-

ADA’s MVRV ratio has flashed a buy signal.

Its current holders are dealing with significant losses.

As an experienced analyst, I see Cardano’s [ADA] current market situation as a potential buying opportunity based on the MVRV ratio and the high number of addresses dealing with losses.

The 6% drop in Cardano‘s [ADA] value over the last week may represent an attractive purchasing chance for investors aiming to make trades contrary to current market trends.

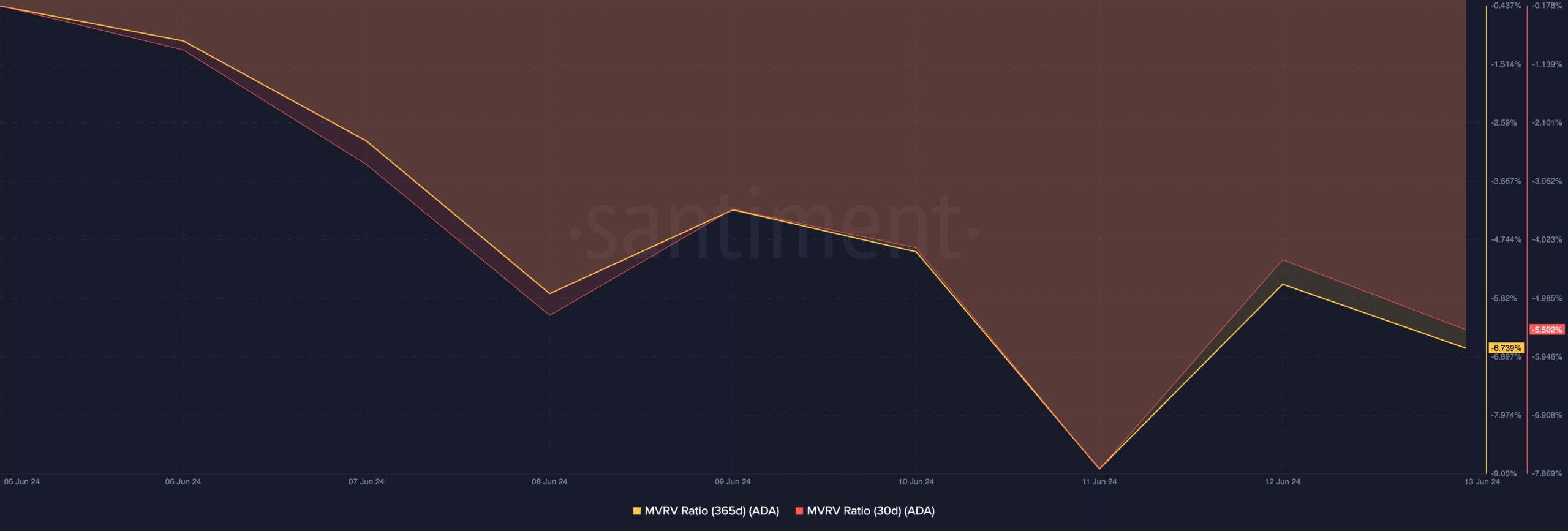

Based on the information from Santiment, I’ve noticed that the altcoin’s Market Value to Realized Value (MVRV) ratio, which is calculated by comparing the current market value of an asset to the total amount paid for it, has shown negative values when assessed across various moving averages. This indicator is commonly used in crypto investing as a buy signal, suggesting that the current price may be undervalued relative to the historical cost basis for investors who bought in at earlier prices. So, from my perspective as an investor, this could be an opportunity worth exploring.

At the point of this writing, ADA‘s Moving Average Value Realized Values (MVRV) stood at a negative 5.44% based on the previous 30 days’ average, and negative 6.72% according to the last year’s average.

As a crypto investor, I often look at the price-to-cost basis ratio (PCBR) of my assets to assess their performance. This metric helps me understand the difference between the current value of an asset and the weighted average cost at which I purchased its coins or tokens. By doing so, I can evaluate the potential profits or losses from each investment and make informed decisions about my portfolio.

When its value surpasses one and is on the rise, the asset is typically traded at prices higher than what most investors originally paid for their holdings.

The coin’s value is believed to be inflated, leading some traders to cash out and potentially triggering a price decrease.

In simpler terms, when the Market Value to Realized Value (MVRV) ratio is less than zero, it means that the current market value of a particular asset is lower than the average cost at which its tokens were bought by investors. This implies that the asset may be undervalued in the market.

In simpler terms, when an asset has a negative MVRV ratio, it means that its current market price is lower than its past average purchase price. This situation can signify a potential buying opportunity as the asset might be undervalued.

