- The recent price action suggested that the bears are still in control from a long-term perspective.

- Traders should closely monitor the $0.3629 support, as a break below this level could lead to further downside risks.

As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I have learned to navigate through the stormy seas of the cryptocurrency market. The recent price action of Cardano [ADA] has been reminiscent of a rollercoaster ride, albeit a somewhat bumpy one.

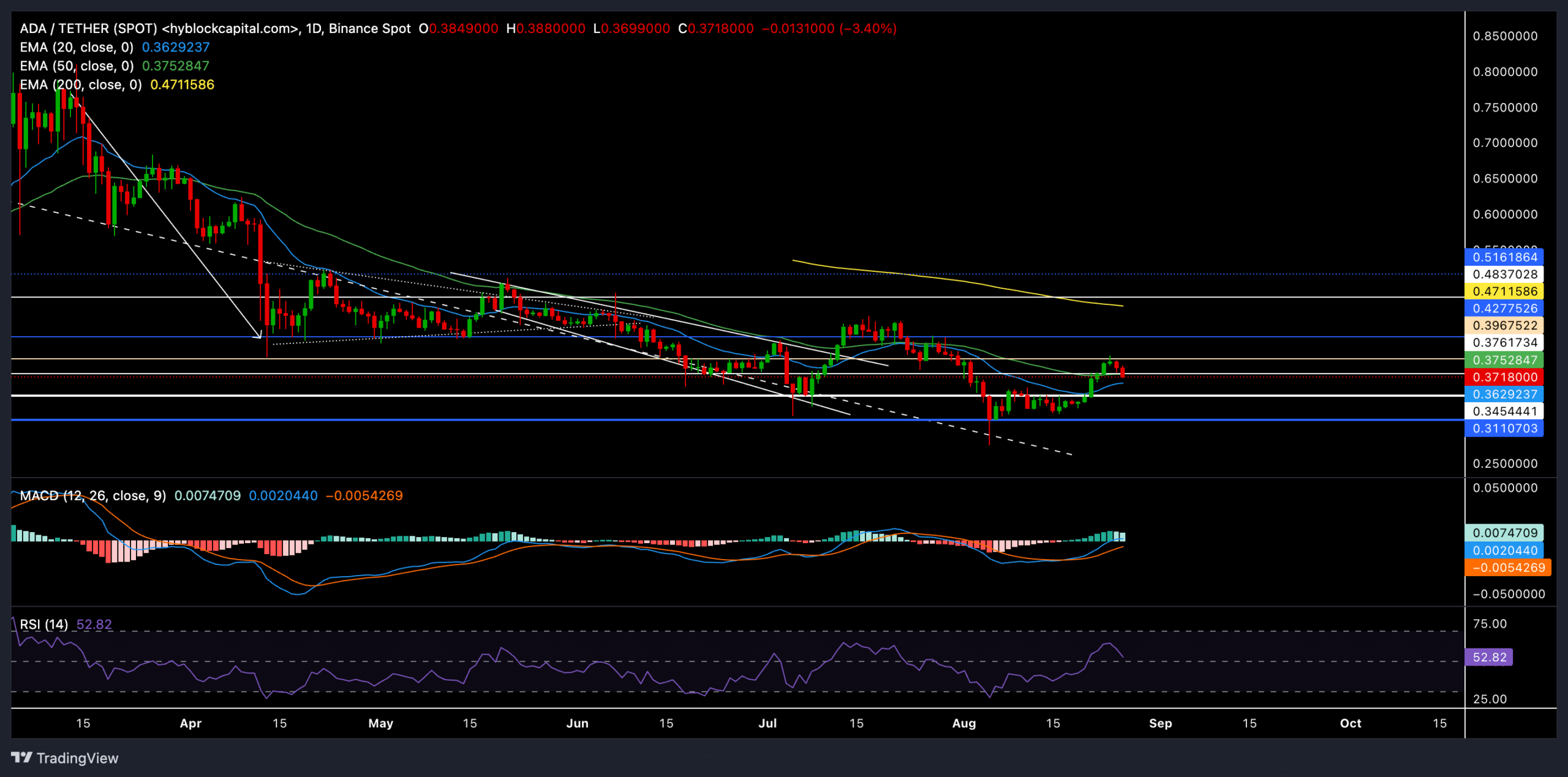

Cardano (ADA) is currently maneuvering through a somewhat volatile market atmosphere, as its value has lately yielded to escalated selling forces at the $0.39 resistance level.

Over the last day, the general feeling towards cryptocurrencies has become somewhat more optimistic, which might provide Cardano with some support around its 20 Exponential Moving Average (EMA). Currently, ADA is trading at approximately $0.37 following a nearly 5% decrease over the past 24 hours.

Cardano bulls triggered a rally above near-term EMAs

Recently, ADA has bounced back from the $0.31 support line, yet it’s been finding it tough to break through the resistance around the $0.39 region.

After bouncing back, ADA‘s price trend closed above both the 20-day Exponential Moving Average (at $0.3629) and the 50-day Exponential Moving Average (at $0.3752). However, a recent reversal has caused ADA to drop below its 50 EMA level.

It’s important to point out that the 200-day Exponential Moving Average (EMA) sits at approximately $0.4711. This EMA functions as a significant barrier for price increases, indicating that bears have been in control over a prolonged period.

In simpler terms, the MACD (Moving Average Convergence Divergence) indicator hinted at a slight advantage for bulls, as its main line hovered slightly above the signal line. After some time, the MACD crossed into positive territory, suggesting that the initial strong selling pressure might be easing.

To get back on track, Cardano (ADA) needs to recover from its 20-day Exponential Moving Average (EMA) and attempt to break the resistance at approximately $0.39 again.

In simpler terms, the Relative Strength Index (RSI) is close to a balanced state, but investors might want to watch for an opportunity where ADA could rebound from the 50-point. But if it drops below that point, ADA may experience a delayed bounce-back.

Key levels to watch

Support right now is at the $0.375 mark. If Cardano (ADA) manages to stay above this point, it may try to push past the $0.39 resistance. A successful breakthrough above the resistance could pave the way for a potential recovery towards the 200 Exponential Moving Average (EMA) around the $0.47 level.

If the bears persistently apply pressure and ADA falls below $0.3629, there’s a possibility it might revisit the $0.3454 support point again.

Read Cardano’s [ADA] Price Prediction 2024-25

In the past day, the volume dropped by approximately 3.52%, landing at around $292.17 million, while open interest grew by about 0.96%, reaching $192.97 million. This suggests that traders continue to participate in the market and are on the lookout for more definitive signs.

As a researcher, I’ve just analyzed the trading activity over the past 24 hours and found that the long/short ratio stands at 0.8372. This suggests a bearish sentiment in the market. Interestingly, however, on Binance, the ADA/USDT pair presents a bullish picture with a long/short ratio of 2.4626 as we speak.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-27 13:11