- Cardano short liquidations surged to the highest level in two months after a 10% rally.

- ADA has also formed a double-bottom pattern on its one-day chart, signaling an upcoming bullish reversal.

As a seasoned analyst with years of experience navigating the volatile cryptocurrency markets, I find the recent surge in Cardano [ADA] particularly intriguing. The 10% rally in just 24 hours has not only brought ADA back into the limelight but also triggered the highest level of short liquidations in two months.

In simple terms, after displaying bearish tendencies, Cardano (ADA) is experiencing a turnaround as the overall crypto market recovers. Within the last day, ADA’s value has climbed approximately 10%, currently trading at $0.362.

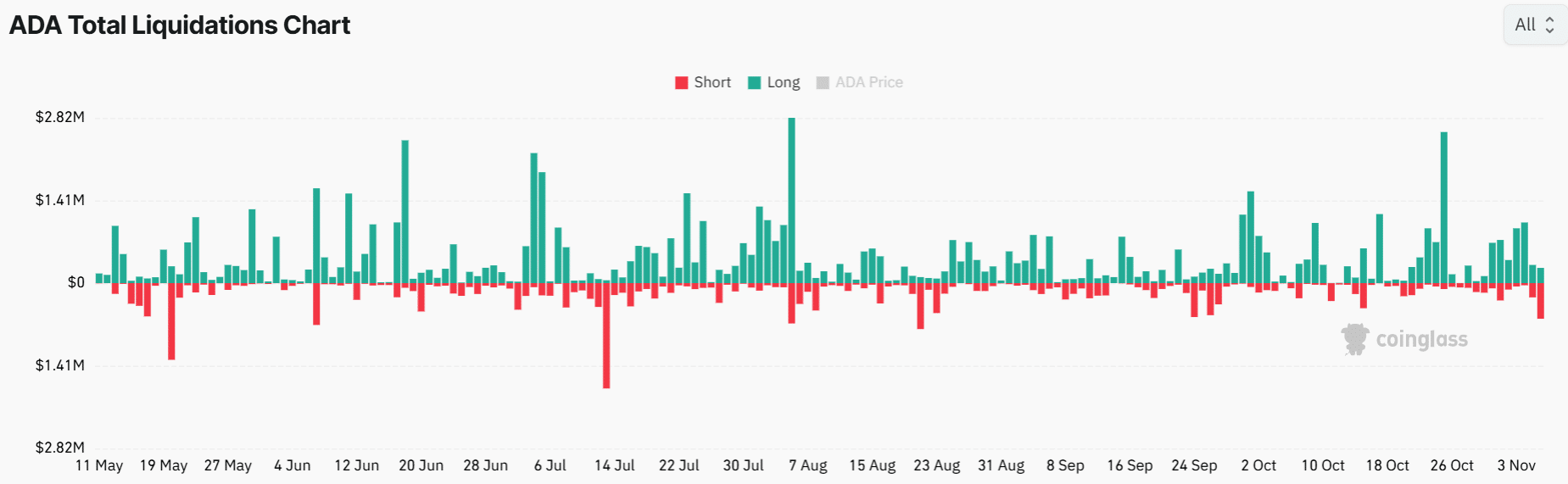

The price rebound has led to ADA short liquidations increasing to the highest level in two months.

Data from Coinglass shows that around $868,000 in open positions on ADA were liquidated. Short sellers suffered the biggest blow as short liquidations came in at $608,000.

Meanwhile, funding rates noticeably increased, going up from a mere 0.0008% to 0.0093%. At the moment of reporting.

This spike indicates that more and more derivative traders are entering into new bullish positions (long positions) on Cardano (ADA). An escalation in long positions implies that these traders are growing increasingly hopeful about the potential growth of ADA in the future.

The positive sentiment in the derivatives market coincides with bullish signals on Cardano’s one-day chart.

