- ADA’s price decline sparked curiosity about its recovery potential as key on-chain metrics flashed mixed trends

- Insights into ADA’s MVRV and inflation rate shed light on its current market positioning and future trajectory

Over the past week, the wider cryptocurrency sector has experienced considerable losses, including Cardano (ADA). In fact, ADA dropped by more than 13% during this period, placing it among the top losers in the top ten cryptos. As market volatility increases, investors are scrutinizing ADA’s price trajectory, examining on-chain indicators such as the 30-day MVRV, and analyzing its annual inflation rate to determine its potential future performance.

Cardano price action – A reflection of market sentiment

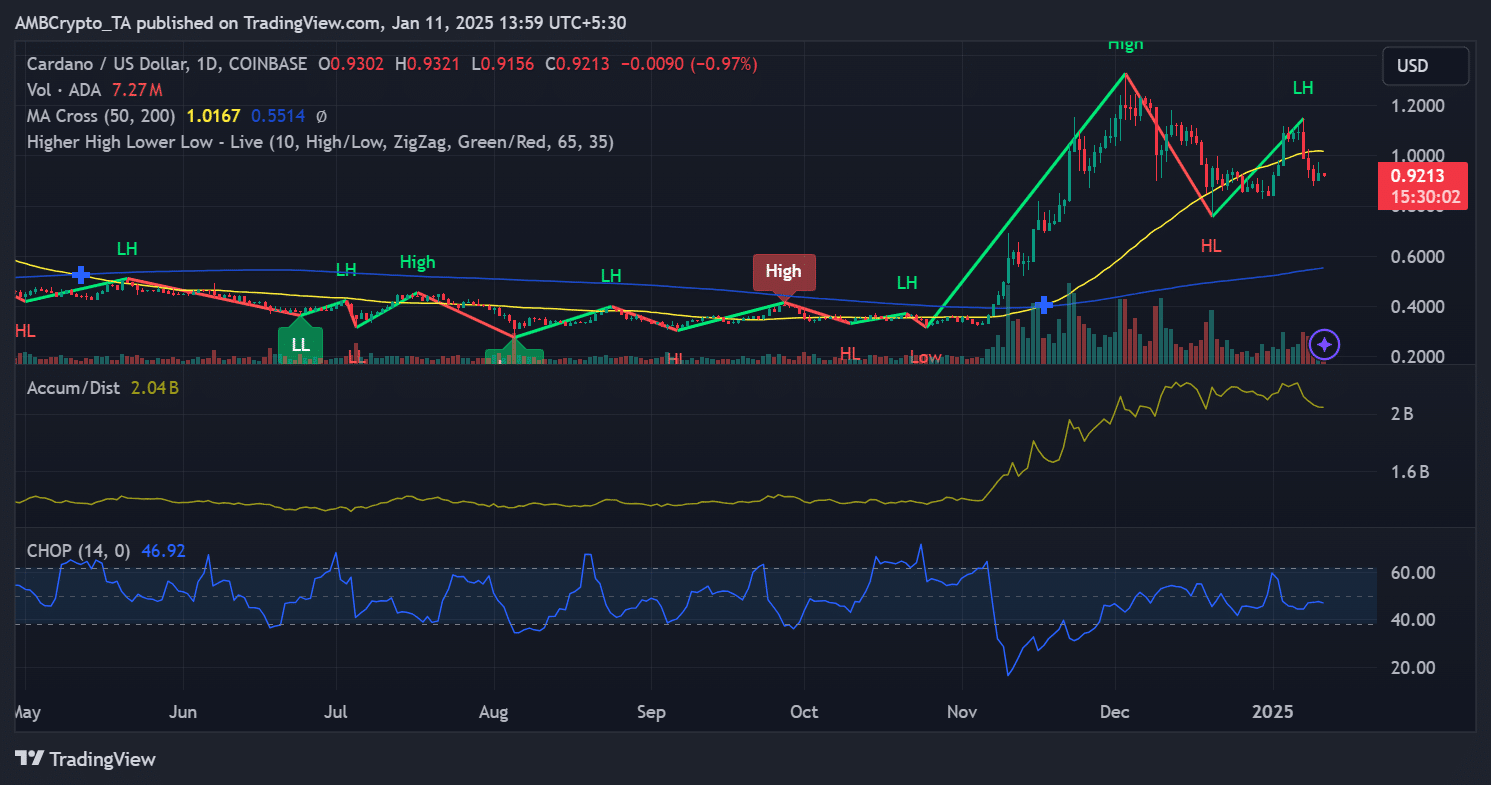

The graph showing the value of this digital coin known as an altcoin indicates a decreasing trend. Right now, Cardano is being traded at around $0.9213. Lately, it’s been having trouble sustaining its previous upward movement and instead, it’s creating lower peaks (LP), which can be observed on the graph.

