- Cardano’s price consolidated around $0.37, with fluctuations indicating bearish momentum

- Uptick in new adoption pointed to growing interest in upcoming upgrades

As an experienced analyst, I believe that Cardano (ADA) is currently in a state of consolidation, with bearish momentum dominating the market sentiment. The price has been hovering around $0.37 for some time now, despite an uptick in new adoption and growing interest in upcoming upgrades.

As a crypto investor in Cardano, I’m excited about the upcoming network upgrade that’s expected to bring significant improvements to the platform. According to the latest report from Cardano’s development team at Input Output Hong Kong (IOHK), we can look forward to advancements in smart contracts, wallet services, core technology, and more. These upgrades could potentially lead to a price surge for ADA as more users and developers are attracted to the platform.

Hence, the question – Is ADA set for a breakout now?

Market sentiment and price trends

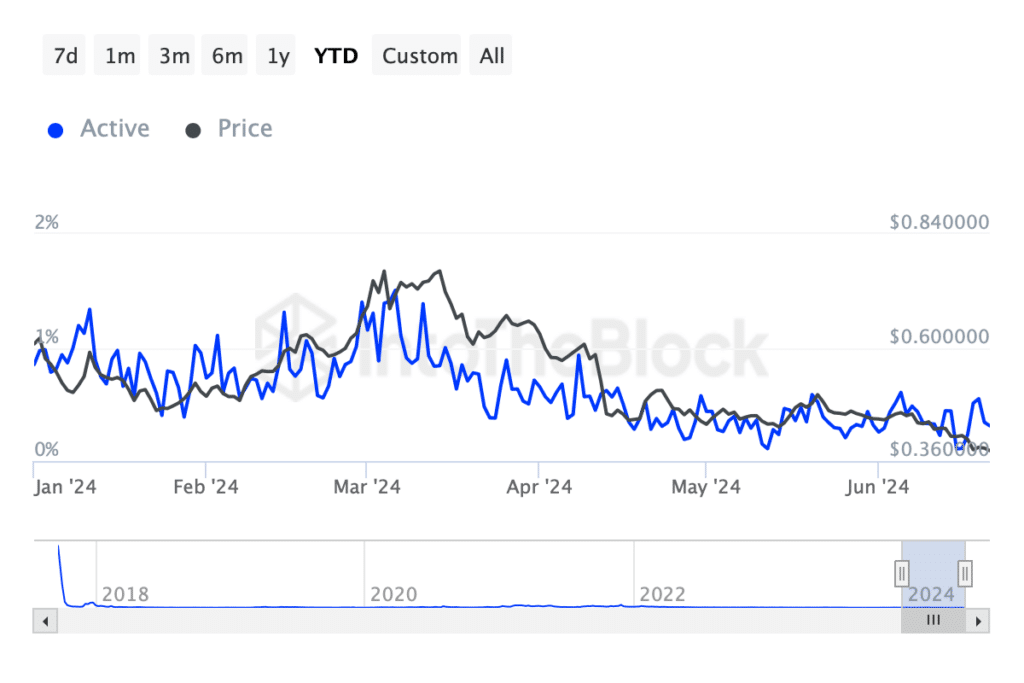

As an analyst, I’ve observed a downward trend in the percentage of active addresses on Cardano’s network since the beginning of the year. Despite this, the cryptocurrency’s price stayed comparatively steady until a significant drop occurred in May.

Starting around late March, the hike in zero balances was associated with a downward trend in price. This implies that an increasing number of holders were selling off or giving up on their positions as the price dropped on the graphs.

The adoption rate of the new system experienced a significant surge at the beginning of February. However, this growth took a downturn around the same time, mirroring the price trend. A notable increase in adoption was observed again in June, which can be attributed to the highly anticipated updates. The community’s excitement is justified as these updates are long-awaited.

Currently, ADA‘s price has bounced back on the graphs, but it hasn’t been able to maintain its rising trend. This indicates that the downtrend may persist, leading investors to exercise caution or even sell off their holdings.

