- Cardano was unable to reclaim a key level as support.

- On-chain metrics indicated network-wide accumulation, but whales were slower than the 2020 rally.

As an experienced analyst, I’ve closely observed Cardano [ADA] and its price action over the past few months. Based on my analysis of the current market situation, I believe that Cardano has faced a setback in its attempt to reclaim the $0.5 resistance level. This region served as a psychological barrier during the April sell-off and failed to act as support when prices bounced back above it in May.

Cardano [ADA] saw a move past a local resistance zone at $0.5. T

On the 24th of April, his market area experienced a price imbalance, with the daily chart showing prices falling below a significant support level that failed to hold.

As I pen down these words, a pattern mirrors itself in the market. Despite a brief surge above that particular price mark on the 20th of May, the value has since dipped below it once more, now hovering around $0.482.

Do the on-chain metrics have a more encouraging outlook?

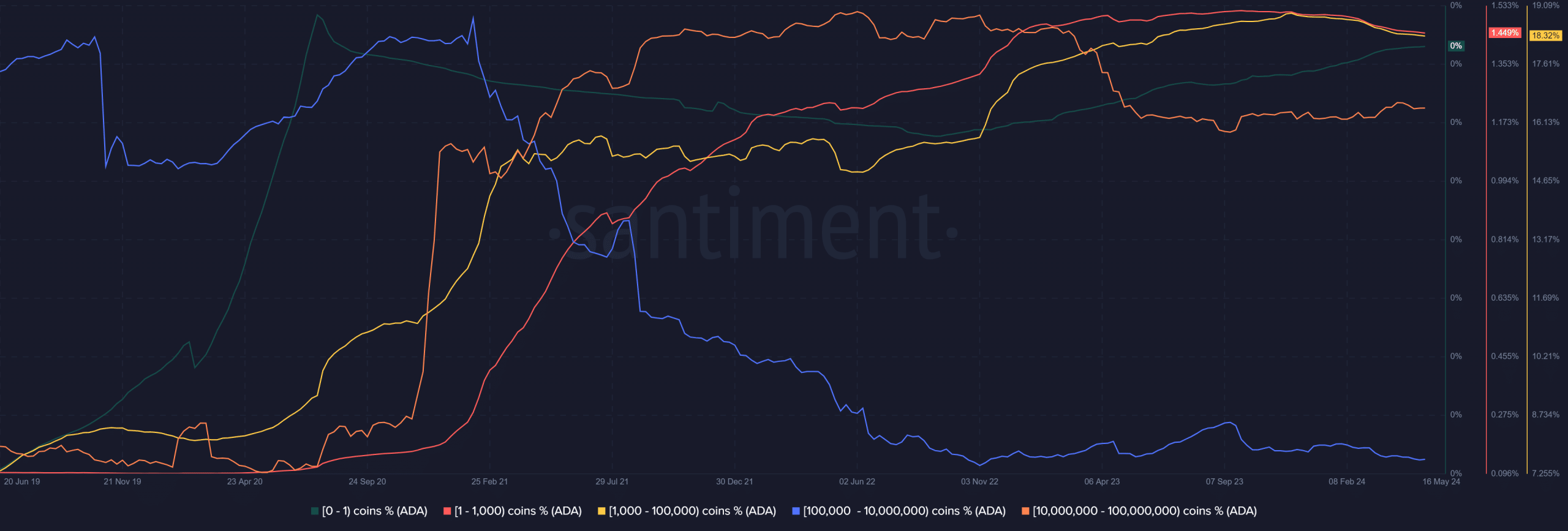

The supply distribution did not reflect a whale accumulation yet

Since the 30th of November, 2023, there has been a decrease in the number of wallets containing between 1,000 and 100,000 ADA units.

In January 2023, there was a significant drop in the number of wallets holding between 10 million and 100 million ADA tokens. However, since then, these wallets have been gradually increasing their holdings in the year 2024.

