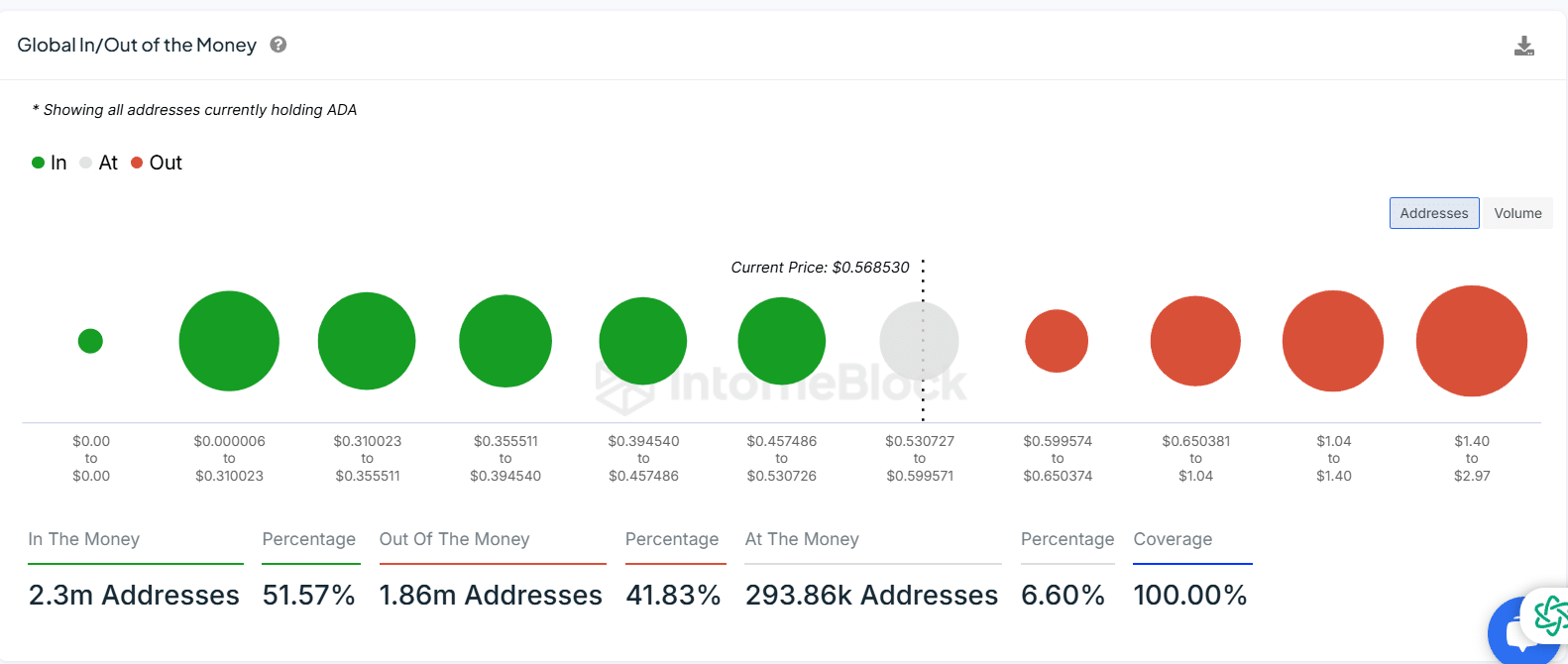

- In/Out of Money data revealed $0.2 and $1.99 as key ADA price levels.

