-

ADA whales have intensified coin accumulation.

This has occurred amidst the steady drop in the altcoin’s value.

As a researcher with extensive experience in analyzing cryptocurrency market trends, I’ve been closely monitoring the recent developments surrounding Cardano (ADA). Despite the steady drop in ADA’s value over the last month, whales have intensified their coin accumulation. This trend has been evident in the significant increase in large transactions and a surge in daily whale activity.

Large investors holding Cardano (ADA) have persistently bought up the cryptocurrency, even as its value dropped by nearly 30% over the past month.

On their X platform, specifically in a recent post (previously known as Twitter), IntoTheBlock highlighted that there was an average of approximately $13.84 billion in significant transactions per day for Cardano’s ADA cryptocurrency over the past week.

This amount equates to approximately one-third of the current Bitcoin [BTC] trading activity, five times greater than Litecoin‘s [LTC] volume, and more than sixteen times the volume of the popular meme coin, Dogecoin [DOGE].

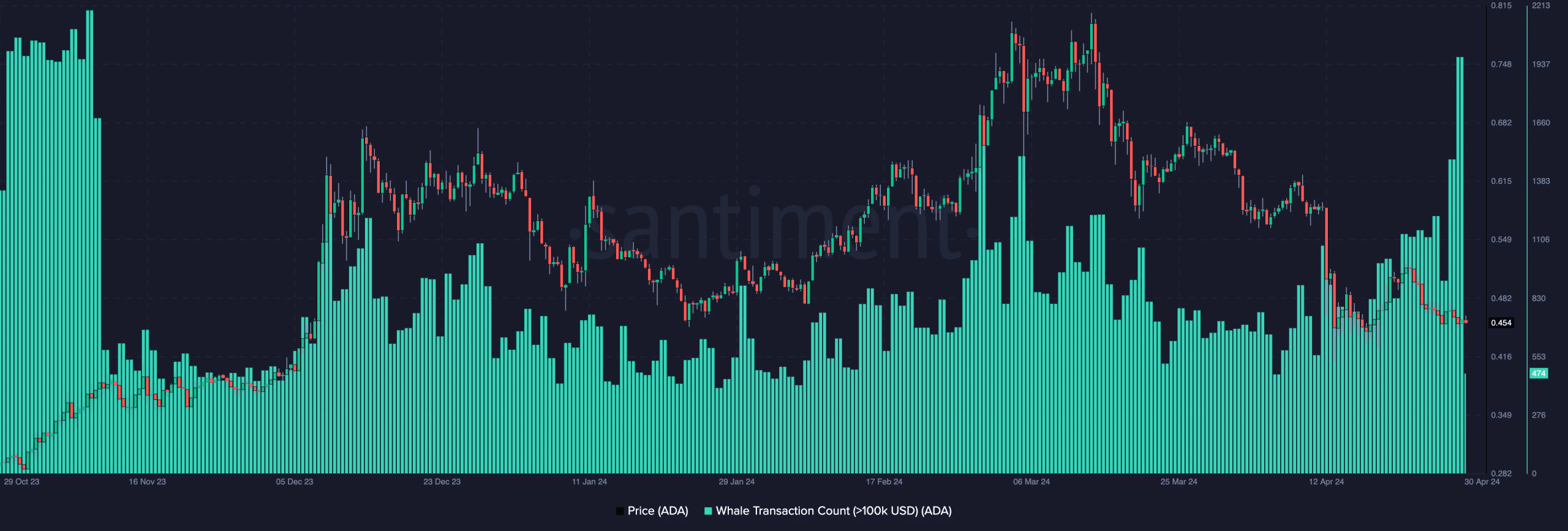

As a researcher analyzing data from Santiment, I discovered an intriguing trend regarding whale transactions for the specific coin under investigation. On April 29th, there was a significant spike with a record-breaking 1,776 daily transactions worth over $100,000 each. This marked the highest number of such transactions since November 8th, 2023.

Based on historical trends reported by the data source, these peaks in whale activity may indicate upcoming price changes, potentially signaling a short-term rally for ADA.