ADA holders deal with losses

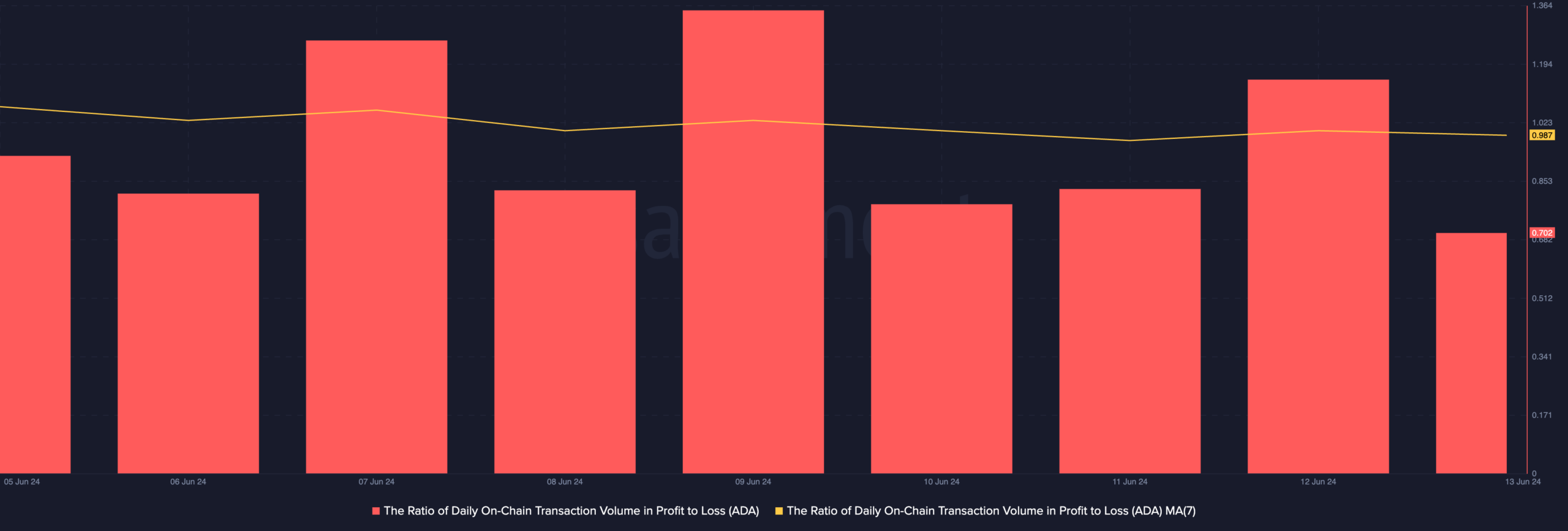

As a crypto investor, I’ve observed that ADA‘s value decrease over the last week has diminished its profitability for me and other holders. This was further highlighted when I examined the daily transaction data, noticing that the volume of profitable transactions fell short of losses.

Assessed using a seven-day moving average, the value of this metric was 0.98 as of this writing.

I analyzed the data and found that out of every ten transactions resulting in a loss during the given timeframe, only nine transactions led to profits. Thus, it can be inferred that a larger number of ADA transactions ended in losses compared to those with positive outcomes.

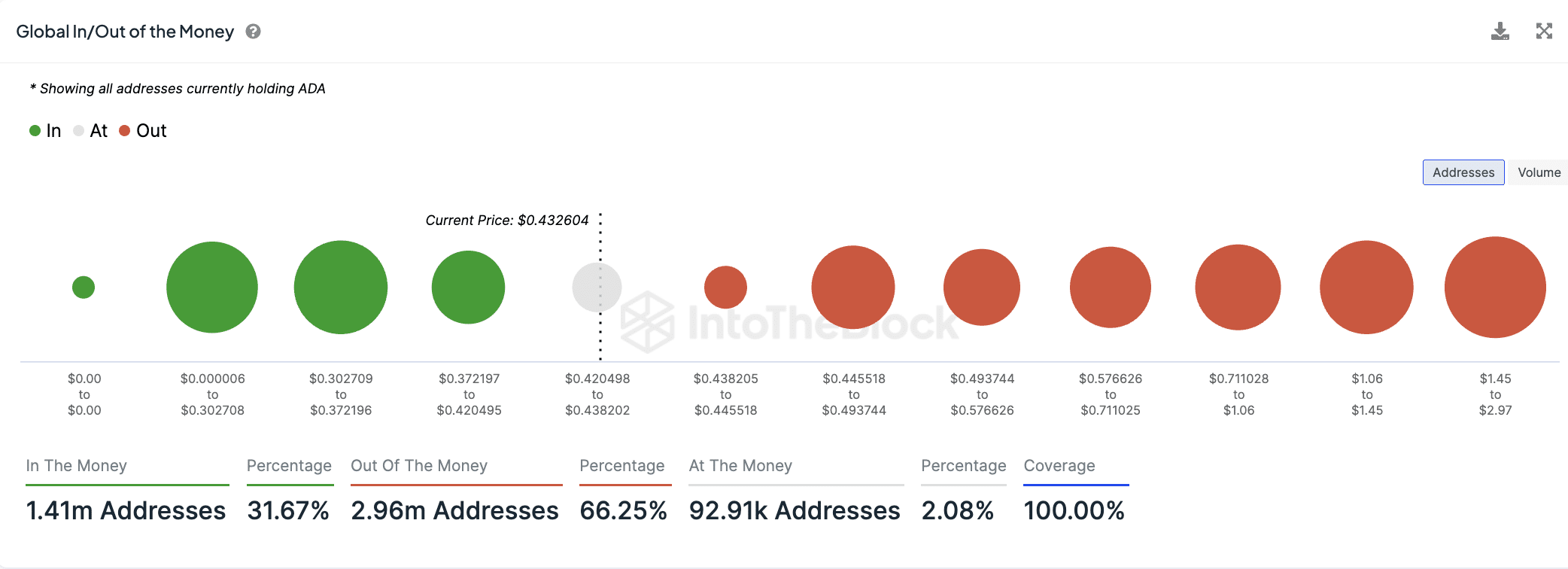

Based on IntoTheBlock’s data, approximately 66.25% of Cardano (ADA) address holders, amounting to around 2.96 million addresses, currently have a negative return on their investment.

In simpler terms, an “out-of-money” address refers to one where the average cost basis of the coins held exceeds their current market value. Approximately 3 million ADA addresses currently hold their coins at a loss.

As an analyst, I would rephrase that statement as follows: Approximately 31.67% of all ADA address holders, amounting to 1.41 million addresses, currently enjoy a positive return on their investment.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-14 02:15