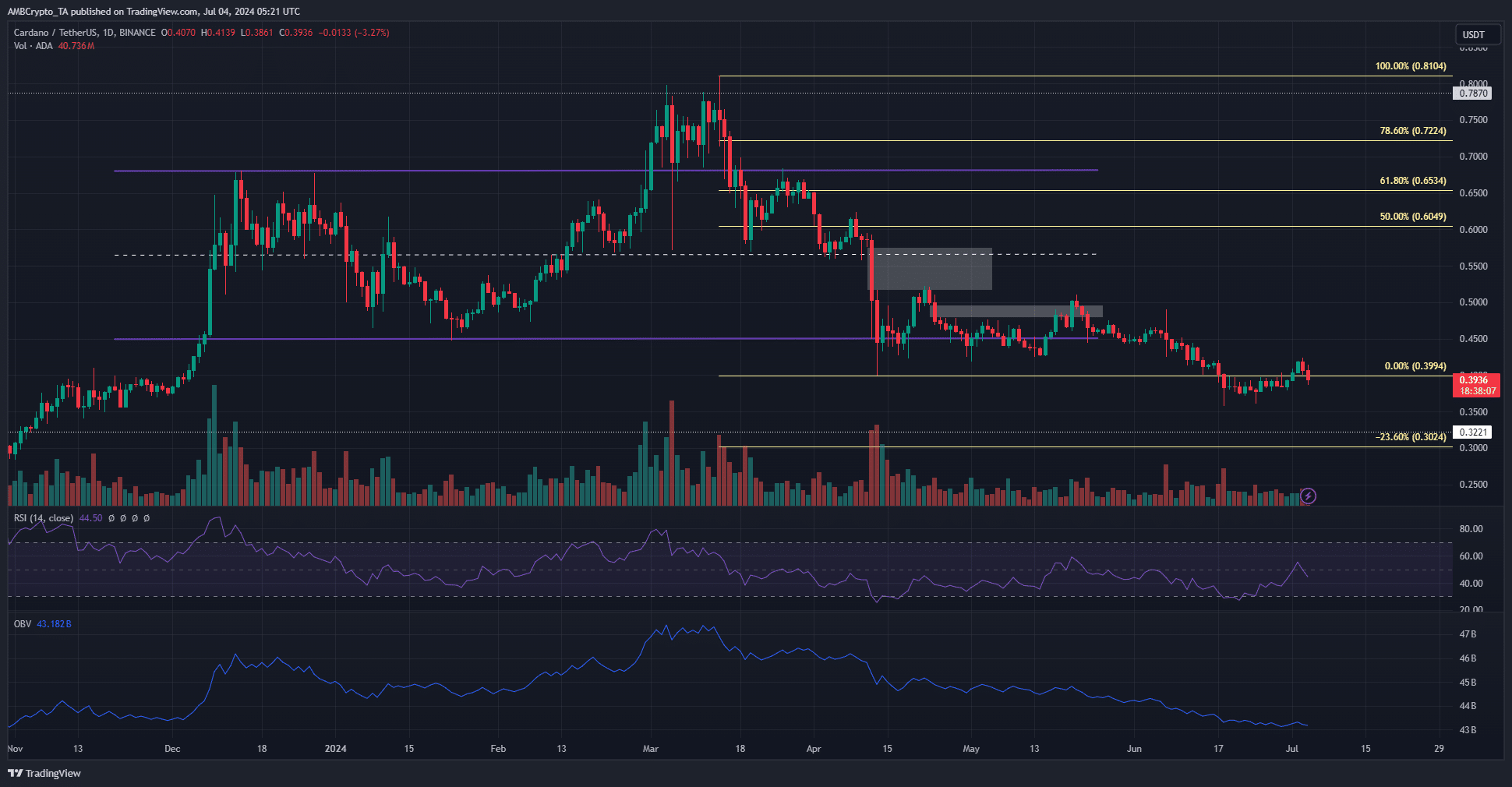

- The market structure and technical indicators on the 1-day timeframe of Cardano were bearish.