ADA may extend losses

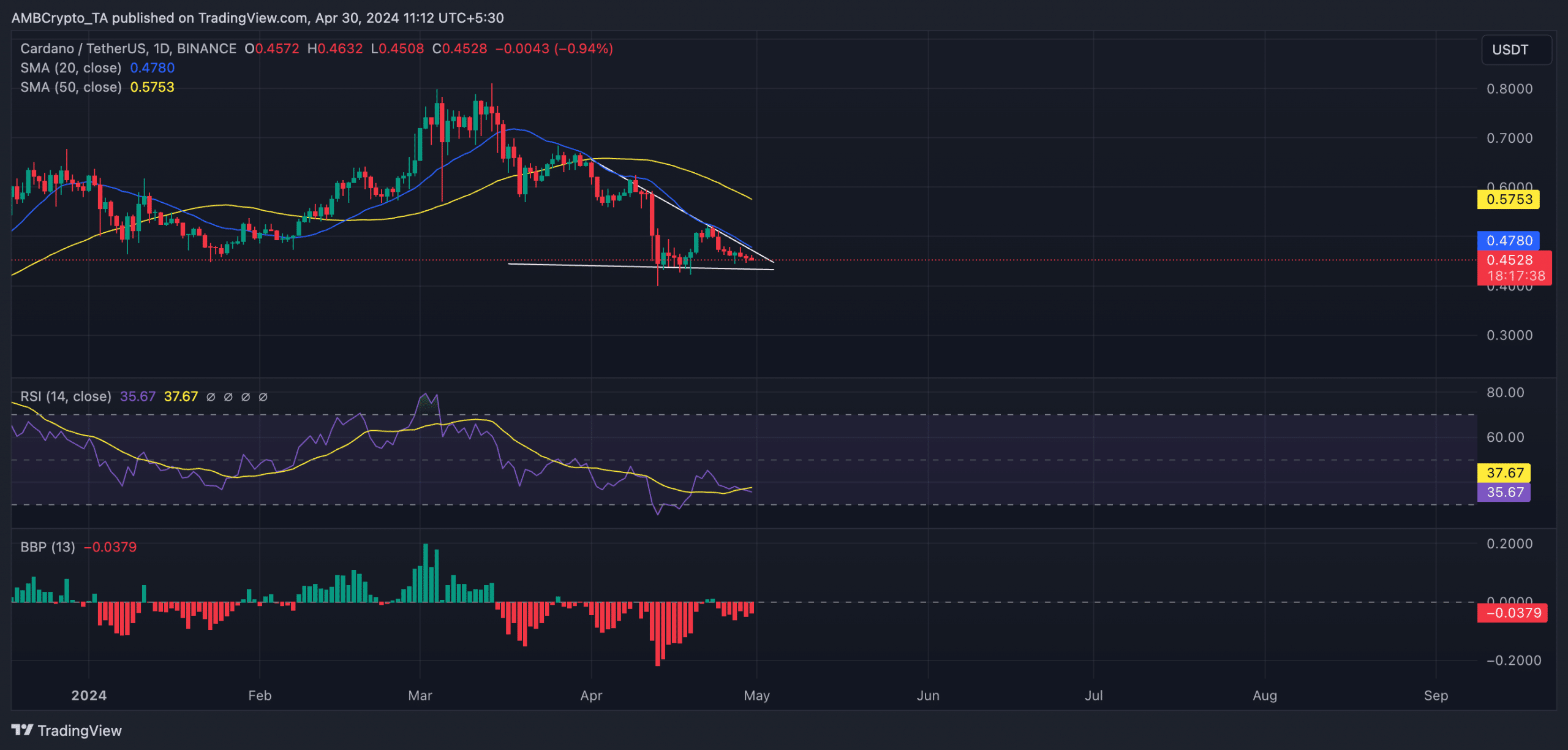

At the moment of publication, the value of ADA was being traded at $0.45. Upon examining its short-term trend on a daily chart, it was evident that the price was sitting below both its 20-day and 50-day moving averages.

As a crypto investor, I frequently observe that moving averages (MAs) act as crucial support benchmarks. Whenever an asset’s value dips to these levels, it usually indicates a brief respite in the price decrease as buyers enter the market. However, if the price falls below these MAs with substantial selling volume, it may signal a continuation of the downward trend.

As a crypto investor, I observed that ADA‘s price dipped below its moving averages on the first of April. This downturn was further validated by the decrease in its Relative Strength Index (RSI), suggesting an increase in selling pressure for the coin since then.

At the current moment, the Relative Strength Index (RSI) of ADA stood at 35.67. If the selling pressure continued, this indicator implied that the coin was approaching being oversold.

Based on the data from CoinMarketCap, I have observed that since ADA‘s price dipped below its moving averages on April 1st, it has experienced a double-digit percentage decline.

At present, the Elder-Ray Index for ADA indicates a decrease in new ADA accumulation. This index has displayed negative values since March 15th, just after the coin reached its highest price of $0.77 for the year. Since then, ADA’s value has been on a downward trend.

As a researcher studying the dynamics of altcoin markets, I would describe an indicator that reflects the balance between buying and selling pressure as follows: This metric reveals the extent to which buyers or sellers are in control of the market. A negative value signifies that sellers hold more influence, meaning bear power is dominating the market.

Read Cardano’s [ADA] Price Prediction 2024-25

However, the prolonged decline in ADA’s value has led to the forming of a descending triangle.

Should the sentiment shift, the price of the coin could rebound from its support at $0.45, potentially rising to be traded at around $0.49. It’s even plausible that the coin’s value might surpass $0.52 under such circumstances.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

2024-04-30 11:03