-

Cardano’s lowered volatility promised a sharp price move soon.

The resistance at $0.36 and $0.42 could be pivotal in deciding ADA’s trend.

As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I can’t help but feel a mix of anticipation and apprehension when looking at Cardano [ADA]. The lower volatility is a double-edged sword – it could mean a significant price move is imminent, but history tells me to brace for impact.

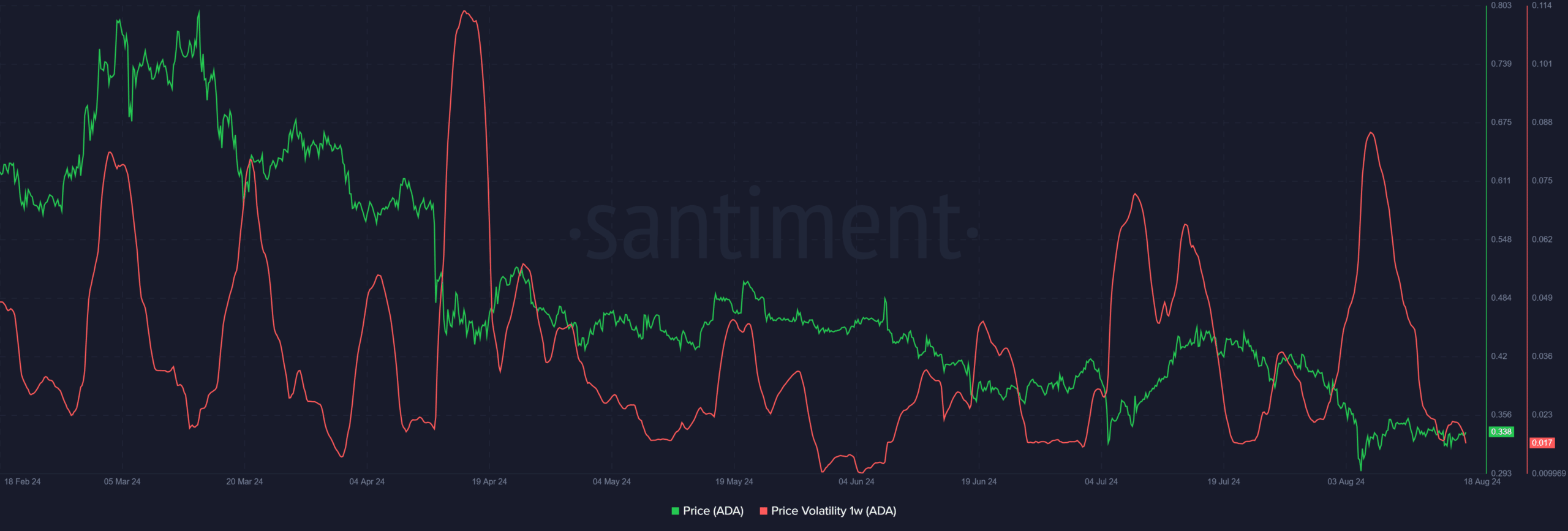

Over the past week, the volatility of Cardano [ADA] reached its lowest point in six weeks. Typically, when volatility decreases, it suggests that the price is stabilizing and preparing to make a significant surge.

It’s possible to speculate about the potential future trajectory of ADA, but it may not break free from the current bearish trend immediately. Analysis by AMBCrypto suggests some patterns that could guide its movement, but a definitive change in direction might take some time.

ADA has bad news for bulls

Over the past week, I’ve noticed some significant fluctuations in the price of Cardano, as reflected in its volatility chart. Interestingly, despite these spikes, they haven’t managed to reverse the overall downward trend that’s been going on since April.

Either they resumed the downtrend or saw a sharp move upward to retest a former support zone.

