- Cardano has a strongly bearish market structure

- The technical indicators projected a deep price drop could arrive soon

As a researcher with extensive experience in analyzing cryptocurrency markets, I’ve closely monitored Cardano [ADA] and its recent price action. Based on my technical analysis and market structure assessment, I believe that Cardano has a strongly bearish outlook.

As a researcher studying the cryptocurrency market, I’ve noticed an intriguing development with Cardano (ADA). The token appears to be forming a bullish chart pattern that could potentially push its price towards the $1 mark in the near future. Furthermore, there have been positive shifts in its social metrics, as sentiment among investors has become more optimistic. However, despite these encouraging signs, I must admit that the actual price action has yet to fully inspire confidence.

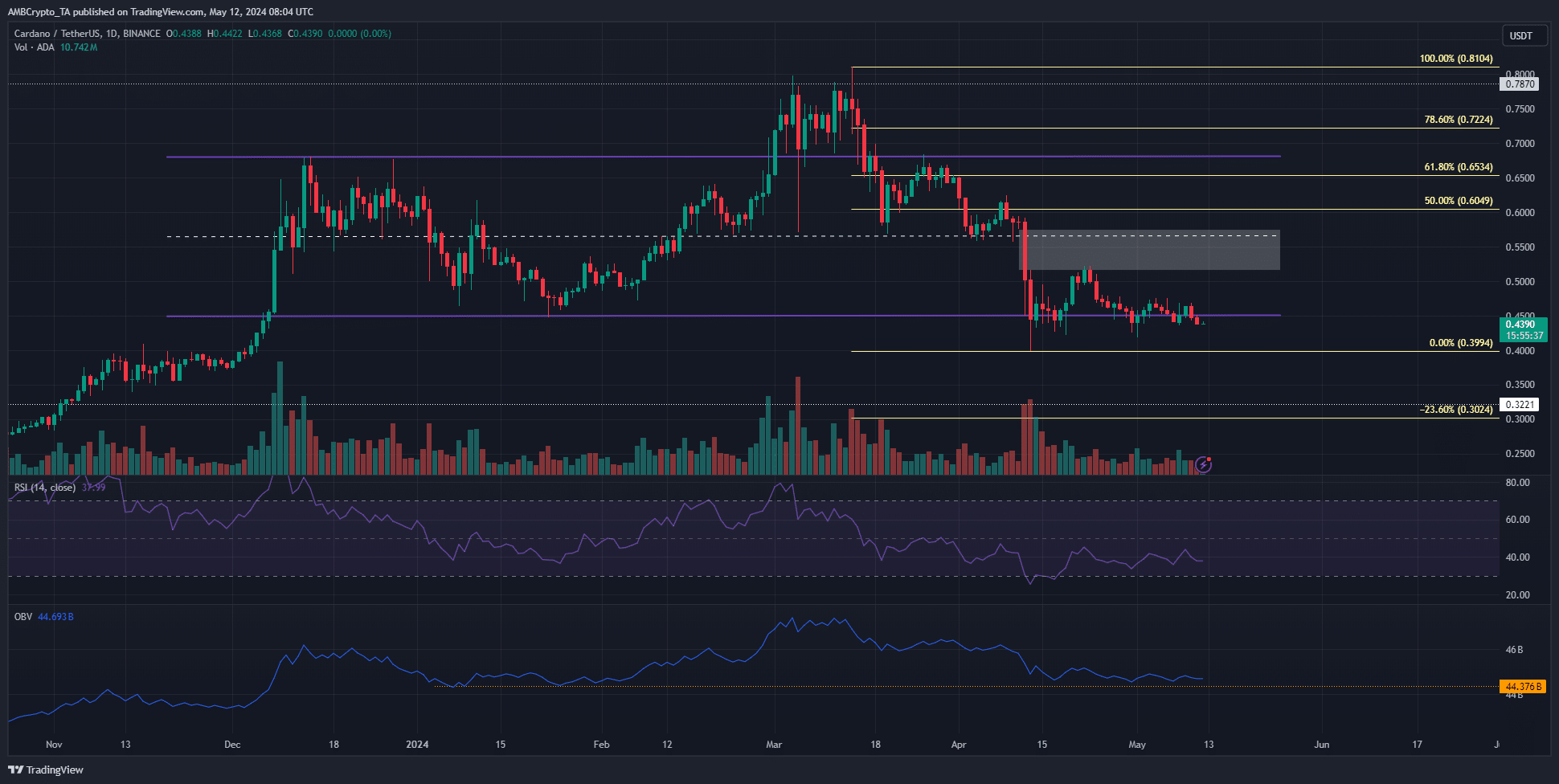

As an analyst, I observed that the price had dipped below the lowest point reached by ADA in January 2024. Furthermore, the technical indicators suggested that the buying pressure was waning among bulls. To shed light on potential future price movements, I turned my attention to the Fibonacci levels. These mathematical patterns derived from past market data projected possible depths for the next downward trend in ADA’s price.

Here’s what investors need to be prepared for.

The chances of a 30% plunge

During the year 2024, the price of ADA generally remained between a specific price band, which extended from $0.447 to $0.678. Lately, over the past month, the values have persistently stayed near or slightly beneath the lower boundary of this band.

As an analyst, I’ve noticed that in the early part of April, the mid-range support level at $0.567 was broken, resulting in a noticeable disparity or imbalance appearing on the chart. Later in the month, this area was revisited and functioned as resistance.

