-

ADA remains in consolidation, with indicators suggesting a bearish short-term outlook.

Persistent negative indicators and low engagement hint at continued consolidation without a clear breakout.

As a researcher with extensive experience in analyzing cryptocurrency markets, I believe that Cardano [ADA] is currently stuck in a prolonged consolidation phase, and the indicators suggest a bearish short-term outlook. The lack of clear direction and persistent negative indicators, coupled with low engagement and volume, indicate that ADA may continue to trade within its current range without a significant breakout.

As a researcher studying the cryptocurrency market, I’ve observed that Cardano (ADA) has been trading within a narrow range of $0.40 and $0.46 over the last few weeks, indicating a period of consolidation. Currently, ADA is priced at $0.44, representing a 0.7% decline in the previous twenty-four hours. However, it remains unclear if this digital asset is prepared to break free from its current phase and make significant price movements.

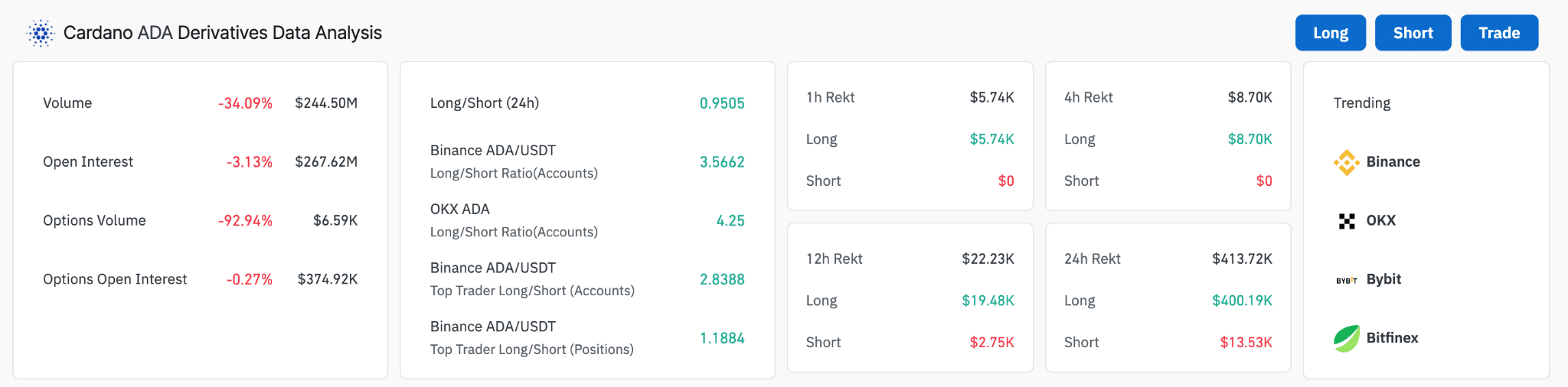

As a market analyst, I’d like to begin by delving into the current scenario of ADA‘s derivatives market based on the latest data from Coinglass. The sentiments appear divided, with some traders expressing bullishness while others exhibit bearish tendencies. Moreover, there has been a significant decrease in trading activity, indicating reduced market participation.

The derivatives data indicates that traders on various platforms hold contrasting views regarding the market’s direction. For instance, Binance exhibits a generally optimistic outlook, while OKX displays a more pessimistic attitude.

Although there’s a positive outlook reflected in long/short trading ratios, the decrease in trading volume and options activity could limit significant price increases for Cardano (ADA). If we don’t see a substantial increase in trading volume and market participation, ADA is likely to remain within its current price range without any clear breakthrough.