As a seasoned crypto investor, I’ve noticed that the growth of both large and medium-sized investors, or “whales” and “sharks,” respectively, during this market cycle has been more subdued compared to the 2020-21 rally. However, it is important to remember that history doesn’t always repeat itself, and the significant surge in whale holdings we witnessed then might not occur again.

Yet, as things stand, the whale wallets were not too keen on adding Cardano to their hoard.

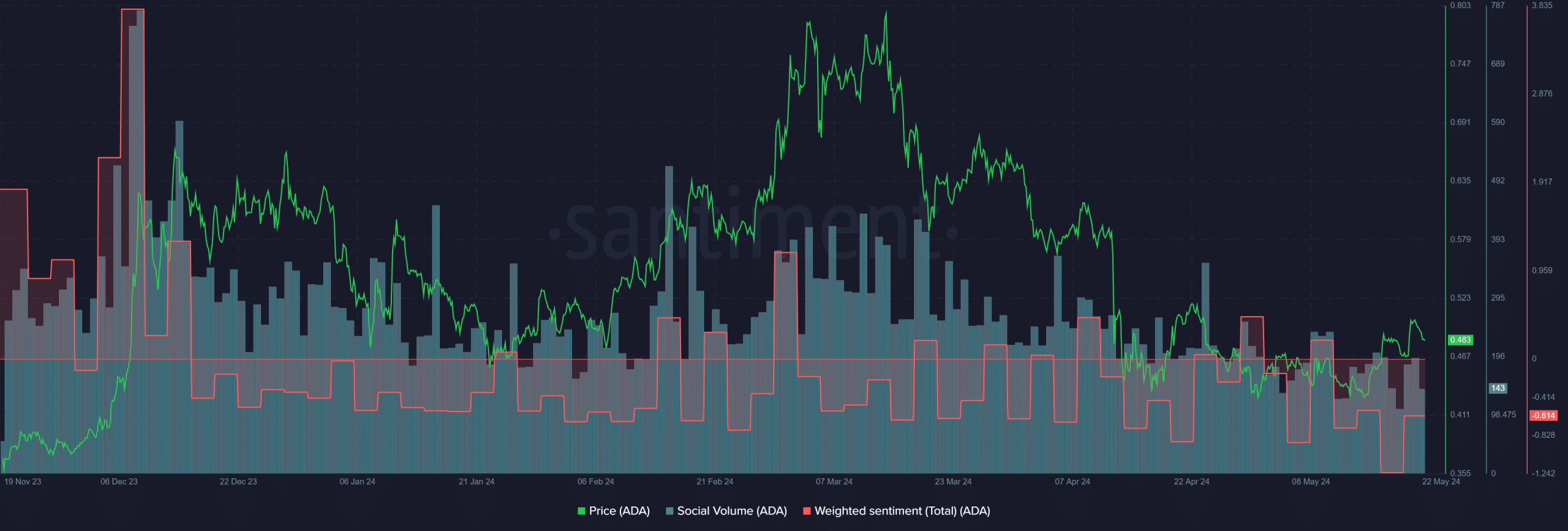

The social data showed disappointing results. For over two months, the social buzz has decreased noticeably. Additionally, the sentiment analysis, given greater significance, has remained largely negative since March.

Do the liquidation levels offer hope to the bulls?

