- Cardano (ADA) is leading the upcoming token unlocks, with an expected release of 37.06 million tokens

- Solana (SOL) and Worldcoin (WLD) are also set for linear unlocks

As a seasoned researcher with years of experience navigating the volatile cryptocurrency market, I find these upcoming token unlocks to be both exciting and intriguing. The anticipated release of 37.06 million Cardano tokens is particularly noteworthy, given their potential impact on ADA’s short-term price dynamics.

💥 Trump Tariff Shockwave: EUR/USD in Crisis Mode?

Find out what experts predict for the euro-dollar pair this week!

View Urgent ForecastDuring the opening week of November, we can expect another major wave of token releases in the cryptocurrency market, following October’s distribution of over $1 billion worth of tokens. This trend will persist with a new set of unlocks. Notable tokens like Cardano, Solana, and Worldcoin are included in this upcoming event.

Each token distribution event may result in different levels of circulating supply, causing market observers to carefully evaluate the possible effects on the market.

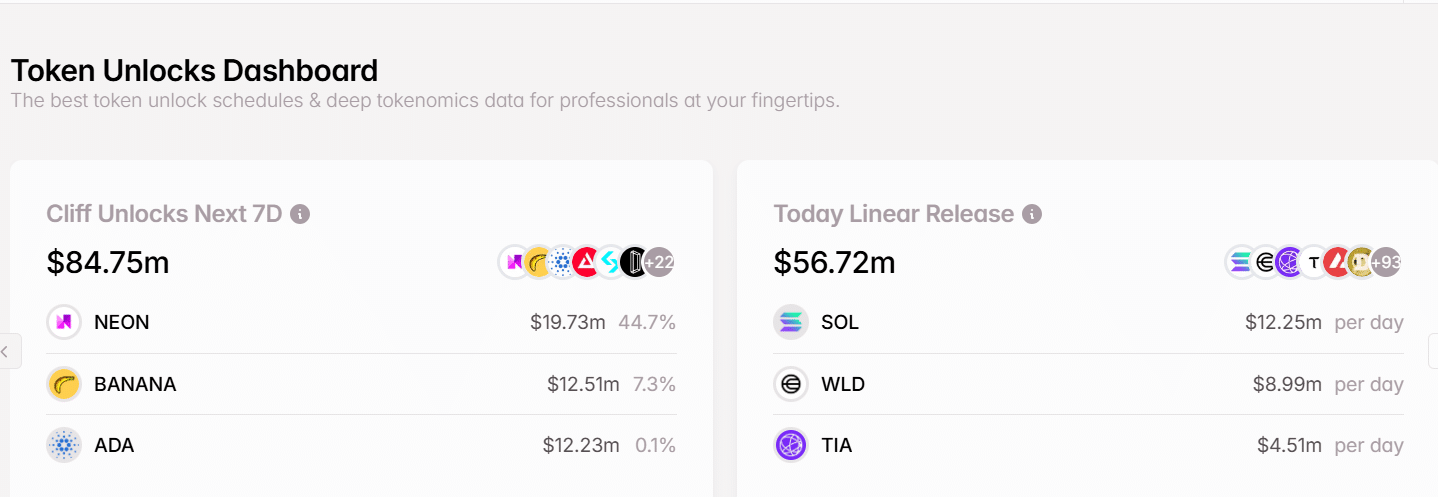

Major cliff unlocks – Cardano (ADA) takes the lead

Cardano (ADA) holds the largest upcoming token releases, estimated to be around 37.06 million tokens, worth approximately $12.44 million. This release corresponds to a mere 0.10% of ADA’s current circulating supply, but it may potentially impact ADA’s immediate market value.

As a crypto investor in ADA, I understand that when the rate of demand fails to match the increased supply, there might be an uptick in sell pressure. This surge in supply could potentially cause minor price volatility, particularly in a lively market like ADA’s.

As a researcher delving into the world of cryptocurrencies, I’ve recently come across an interesting development with NEON. A staggering 53.91 million tokens, equivalent to around $20.18 million, have been unlocked. This represents a substantial 44.92% of its total circulating supply. Given the magnitude of this unlock in relation to NEON’s current supply, it is reasonable to expect that this event could potentially cause significant price fluctuations or volatility.

Nearly half of NEON’s circulating tokens will become available on the market with the event.

In simpler terms, projects like BANANA, XAI, BGB, and AGI, which have smaller release events, might experience changes in their individual environments. Yet, these events could potentially have a lesser effect on the overall market at large.

Linear unlocks for Solana (SOL), Worldcoin (WLD), and Dogecoin (DOGE)

Beyond cliff releases, a number of tokens are designated for gradual unlocks, meaning they’re doled out over time instead of all at once. Solana (SOL) heads this group, distributing 524,030 tokens worth approximately $85.86 million, which represents around 0.11% of its total circulating tokens.

As a researcher, I’ve observed that the current low percentage of SOL might not trigger immediate, significant price fluctuations. Instead, it seems plausible that consistent releases could subtly influence price changes or foster a sense of stability in the long run.

Worldcoin (WLD) and Dogecoin (DOGE) are set to have linear releases, with the former having a value of approximately $65.15 million and the latter around $14.48 million. It’s worth mentioning that the release of WLD will represent 6.16% of its current supply in circulation. This could potentially cause selling pressure and price volatility if market demand doesn’t align with the increased supply, as it may not be immediately absorbed.

Contrastingly, Doge might experience less price fluctuations due to its limited supply, but it’s uncertain how the community will respond in the future.

Market impact – Are these token unlocks enough to move prices?

Even though the total worth of the November unlocks didn’t surpass the $1 billion mark achieved in October, the distribution of these high-value tokens may nevertheless impact market trends. This is particularly relevant for tokens where a substantial proportion of their circulating supply is being made available at once.

As a researcher studying the cryptocurrency market, I’ve observed that coins like NEON and WLD, which have significant portions of their circulating supplies yet to be released, might experience heightened volatility due to potential selling pressure. Conversely, tokens such as ADA and SOL, with smaller unlock percentages, may only see modest price fluctuations because these releases are more likely to be smoothly absorbed without causing a significant impact on prices.

In essence, how much these releases affect things will heavily rely on the current market climate and investors’ attitudes towards investing. If there continues to be a high demand in the market, the additional funds from the released tokens might get soaked up quite easily.

On the flip side, when demand decreases, an increase in supply might cause a drop in prices for specific tokens due to their entry into circulation.

Throughout the first week of November, market observers are set to keenly observe token unlock events to evaluate their impact on individual tokens as well as the broader cryptocurrency market. Whether these releases will trigger significant price fluctuations is unclear, but they offer vital insights into each project’s liquidity patterns and the market’s reactions to shifts in supply.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

2024-11-05 11:04