Analyzing Cardano’s double-bottom

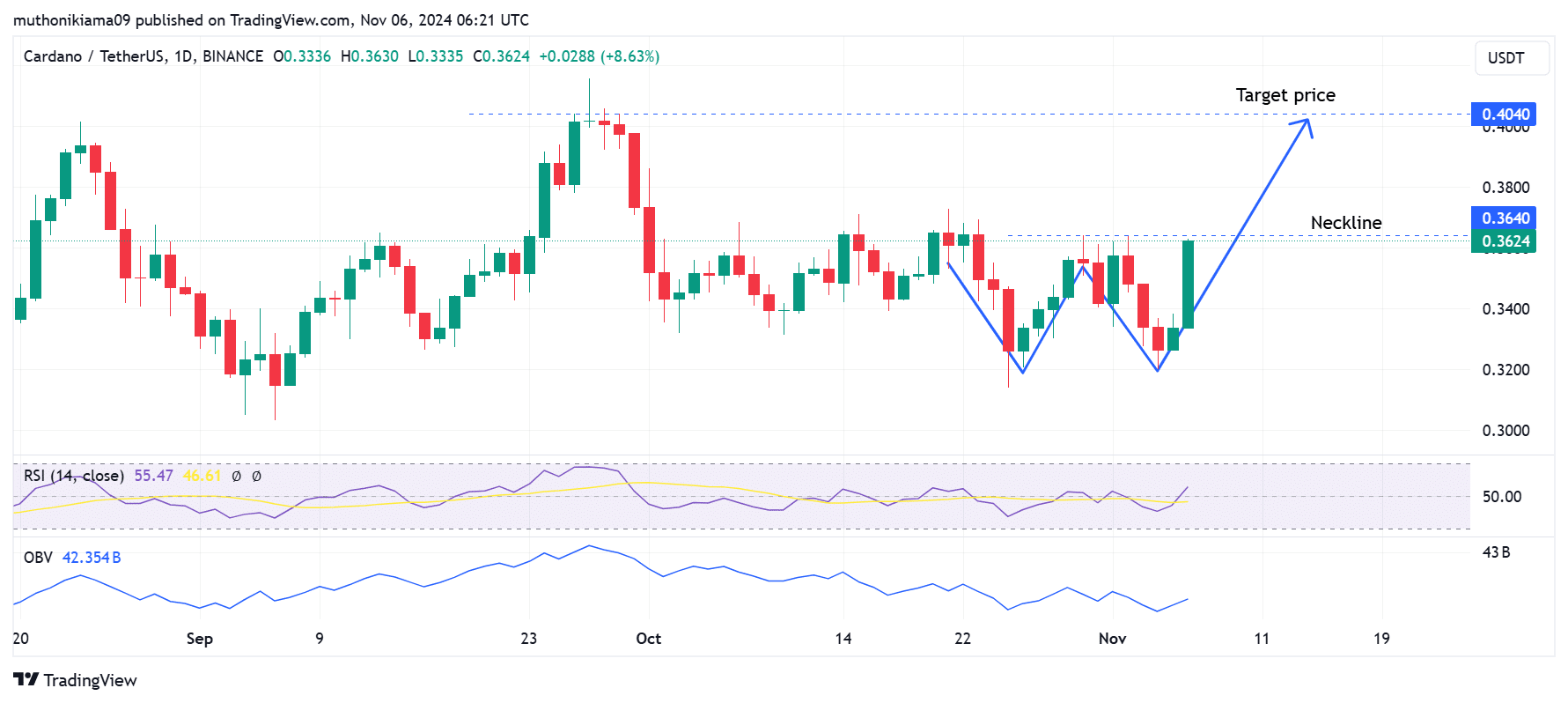

Cardano has developed a double-bottom structure, typically signaling an upcoming bullish shift. This formation suggests that the ADA price has established a robust base of support, implying a potential increase in its value is on the horizon.

As an analyst, I’ve observed that the digital currency ADA has recently tested support at around $0.364 within a double bottom pattern. If this bullish reversal persists, I anticipate a potential 11% increase in ADA’s value, which could propel it towards the next resistance level at approximately $0.404.

