- At the time of writing, Cardano had a bullish long-term outlook

- Past month’s range formation offered swing traders plenty of opportunities

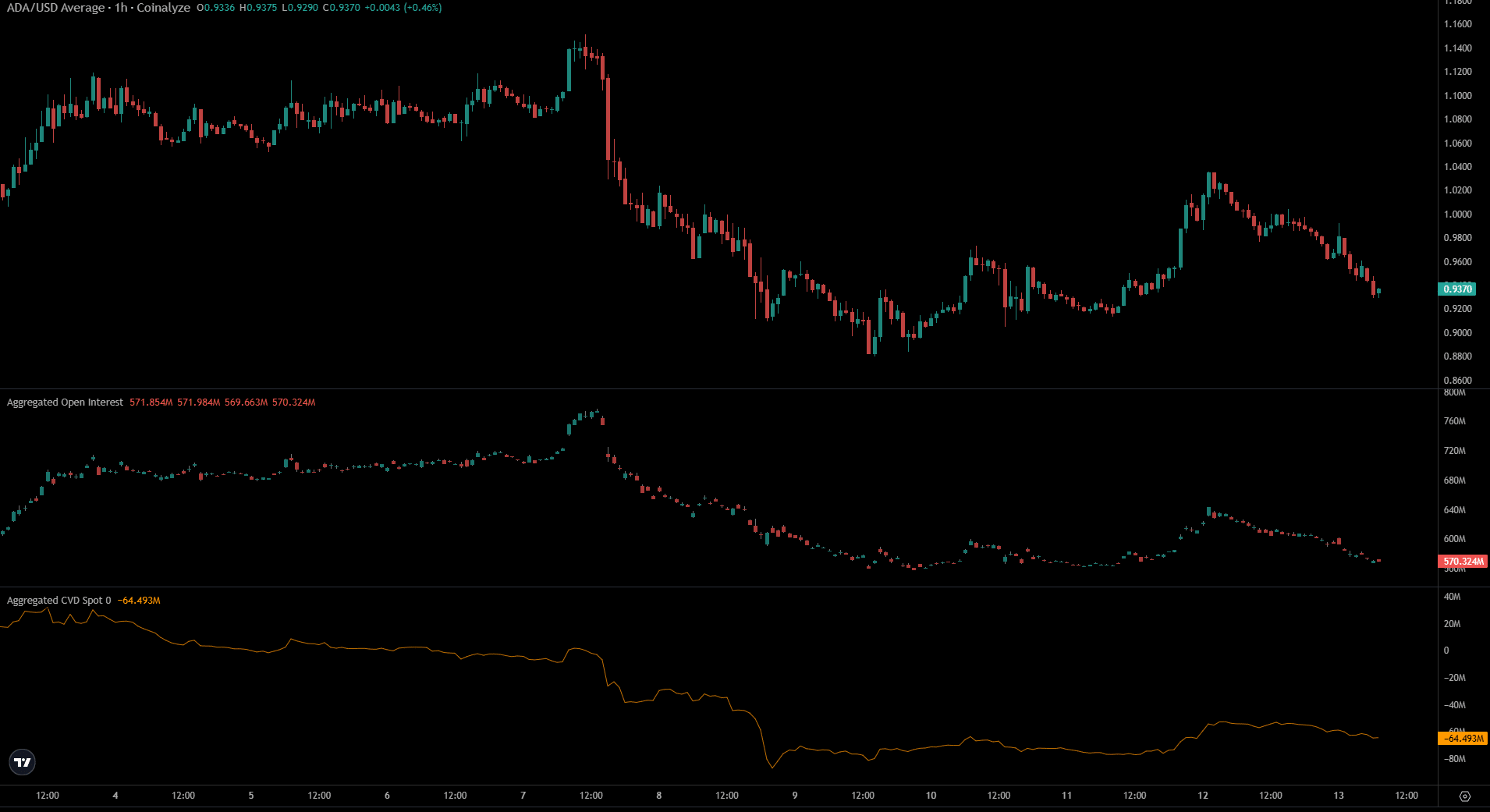

Over the last few days, the price action of Cardano (ADA) displayed significant fluctuations in its longer-term movements. Notably, the potential resistance point at $1 coincided nicely with the trading range that Cardano has been moving within for about a month.

Refusing advance at this resistant area implies a potential price drop is imminent over the next few days. However, this setback might present an attractive buying chance for those who are confidently bullish.