The A/D line showed less enthusiasm among buyers, mirroring lower trade volumes. Simultaneously, the CHOP index hinted that the movement of ADA’s price is confined within a range and is not showing strong directional momentum, which is often seen in markets during consolidation stages.

Important levels to keep an eye on are $0.90 acting as near-term support and $1.00 serving as resistance. If the price fails to stay above the support level, it could result in additional downward momentum.

MVRV Ratio signals possible undervaluation

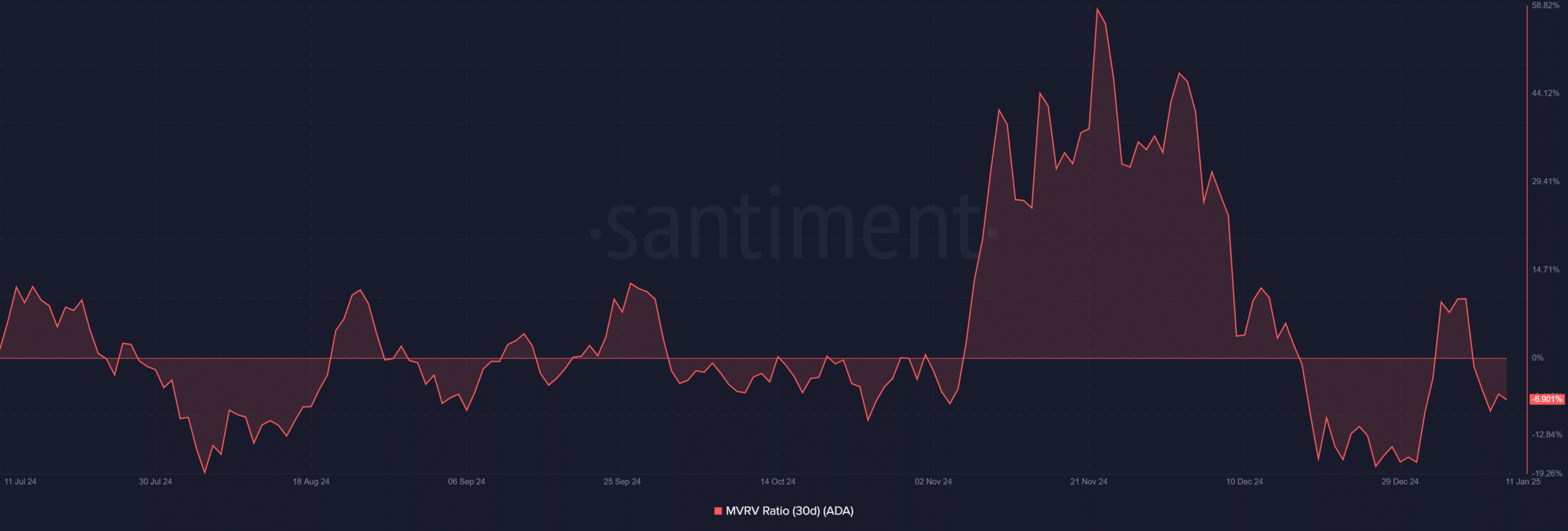

At the moment, the 30-day Market Value to Realized Value (MVRV) ratio, a measure indicating the profitability of short-term investors, stands at a loss of approximately 6.90%.

It appears as if Cardano’s current state indicates an underpricing, resulting in typical holders experiencing paper losses. Precedently, similar situations have occasionally been followed by a turnaround, but it’s important to note that this isn’t always the case.