If the trading volume increases as well, a push past the current resistance level could occur. The On-Balance Volume (OBV) indicator suggests that the buying pressure is growing along with the price rise, which indicates a strong trend.

The Relative Strength Index (RSI), a useful tool, suggests a potential increase toward the target price, as it’s currently at 55 and has climbed over its signal line, indicating an increase in bullish energy.

As these bullish signals align, a pathway toward $0.404 remains likely for Cardano.

Cardano MVRV ratio stumbles

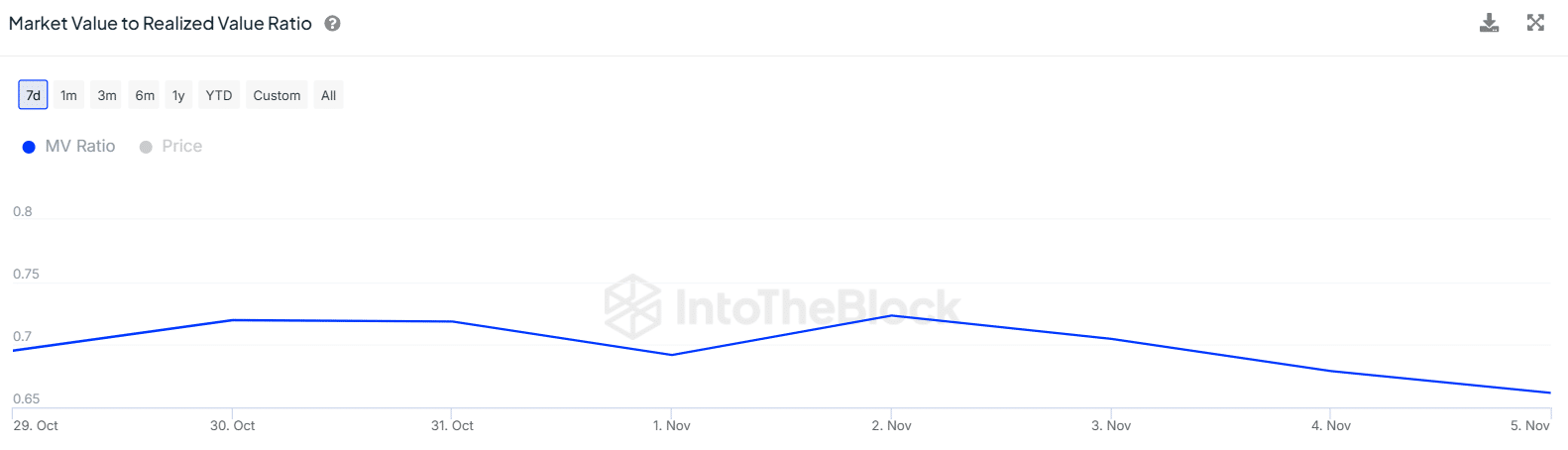

Over the past four days, the Cardano Market Value to Realized Value (MVRV) ratio has noticeably decreased, falling from 0.723 to 0.661 as of now.

A decreasing MVRV ratio suggests that the market value of ADA is lower than its actual worth, implying that present ADA buyers may be purchasing at a discounted price.

Keep in mind that a drop in the MVRV (Maker’s Value to Realized Value) ratio might not necessarily mean that the ADA rally has lost momentum, but rather investors could be losing faith. This underscores the necessity of additional buyer interest to verify the continuation of the uptrend.

Will Cardano sustain its gains?

Following the latest price surge, as reported by CoinMarketCap, Cardano’s (ADA) total market value reached a staggering $12.70 billion, pushing Toncoin (TON) down in terms of market cap. In a span of 24 hours alone, Cardano gained an impressive $1 billion to its market capitalization.

Realistic or not, here’s ADA’s market cap in BTC terms

A return to the top-ten largest cryptos could renew positive sentiment from investors, supporting the likelihood of more gains.

Yet, the latest surge in ADA appears closely tied to overall market opinions. As such, it’s essential for investors to monitor shifts in general market sentiments to verify whether this upward trend will persist.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-11-06 18:15