Multiple timeframe analysis outlines key Cardano levels to buy and sell at

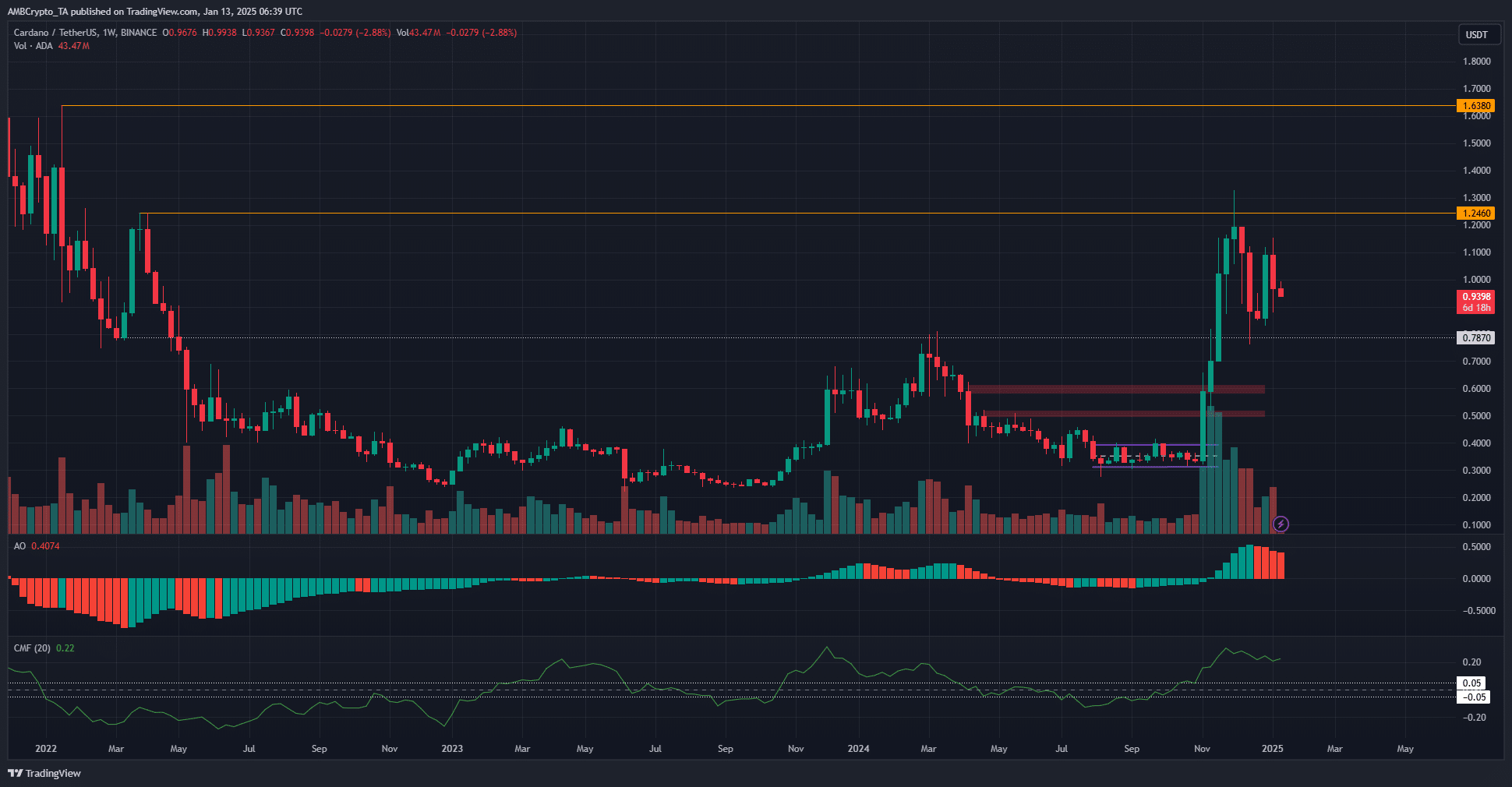

Over the course of a week, the perspective on Cardano showed a significantly optimistic trend, leaning towards a bullish market. The level of resistance at $0.787 was overcome and subsequently acted as a foundation for potential growth. Currently, the $1-region stands as a hurdle for buyers trying to gain ground.

Starting from January 2022, the range around $1.04 to $1.14 and the $1.246 level emerged as potential resistance points for ADA investors looking to buy. Over the following weeks, these areas could prove crucial as barriers for any bullish momentum. However, the market trend favored the bulls, given the readings from the Awesome Oscillator. Additionally, the Capital Flow Multiplier (CFM) suggested substantial investment inflows in recent times.