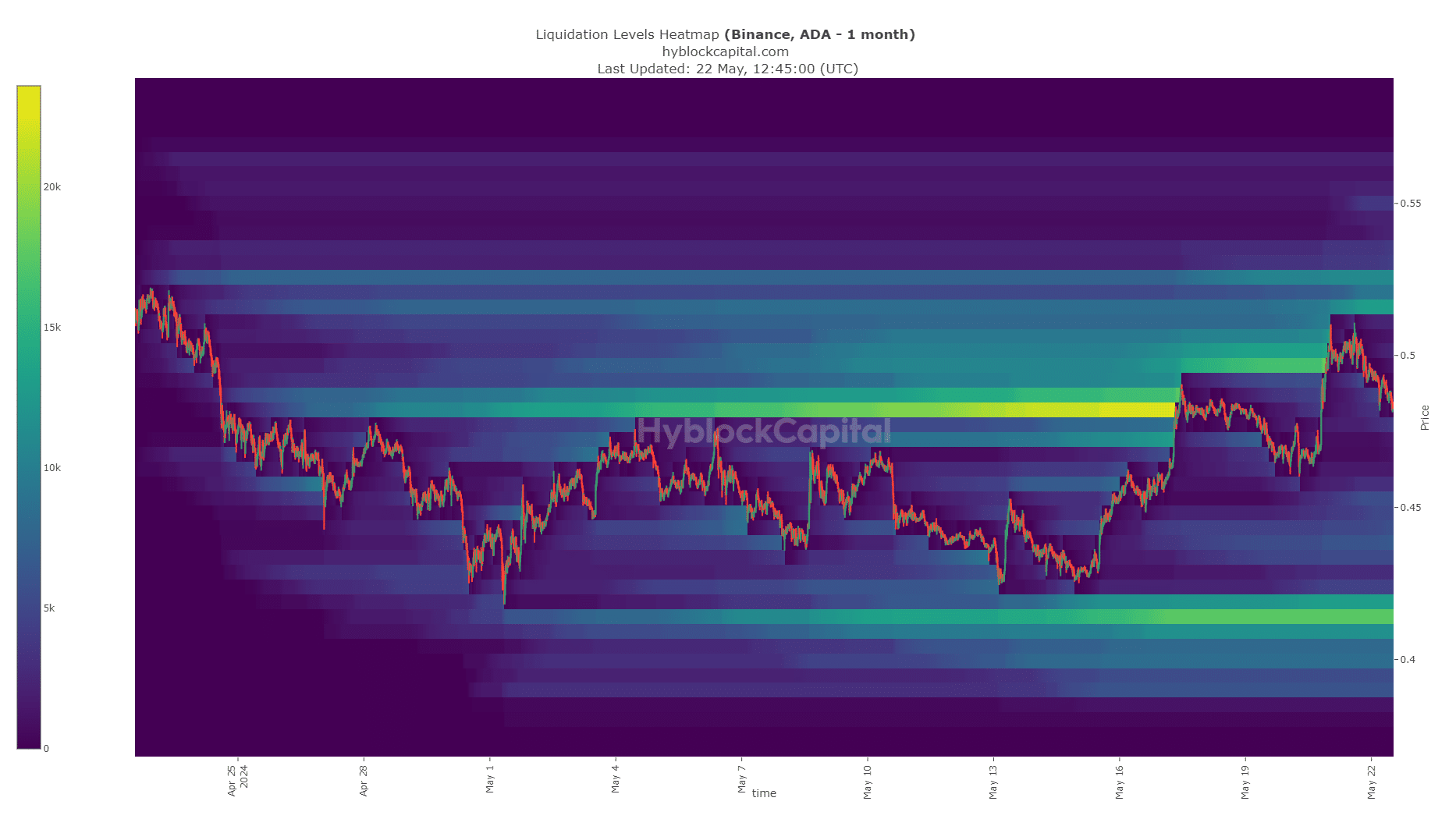

With a 1-month look-back, the liquidation heatmap highlighted the significance of the $0.5 mark as a key area for market liquidity. Once this level was breached, there was a noticeable rejection in the price of ADA.

This indicated that consolidation around $0.477 before the next rally to $0.525 is possible.

A consolidation in such circumstances allows for a greater number of short positions to be established, thereby enhancing the overall liquidity in the market.