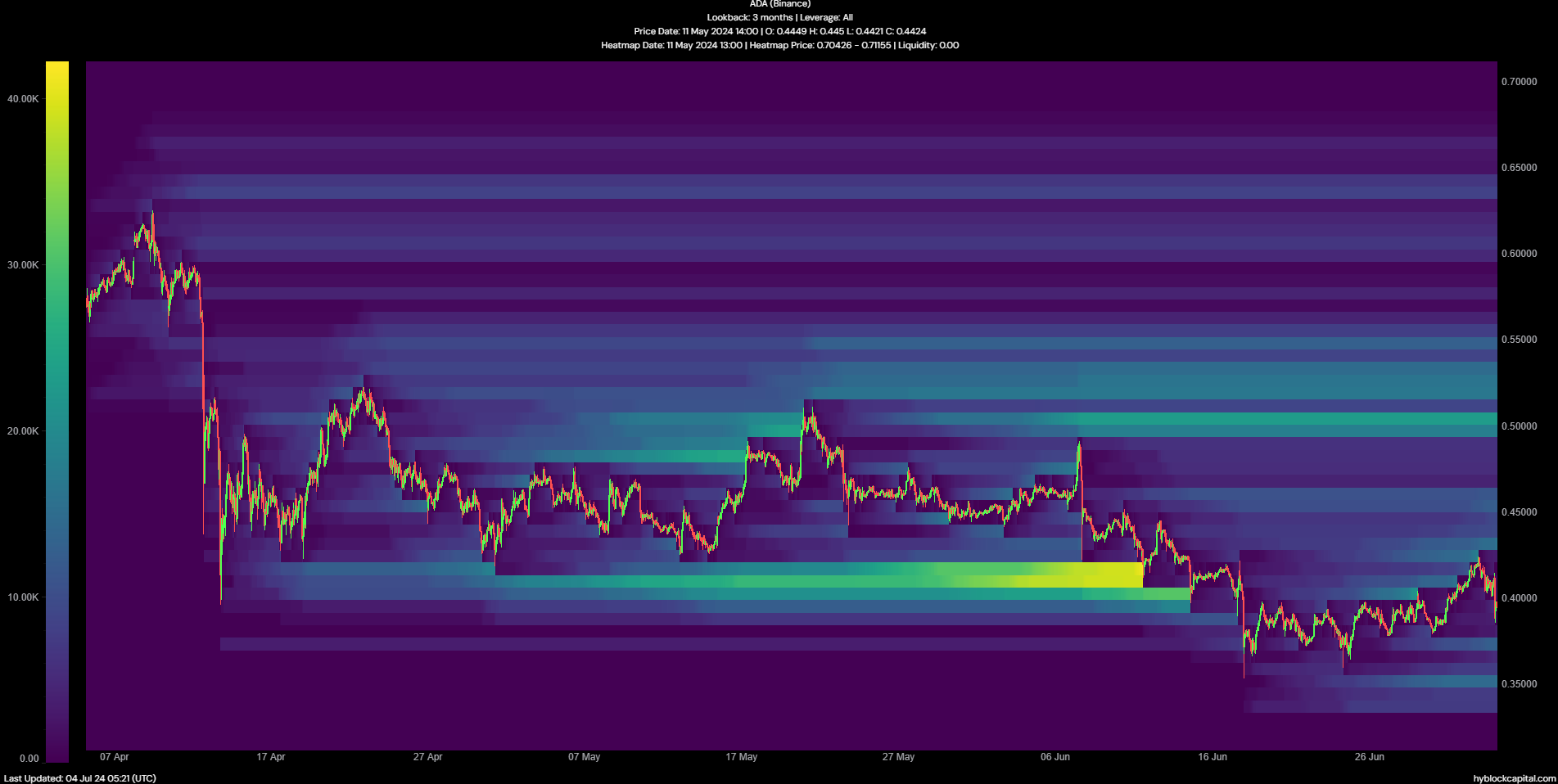

- The liquidation heatmap highlighted key short-term levels to watch.

As a researcher with extensive experience in analyzing cryptocurrency markets, I have closely monitored Cardano’s [ADA] price action and technical indicators. Based on my observations, I believe the market structure and bearish trends are likely to persist in the coming days.

Cardano’s price trend remained downward on the chart. Since mid-April, Cardano’s bearish price prediction has been evident on the higher timeframes following the loss of the support level at $0.56. In late June, bears reinforced their control over the market.

As a researcher studying the stock market trends, I’ve noticed that the previous low at $0.4 in mid-April didn’t manage to keep the price from falling further. The market seemed poised for a potential drop, with the price hovering dangerously around this level. So, the question becomes: what will be the next target for sellers if the downward trend continues?

Cardano price prediction shows bears will be happier in the coming days

As a researcher studying the price movements of ADA from December 2023 to May 2024, I’ve noticed that the previously established range was violated and flipped to become resistance. By referencing the Fibonacci levels plotted during the March price decline, it appears that the next bearish target lies at the 23.6% extension level, which aligns with the $0.3 support level.

On a daily basis, the technical indicators indicated a bearish trend. The Relative Strength Index (RSI) attempted to rise above the neutral 50 level, but was unable to sustain this gain, thereby reinforcing the downward trend.

The OBV was also in a persistent downtrend.

The robust demand to sell and the scarcity of buyers indicated a high probability that the price would drop to around $0.3.

The liquidation heatmap indicated a potential range formation

As a researcher studying market trends, I’ve observed that during the first half of June, the $0.4-$0.415 range emerged as an area with significant liquidity and numerous potential sell orders. This level served as support but eventually succumbed to the downward selling pressure. Over the past ten days, this zone has transformed into a resistance level for me.

Read Cardano’s [ADA] Price Prediction 2024-25

The heatmap representing the liquidation of assets indicated an accumulation of liquidity around the price point of $0.427, slightly above the latest peak. Additionally, $0.35 emerged as a significant area of focus in the near term.

As an analyst, I would hypothesize that the price of ADA may fluctuate between the $0.42 and $0.37 ranges to enhance market fluidity around those price points. Within this timeframe of a few weeks, we could observe a concentration of transactions at these levels before the price consolidates.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2024-07-04 19:04