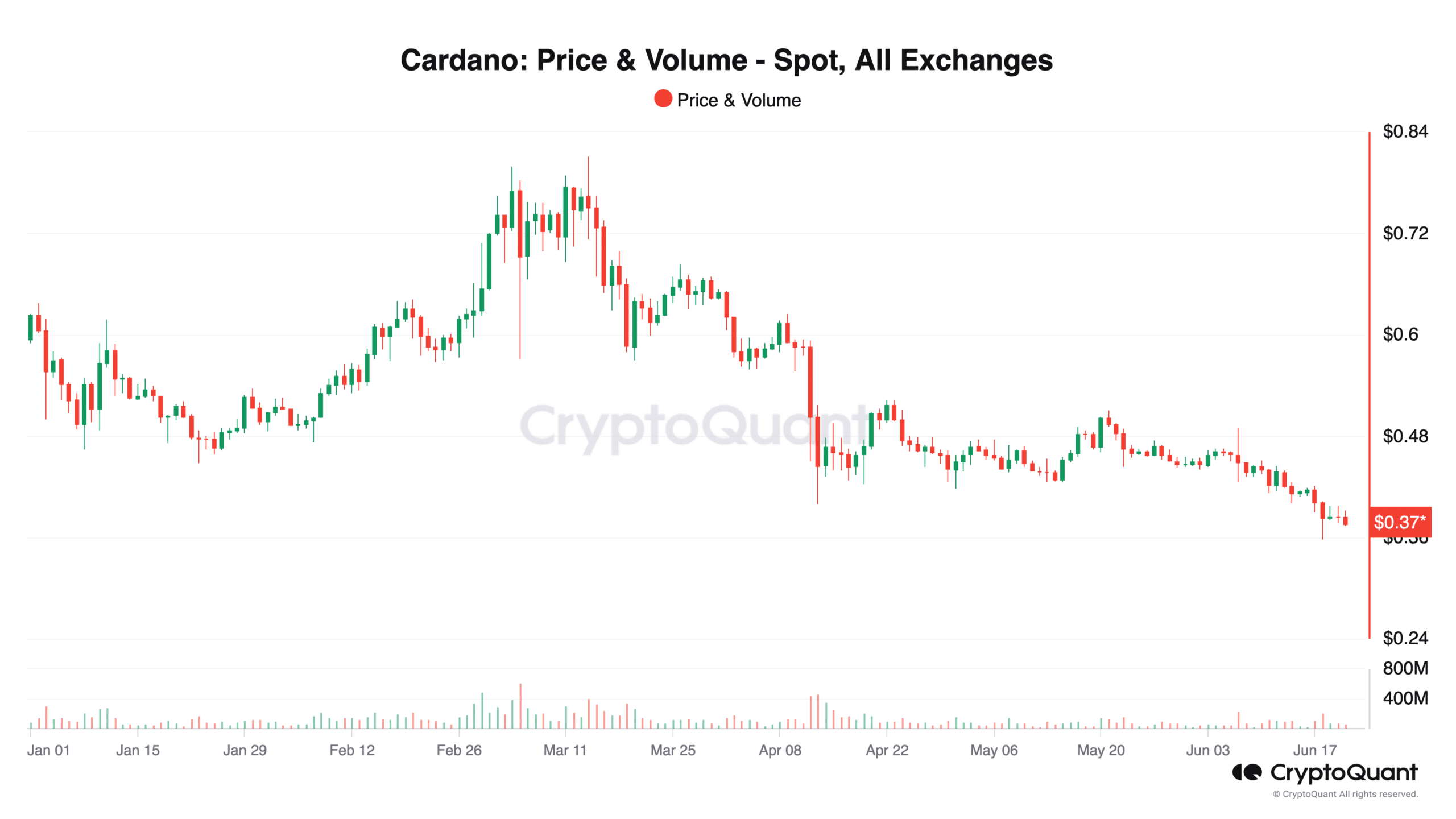

As an analyst, I’ve observed that ADA‘s price tends to cluster near the $0.377 mark, exhibiting only subtle oscillations suggesting a weak trend in either direction.

In simple terms, the red line representing the 50-day moving average appeared to obstruct price advances near the $0.385 mark, while the blue line denoting the 200-day moving average functioned as a short-term cushion around the $0.376 level.

Multiple signals were generated by the MACD line’s interaction with the Signal line in the chart. These signals occurred near the zero line, suggesting that the market’s momentum, be it positive or negative, was weak and not strongly driving price movements.