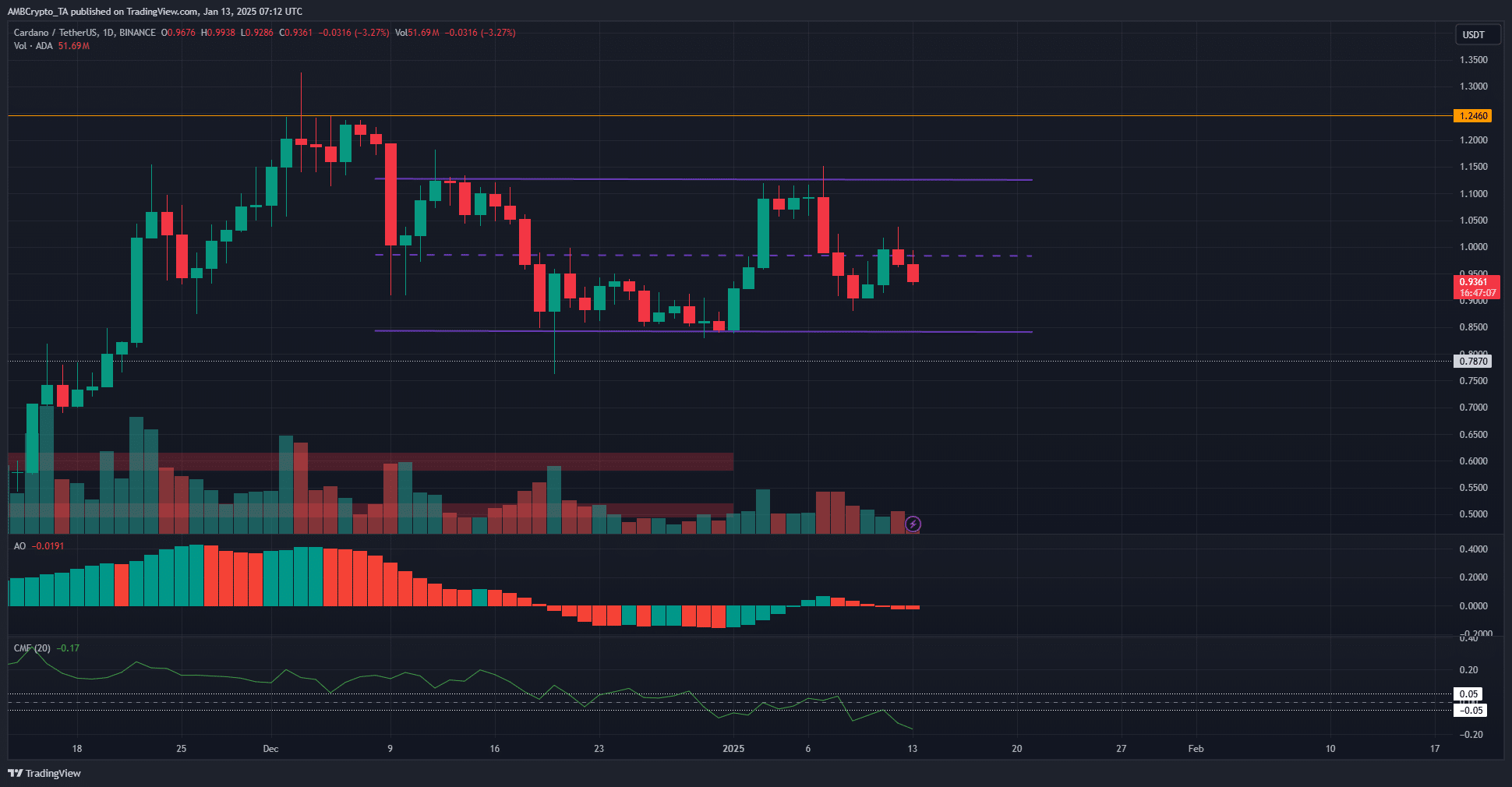

On a day-to-day chart analysis, we noticed a price range, marked in purple, spanning from $0.84 to $1.12. The middle of this range is at $0.98, a level that has acted as both support and resistance over the last six weeks, adding credibility to this range formation.

Underneath the lowest prices lies the higher timeframe support at $0.787. Since Cardano has been turned down near the mid-level in the past few days, it’s plausible that we might see a shift towards $0.84 and potentially even dip to $0.78 over the next few days, given the current trend.

day by day, the Cumulative Match Factor stood at -0.17, indicating strong selling activity. Additionally, the Awesome Oscillator displayed a bearish pattern. Combined, these indicators suggested that a drop towards the lower end of the range might occur soon.

Looking closer at shorter time periods, AMBCrypto noticed a pessimistic short-term feeling. The Open Interest has been trending downwards over the last 36 hours as well. This suggests a degree of caution in the speculative market. Additionally, the spot CVD saw a slight decrease initially but has shown some recovery from the previous week.

Read Cardano’s [ADA] Price Prediction 2025-26

In simpler terms, because higher timeframes are more significant, short-term market fluctuations, such as drops to $0.84 or less, should not cause concern among investors. Instead, these instances might offer a good chance to buy Cardano. Over the upcoming months, if the price surpasses $1.246, it could indicate another robust price movement for Cardano.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-13 17:11