- ADA’s Open Interest (OI) has increased by 6.9%, indicating strong traders’ participation.

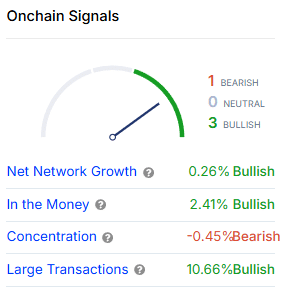

- ADA’s on-chain metrics suggested that bulls were dominating the asset.

As a seasoned crypto investor with a knack for spotting trends and deciphering market signals, I find myself quite bullish on Cardano (ADA) at the moment. The past few days have seen ADA surge by nearly 100%, and given its current bullish price action pattern, it seems poised to continue this rally.

Over the last few days, Cardano [ADA] has experienced a significant surge, with gains close to 100%. Given its strong bullish trend, there’s a good chance it will keep rising based on its recent price action.

On the other hand, although the overall market outlook was optimistic, certain assets saw a decline in their prices, but others managed to achieve significant increases.

Cardano appears set to keep climbing in value. This positive forecast stems from factors like the prevailing optimistic market mood, a surge in large transactions, and indications of bullish trends in its price movements.

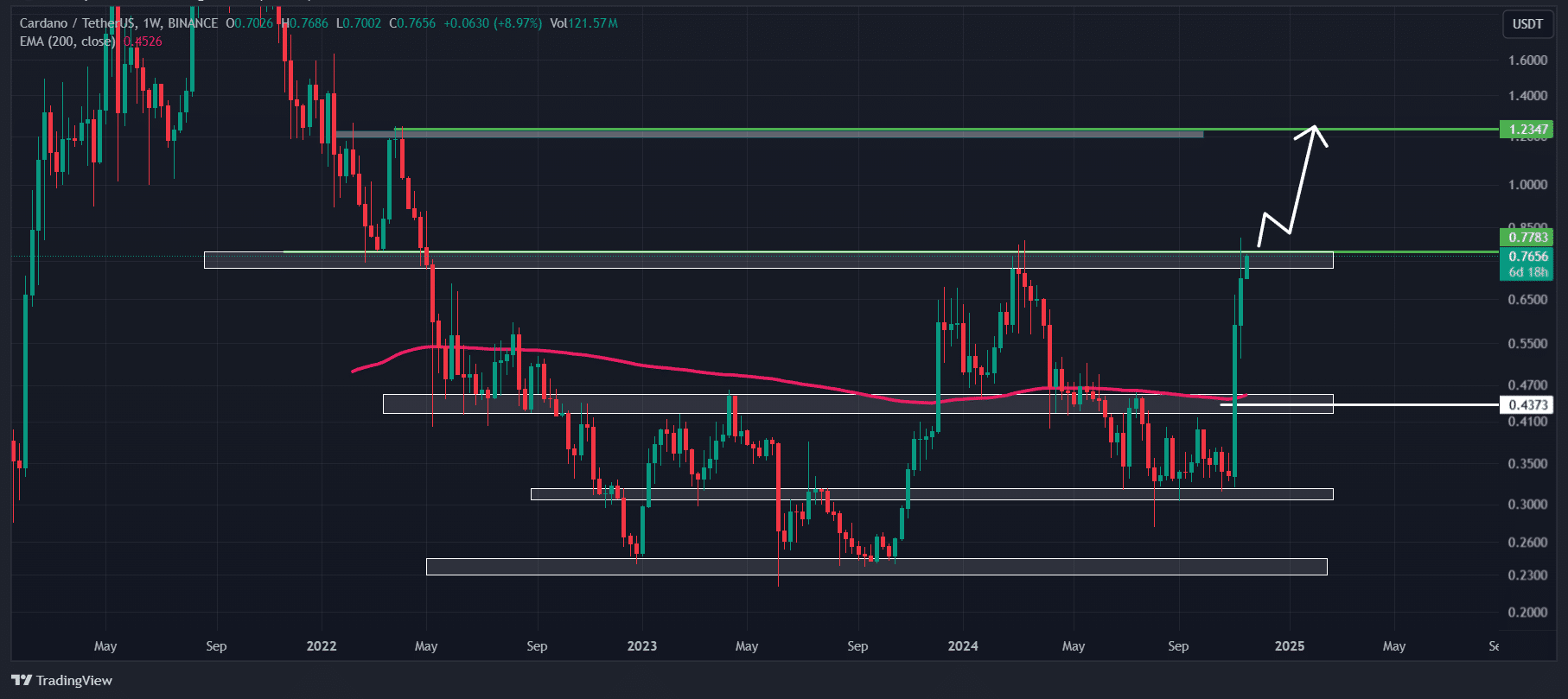

Cardano technical analysis and key levels

Based on AMBCrypto’s technical assessment, at the moment of reporting, ADA was encountering significant resistance around $0.77 and was making an effort to overcome it.

Given the latest price trends, if the altcoin manages to exceed the current $0.80 mark and concludes the daily trade above that point, there’s a high likelihood it might jump by approximately 30% more.

As I’m typing this, ADA is being transacted at a price higher than its 200 Exponential Moving Average (EMA) in the daily chart, suggesting that it’s currently experiencing an upward trend.

As I closely monitored the market dynamics, I noticed that the Altcoin’s Relative Strength Index (RSI) had ventured into overbought territory. This observation might indicate an impending adjustment or drop in its price, a trend that is often seen when an asset is overbought.

Based on the prevailing market mood, it seems uncertain that ADA will experience a price drop, but there could be a chance for price stabilization near its resistance point instead.

Bullish on-chain metrics

Besides technical analysis, on-chain metrics further supported ADA’s positive outlook.

Based on data from analysis firm Coinglass, there’s been a significant uptick in Cardano’s Open Interest (OI) over the last four hours by approximately 6.9%, and within the past hour by about 3.2%. This substantial growth in open interest suggests active trader involvement.

Moreover, IntoTheBlock’s analysis indicates a 12% rise in large transaction activity over the last day, implying that whales and institutions may be actively participating in the market as prices near a critical point.

By bringing together these various indicators, it appears that the buyers are presently holding the upper hand in the market, potentially empowering Cardano (ADA) to overcome this substantial resistance barrier.

Realistic or not, here’s ADA market cap in BTC’s terms

At press time, ADA was trading near $0.73 and registered a gain of over 3.9% in the past 24 hours.

Over these days, we’ve seen a significant decrease (42%) in the number of transactions being made, which suggests that fewer traders and investors are actively participating in the market compared to the last day.

Read More

2024-11-19 03:03