The information suggests that although ADA might offer potential for accumulation, overall market trends could postpone an immediate rebound. For a substantial rise to happen, it’s crucial that the market sentiment remains positive and the price of ADA becomes more stable over time.

Annual inflation rate – A steadying factor?

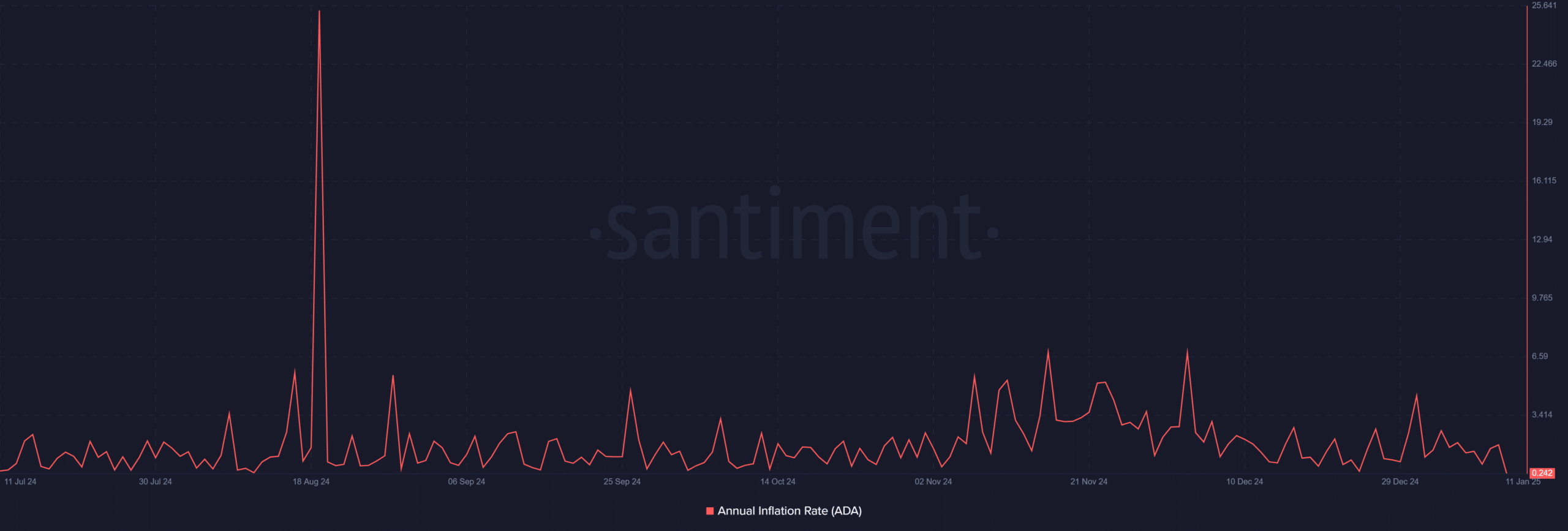

The annual inflation rate on the Cardano network stays quite low, around 0.242%. This low rate highlights the network’s deflationary nature and makes it an attractive option for investors looking to hold for a longer period.

This graph demonstrates that ADA’s design enables it to control excessive expansion of the coin supply, thereby strengthening its unique selling points compared to other blockchain networks.

In other words, if the inflation rate continues to decrease, this might reflect less usage and transactions within the network. This could be an indication that we need to reconsider the network’s utility or find ways to motivate users again, in order to boost activity and ensure the network remains robust.

What lies ahead for ADA?

The future direction of Cardano (ADA) is closely tied to various elements. The overall recovery of the cryptocurrency market will significantly impact ADA’s price movement. An increase in network engagement, evident through wallet usage and transaction volume, may foster a bullish resurgence. Furthermore, for ADA to rekindle investor trust, it needs to breach the resistance at $1.00 and maintain a position above $0.90.

At the present moment, Cardano’s market standing mirrors wider trends in the cryptocurrency sector, suggesting potential undervaluation due to a negative MVRM ratio. Additionally, its modest inflation rate underscores the stability of its monetary supply.

Despite some conflicting indications from the graphs, they emphasize the importance of enhancing market confidence and boosting network interaction to reignite ADA’s progression.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2025-01-12 01:11