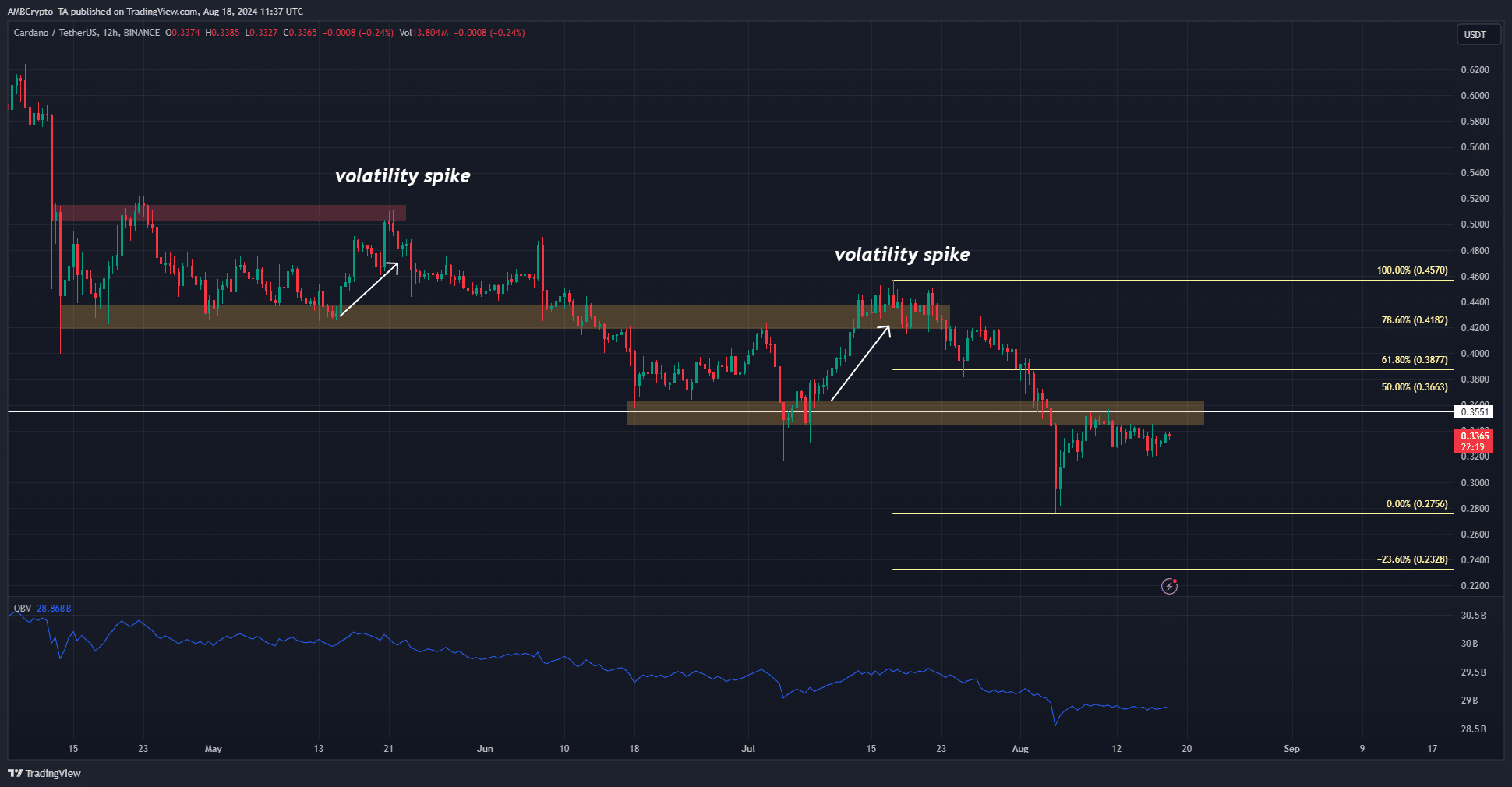

On the 12-hour chart you see, it underscores two significant price swings, similar to those seen since May, which were mainly caused by a surge in ADA‘s value.

It appears that despite the opportunity for the price to stabilize, the bullish momentum was insufficient to shatter the persistent bear trend permanently.

In my investigation, I observed that each price surge merely re-visited a recently established peak, yet failed to breach beyond these levels and rise further, as depicted in the OBV.

Currently, the market’s volatility has dropped to its lowest point in six weeks. The probable outcomes could be either a brief rebound followed by a downturn (bearish reversal) or a progression towards the Fibonacci extension level at approximately $0.233.

How high could a potential bounce go?