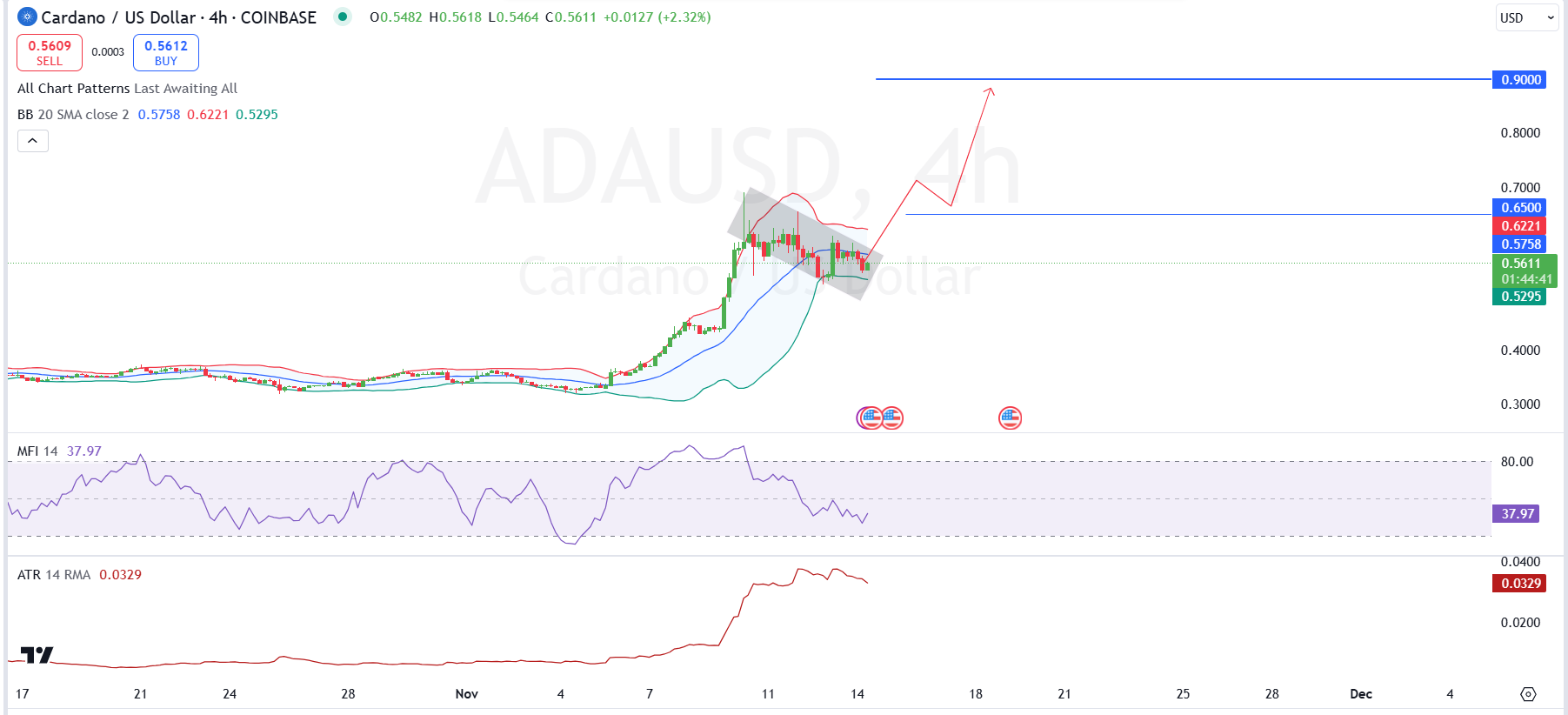

- Tightening Bollinger Bands shows ADA is gearing up for a breakout.

As a crypto investor with a few years under my belt and a portfolio that’s seen its fair share of market swings, I find myself intrigued by the current state of Cardano [ADA]. The recent rally has been nothing short of impressive, but as always, it pays to be cautious and analyze the situation from various angles.

In the past week, the value of Cardano [ADA] has experienced an upward trend, surging by approximately 42%, and currently standing at $0.50 – a level not seen since April.

On the 14th of November, ADA was exchanging hands at approximately $0.55, representing a minor decrease of around 4.07% over the preceding 24 hours. Lately, Cardano has managed to regain its position among the top 10 cryptocurrencies, surpassing Tron in terms of market capitalization.

Is Cardano consolidation a buildup for breakout?

As a researcher observing the market dynamics, I find myself noting that at present, Cardano has entered a consolidation period following a robust upward trend. At this moment, its trading activity seems to be confined within a tight band, hinting at a subtle bullish sentiment.

On the 4-hour chart, Bollinger Bands indicate a narrow compression, hinting at an imminent ADA price surge or breakout. The upper limit of the band around $0.65 may act as potential resistance, with a future goal of reaching approximately $0.90 in the longer term.

As an analyst, I’m finding a growing sense of optimism with each supporting indicator we’re seeing. Specifically, the Money Flow Index currently stands at 37.97, suggesting that there’s still some wiggle room for further price increases without venturing into overbought territory.

As the Average True Range indicates a decrease in market volatility, it could be hinting at an impending significant price shift or movement.

Should ADA surpass the $0.65 barrier, it might trigger a fresh upward trend, with investors looking towards $0.90 as the next notable objective.

On-Chain data shows $0.2 and $1.99 as key levels

According to AmbCrypto’s examination, there are two critical price points for Cardano that might substantially influence market dynamics.

At approximately $0.2, roughly 540,000 wallets holding ADA would find themselves in a position where they would incur losses if the price remained at that level. If the price of ADA falls to this point, numerous holders might choose to sell their assets, which could escalate liquidation pressure and potentially drive the price down further.

Instead, when the price hits $1.99, approximately 726,000 previously “Out of the Money” addresses will become profitable, transitioning to being “In the Money.

As an analyst, if ADA’s price climbs to $1.99, I anticipate a surge in profit-taking among its holders. This could potentially establish a strong resistance level, slowing down any further price increases as numerous investors decide to realize their profits.

In terms of ADA’s market perspective, the key points to consider are the potential support at $0.2 that may trigger selling activity, and the resistance at $1.99 where investors might choose to cash out due to profit-taking pressure.

Keeping a close eye on these potential price levels is crucial because they might considerably influence market liquidity and volatility, which are vital factors to consider.

