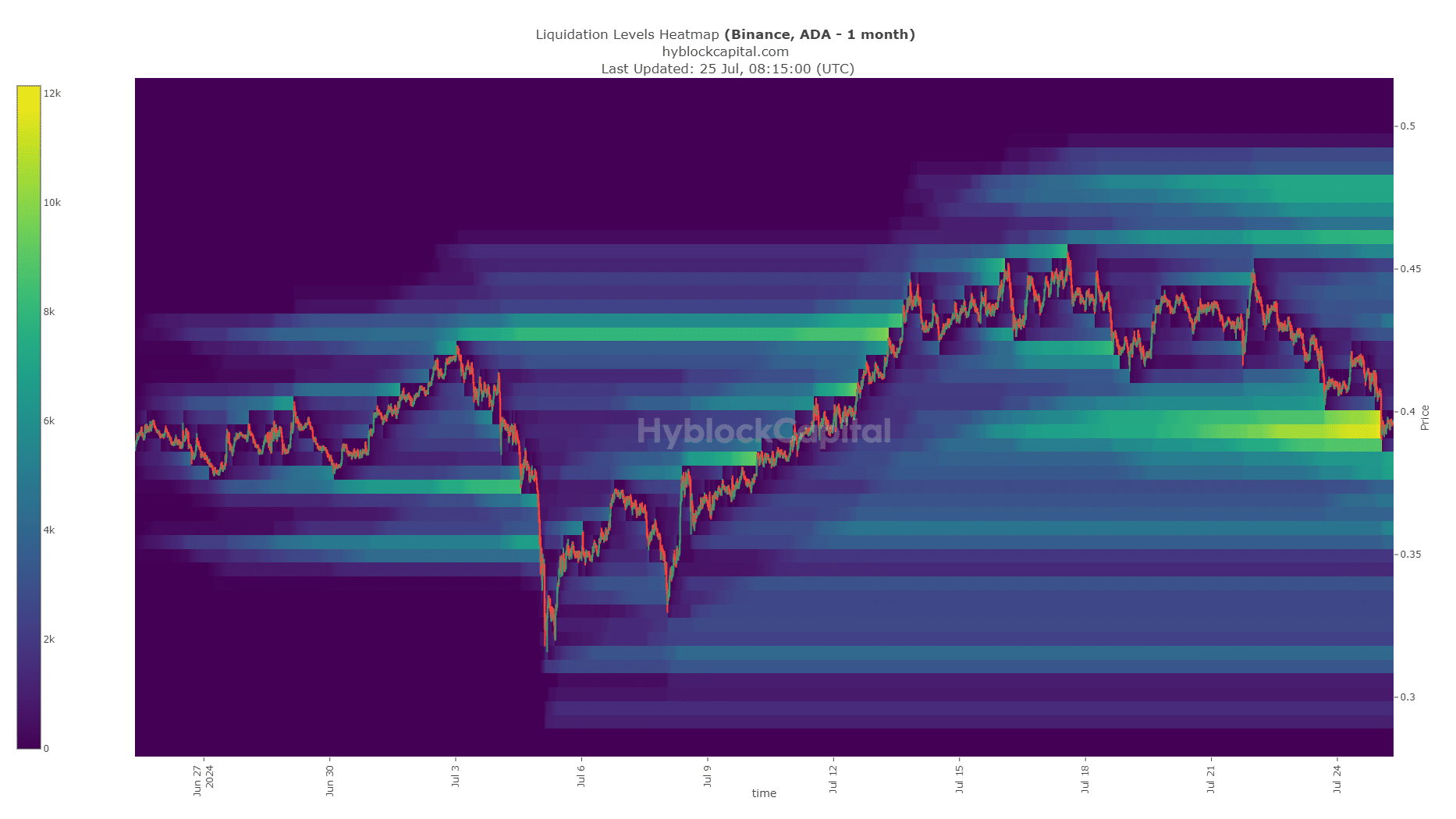

As a researcher studying market trends, I’ve noticed that the technical indicators and price action didn’t provide much optimism. However, the liquidation heatmap offered some intriguing insights. Specifically, the magnetically attractive zone of liquidation levels around $0.46 to $0.48 could potentially draw prices towards them.

Is your portfolio green? Check the Cardano Profit Calculator

As a crypto investor, I’ve noticed that the liquidity pool between $0.39 and $0.4 has been depleted, which typically draws prices in that direction. However, considering the law of supply and demand, if buying pressure overpowers selling pressure, we may witness an upward price trend from hereon.

Despite the challenge of minimal social media buzz and waning consumer interest, the purchasers must strive to reach their goal.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-07-26 00:07