As a crypto investor observing the market, I’ve noticed that when the price of ADA started dropping, there was a surge in trading activity. This heightened volume contributed to the intensified selling pressure, leading to an even steeper decline in ADA’s value.

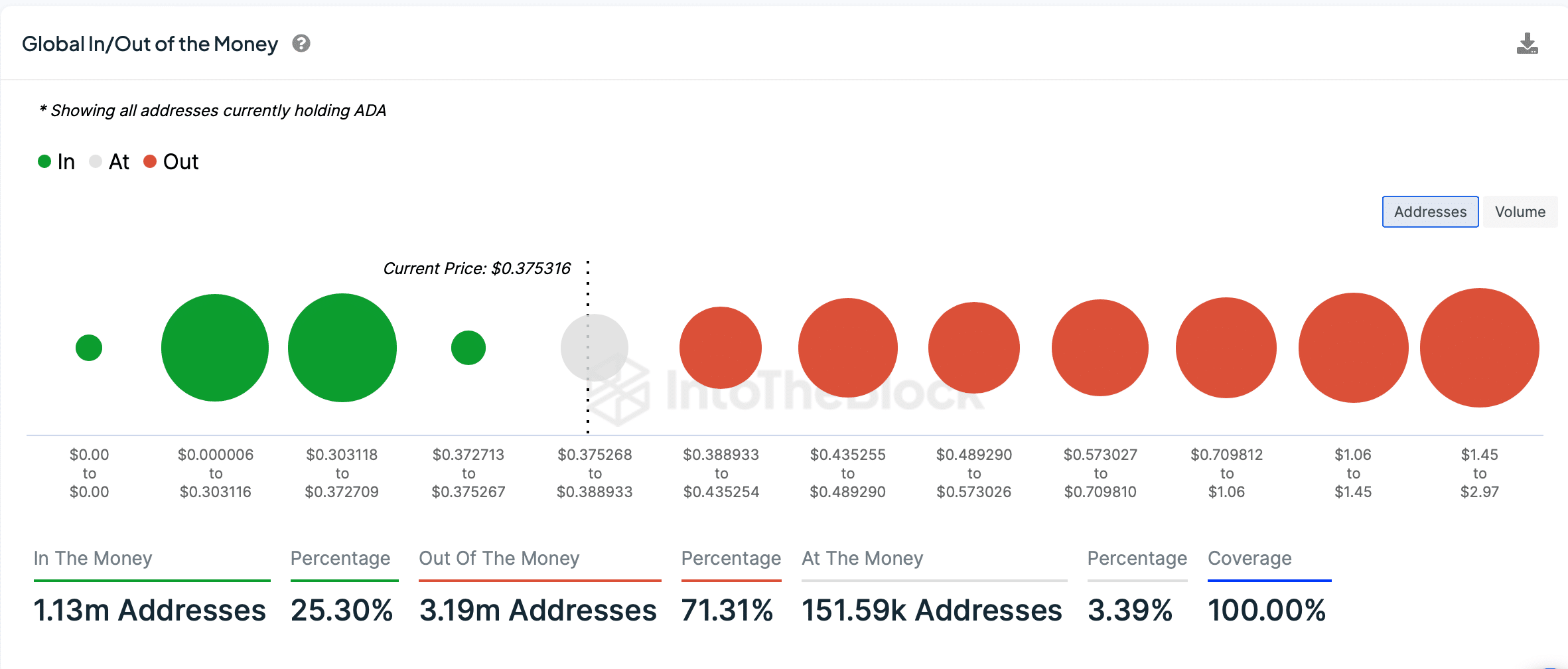

In the end, a large number of addresses holding cryptocurrency at a loss indicates widespread bearish feeling and downward pressure on prices. This is particularly concerning if these holders choose to sell to minimize their losses as the price approaches their initial investment levels.

As a researcher studying the potential impact of upcoming ADA upgrades, I can suggest that if these enhancements effectively boost ADA’s performance and functionality, they might alter the current distribution of addresses. Specifically, more addresses could shift into the “in the money” category, which refers to those holding ADA at prices above their initial investment cost. This shift could potentially fuel a surge in price as investors grow increasingly optimistic about Cardano’s future yield.

Read More

2024-06-23 05:11