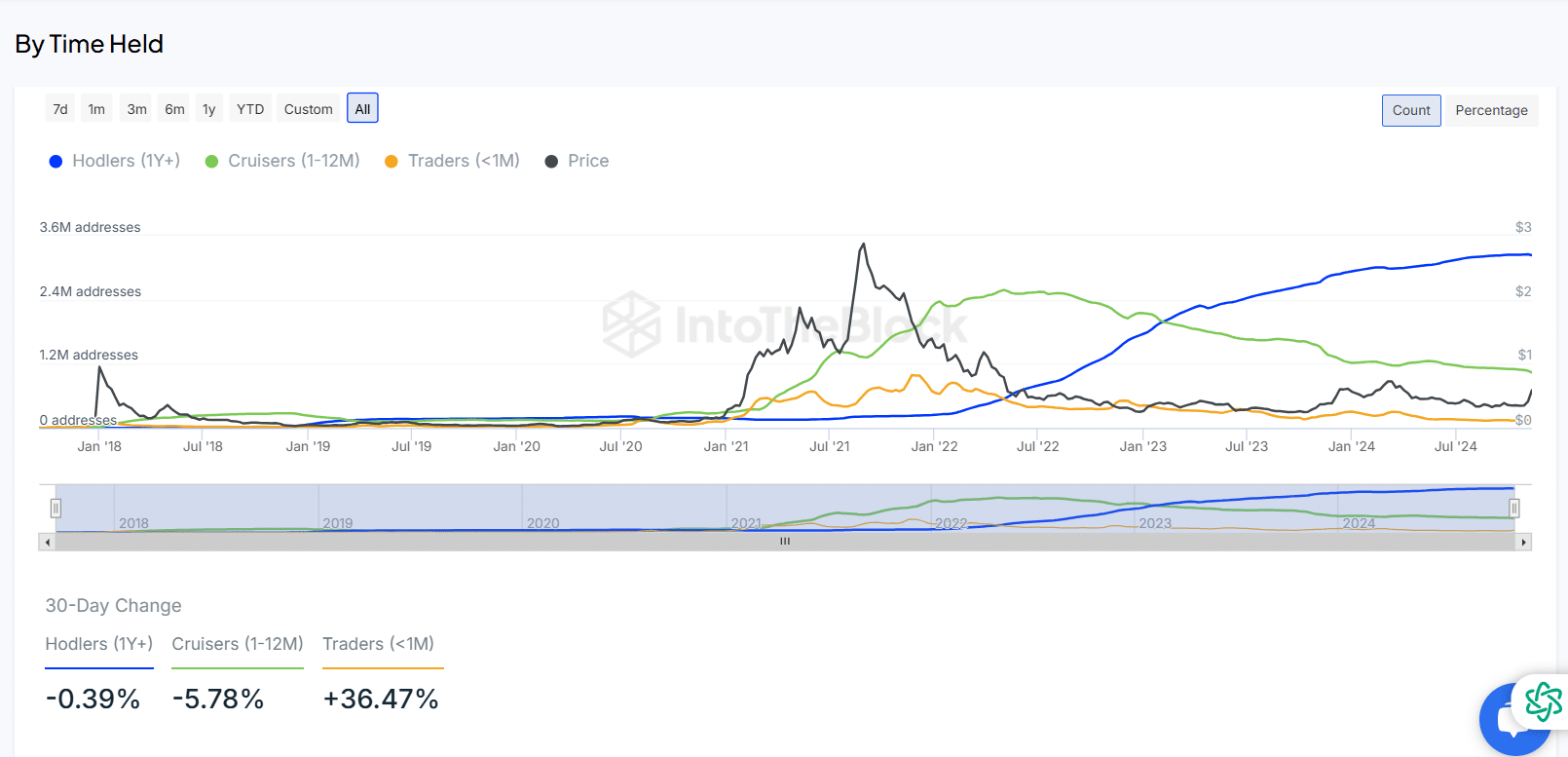

ADA holder trends: 5.78% drop in cruisers, 36.47% rise in traders

Examining data from IntoTheBlock offers insights into the distribution of Cardano addresses based on holding duration, emphasizing significant patterns in the makeup of holders, thereby revealing key trends.

To put it simply, the graph shows a continuous rise in long-term ADA investors, symbolized by the blue line, indicating an increase in trust and dedication from ADA’s investing community over time.

This group has persistently owned ADA throughout the years, indicating a firm conviction in its future growth prospects.

Over the last month, there’s been a 5.78% drop in the price of cruisers (1–12 months), as shown by the green line. This decrease might indicate that medium-term investors are either selling off or switching to shorter holding durations, perhaps to realize profits or reconsider their positions due to market fluctuations.

Over the past month, traders (as shown by the orange line) have experienced a significant increase of approximately 36.47%.

Realistic or not, here’s ADA’s market cap in BTC terms

The surge observed here is probably due to a rise in ADA’s trading volume and temporary market fascination. This could be attributed to the latest price fluctuations or emerging speculative tendencies.

Over time, it appears that the composition of Cardano’s owners is changing slightly. The number of long-term holders seems to be holding steady, whereas there has been an increase in short-term traders. This influx of short-term activity could add some volatility to the market behavior of ADA.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-15 12:40