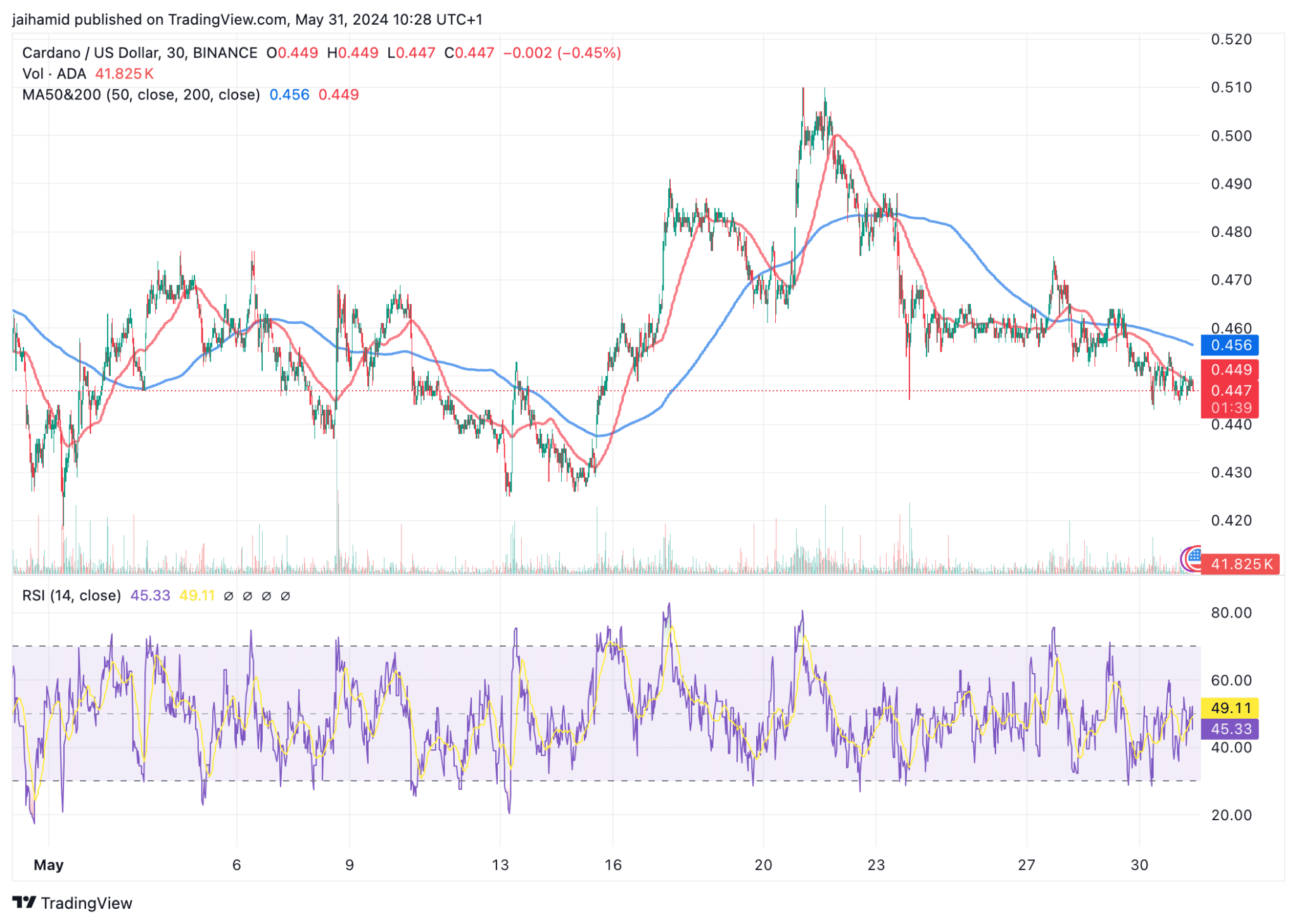

At present, ADA is priced at $0.447. The moving averages indicate a bearish short-term signal, with the 50-day average (represented by the red line) falling beneath the 200-day average (denoted by the blue line). This alignment suggests that ADA may continue to decline towards the lower limit of its recent price range.

As a researcher analyzing market trends, I can say that the Relative Strength Index (RSI) reading of 45.33 does not strongly suggest any particular sentiment towards the market. The RSI is currently within the neutral range and not in the oversold or overbought territory. This implies that there is a balanced pressure on the price, with neither significant buying nor selling pressure driving it out of its current consolidation zone.