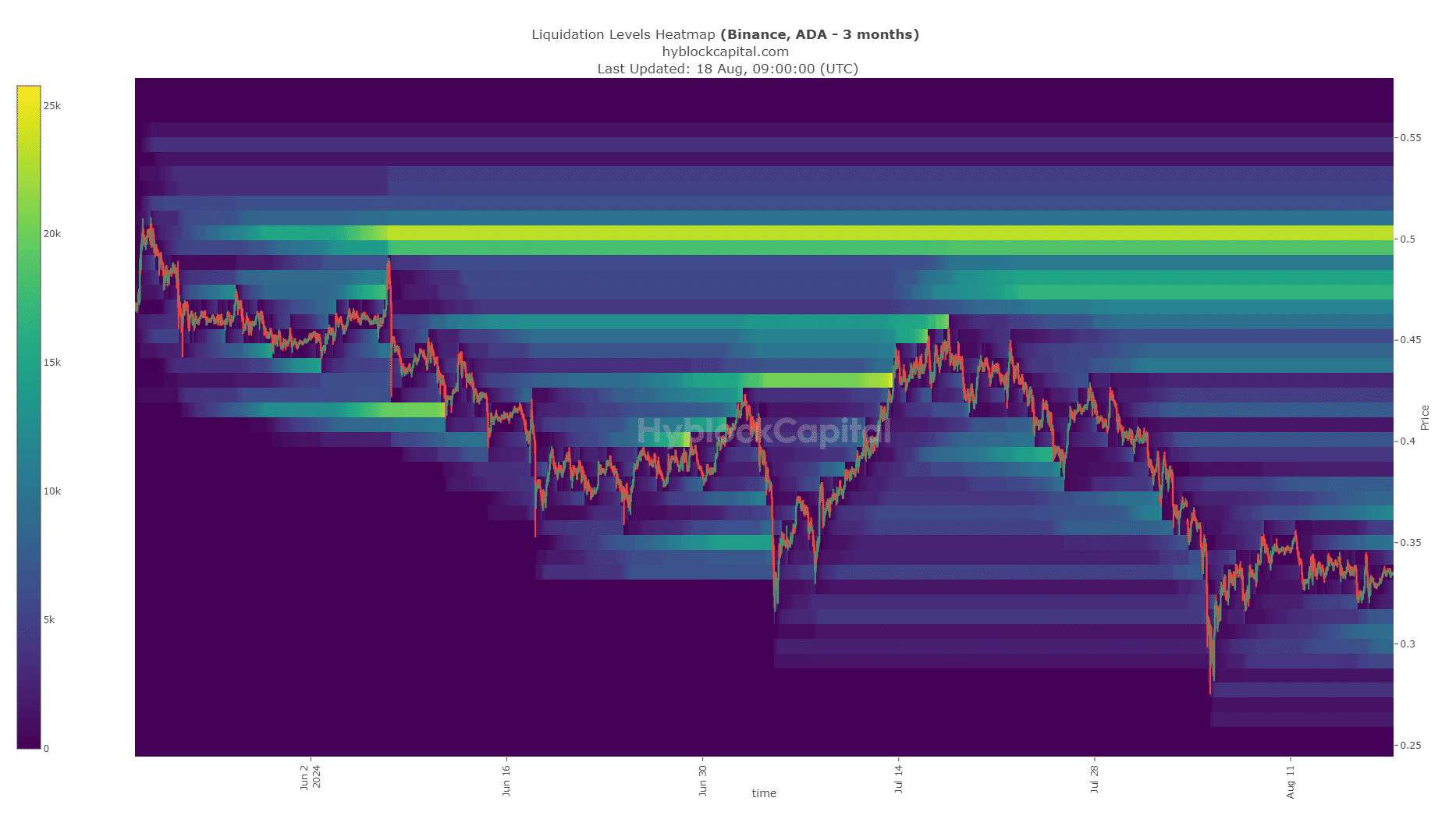

The 3-month liquidation chart emphasized the amounts $0.365, $0.44, $0.48, and $0.5. Among these, $0.48 and $0.5 have the highest concentration of liquidation activity and are the areas with the greatest magnetic attraction.

The other two lined up with the support/resistance zones highlighted on the 12-hour price chart.

Read Cardano’s [ADA] Price Prediction 2024-25

For those trading Cardano using a swing strategy, the Fibonacci retracement levels at approximately $0.366, $0.387, and $0.418 can serve as useful indicators for assessing the potential bullish momentum.

As an analyst, I’m noticing a surge in weekly volatility, which could suggest an intense buying or selling pressure, signaling an impulsive market movement might be unfolding. However, it’s crucial to exercise patience and wait for price rejection at these resistance levels before considering a short position.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-08-19 04:07