Since then, the buying pressure has been insufficient for bulls to reclaim the $0.5 level.

As a researcher analyzing the On-Balance Volume (OBV) indicator, I observed that it had retreated to a support level last seen earlier in the year. The absence of significant buying volume and the persistent downtrend in the OBV suggested that further price declines were a possibility.

The RSI on the daily chart was also below neutral 50 to reflect downward momentum.

As a researcher studying financial markets, I examined the price movement from $0.81 in March and identified Fibonacci levels in a downward trend. Notably, the 23.6% extension, represented by the pale yellow line, pointed to $0.3 as the potential next bearish target.

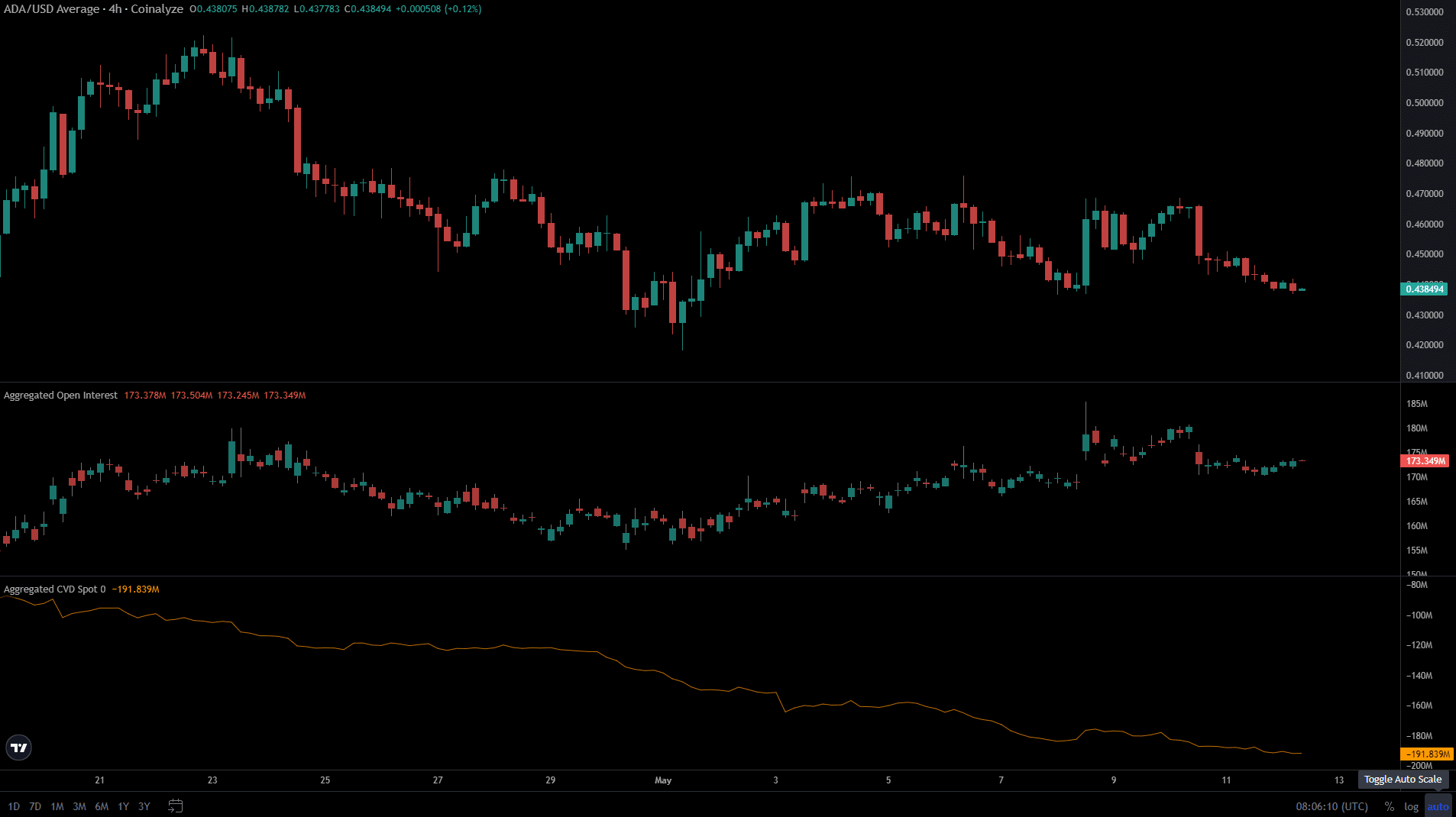

Short-selling was a popular route

During the 11th and 12th of May, the cost of Cardano dropped by approximately 2%, while open interest grew by roughly $3 million. This indicated an increase in short selling positions, signaling bearish market sentiments.

The spot CVD also continued its downtrend, showing a lack of buying.

Read Cardano’s [ADA] Price Prediction 2024-25

If the bears continue to push down the price without intervention from the bulls, there’s a good chance that the predicted 30% decline based on Fibonacci analysis may occur.

The lack of strength is evident in their behavior, as they struggled fiercely to protect their lowest long-term levels.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- THETA PREDICTION. THETA cryptocurrency

- Crypto week ahead: Will Bitcoin, Ethereum hit new highs?

2024-05-12 16:29