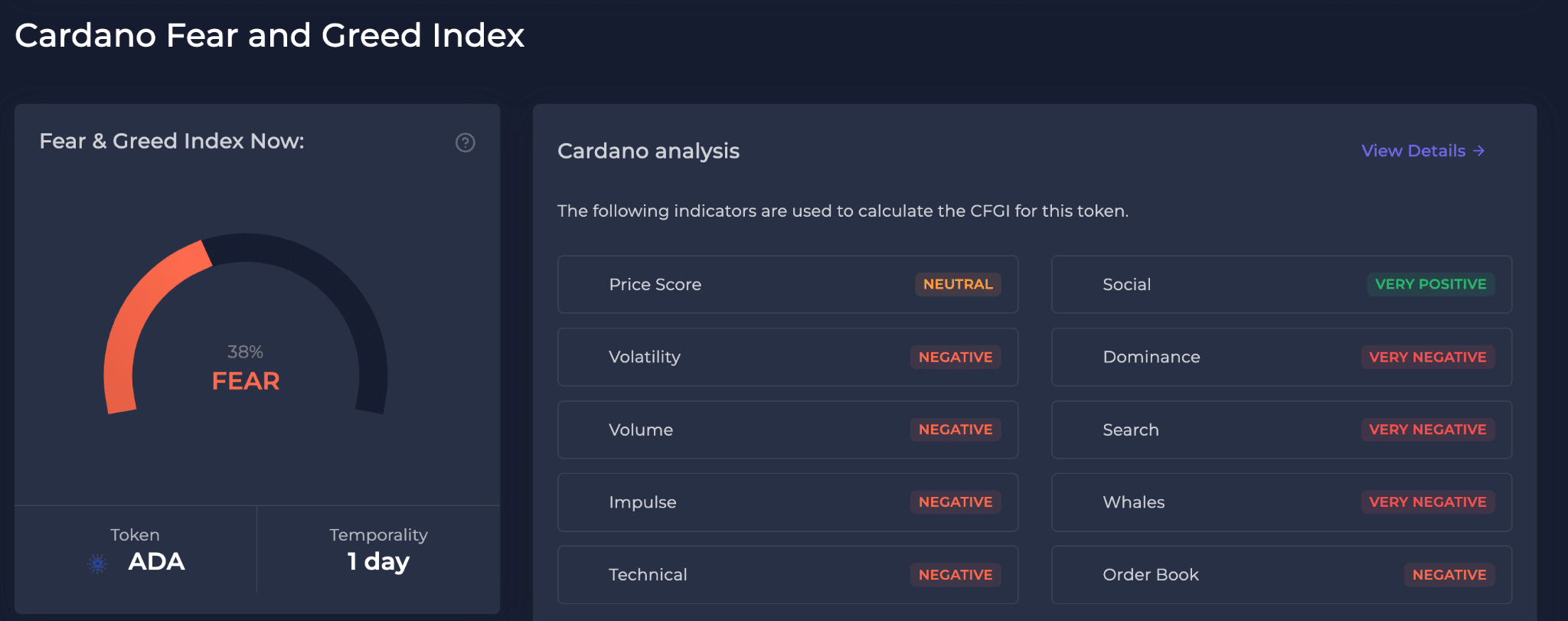

As an analyst, I’d put it this way: The Cardano Fear and Greed Index currently registers at a ‘Fear’ level for me. This alignment is reinforced by the prevailing bearish trends observed in various indicators.

The indicators volatility, trading volume, whale actions, and order book depth are currently signaling caution, implying potential decreased market engagement and sell pressure for Cardano (ADA). Over the past 24 hours, social media activity surrounding ADA has shown significant fluctuations, reflecting shifting levels of community involvement and discourse.

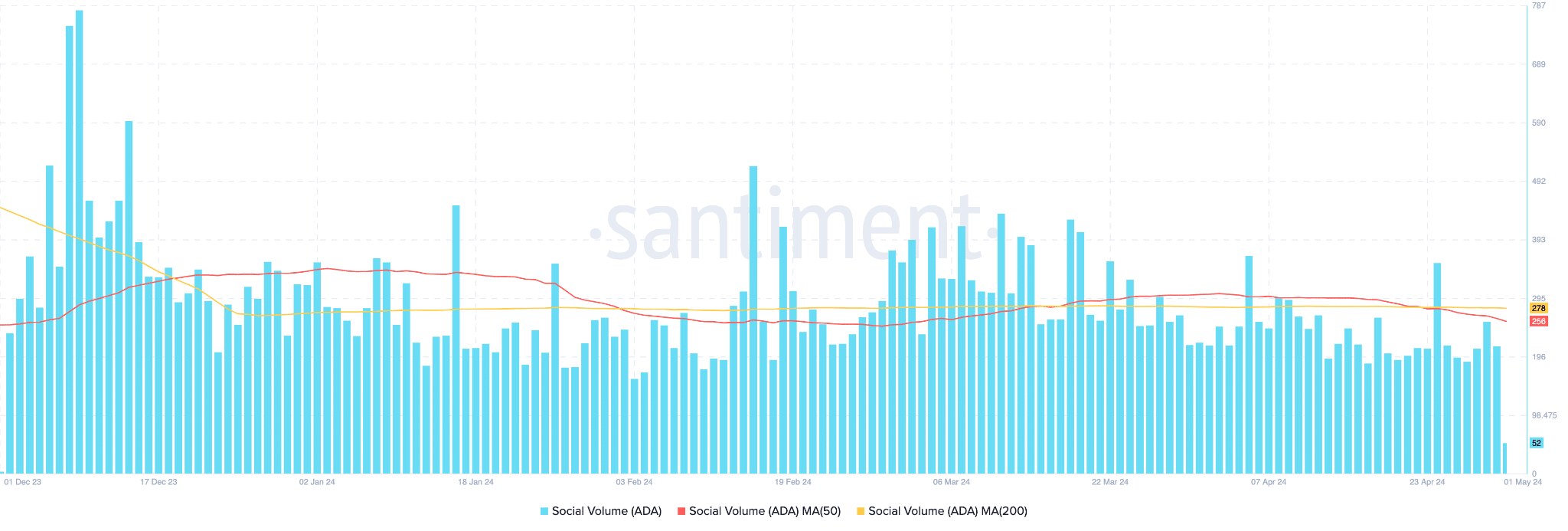

As a data analyst, I’ve noticed an intriguing pattern in the social activity trends based on the 50-day moving average (represented by the red line). Instead of a steady increase, this indicator demonstrates a gradual decrease. While there might be brief surges in conversations, the overall direction indicates a downward trend in engagement levels.

The decrease is more evident when compared to the 200-day moving average (represented by the yellow line), indicating a prolonged reduction in social media buzz surrounding ADA. In summary, it appears that ADA will continue to trade within its current range for the foreseeable future.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-01 00:07