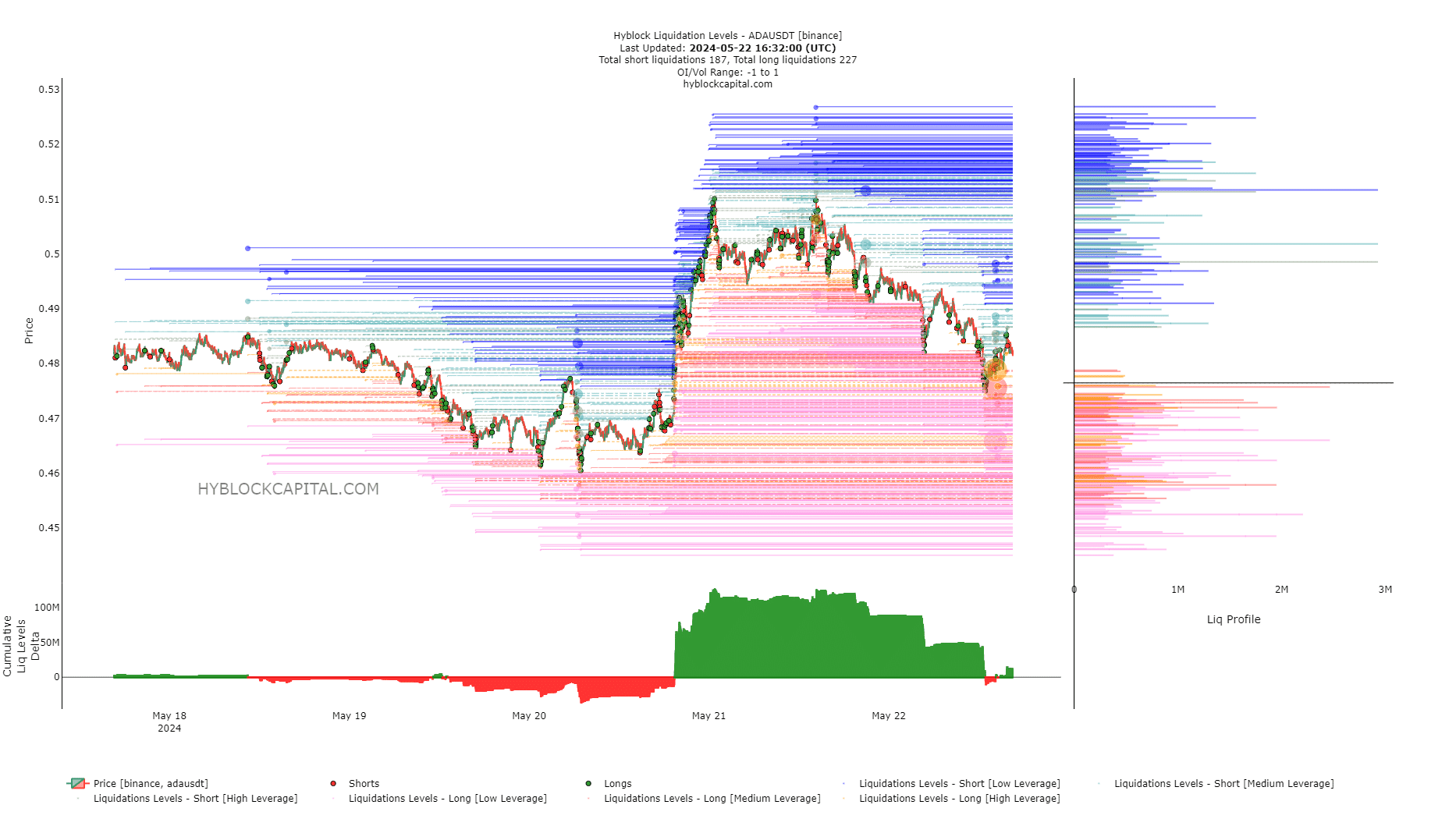

As a researcher examining the market data, I discovered that the number of open short and long positions was relatively equal in the immediate future based on the liquidation levels. However, the recent price drop from $0.51 erased the profits for those who had recently entered long positions.

The analysis of the liquidation levels indicated that a larger number of long positions were at risk of being closed out than short positions.

As a researcher studying market trends, I identified three significant price levels for potential downward movements: $0.479, which is high leverage, $0.475 with medium leverage, and $0.466 as a low leverage point.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Grammys Pay Emotional Tribute to Liam Payne in First Honorary Performance

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

2024-05-23 11:03