- Cardano formed a strategic partnership with BitcoinOS, enhancing its DeFi landscape

- Collaboration could be a crucial catalyst for an ADA breakout on the charts

As a seasoned crypto investor who’s been through numerous bull and bear markets, I find the recent partnership between Cardano and BitcoinOS to be a promising development. Having closely followed both projects, I can see how this strategic alliance could serve as a catalyst for Cardano’s growth, particularly in its DeFi landscape.

Lately, talks have been heavily focused on the possible growth of the Cardano blockchain using ADA as its token. Now, these discussions are making substantial progress.

As a crypto enthusiast, I’m thrilled about the latest news: EMURGO, the business wing of Input Output Global, is teaming up with BitcoinOS to build a link between the Cardano and Bitcoin blockchain networks. This partnership promises to be a game-changer!

Building on each project’s strengths

According to recent reports from X (previously known as Twitter), the BitcoinOS Grail Bridge is designed to establish a link between the two blockchain systems. This connection will make Cardano the initial layer-1 network to align with the BOS framework, thus amplifying Bitcoin’s capabilities.

Compared to newer systems, Bitcoin’s original blockchain design has fewer capabilities for creating and executing smart contracts.

In response, the bridge facilitates a seamless exchange of assets between the two platforms, empowering users to utilize both proof-of-work (PoW) and proof-of-stake (PoS) mechanisms simultaneously.

Conversely, Cardano stands out as a frontrunner in the Decentralized Finance (DeFi) sector, with more than 1,370 Web3 projects and approximately 90 million transactions handled on its platform. This impressive track record sets Cardano apart from other competitors, positioning it as an excellent choice for this pioneering project.

Impact on Cardano’s price action

Typically, October sees a surge in positivity (bullish momentum) for cryptocurrencies, but Cardano has found it difficult to match the performance of its counterparts. Of particular note is Solana, which has gained significant ground recently, recording weekly returns exceeding 10%.

As a crypto investor, I find the current deployment of the BitcoinOS Grail bridge to Cardano particularly significant and well-timed. This development could prove pivotal in rejuvenating ADA’s standing within the market, especially as it nears its former support level.

Given that approximately 80% of ADA investors are experiencing net losses after a period of consolidation, the chatter about this situation could encourage these holders to look for higher returns.

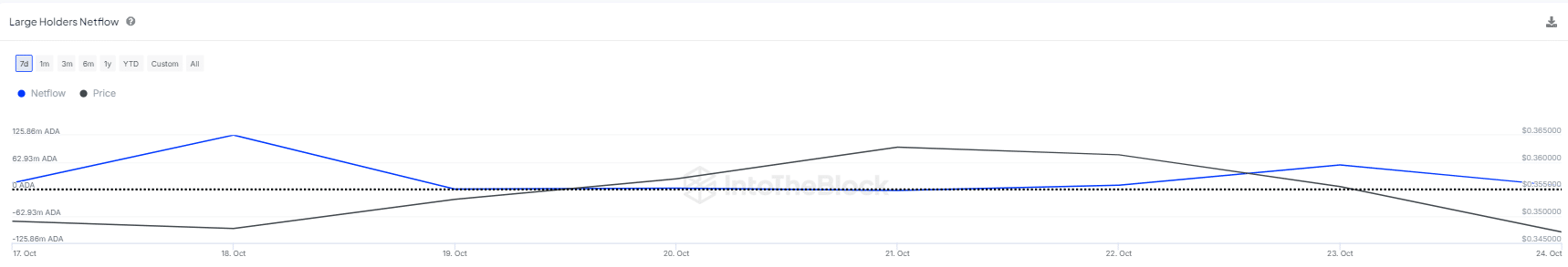

Source : IntoTheBlock

It’s worth noting that in the last two days, around 60 million ADA tokens have been moved to large holders’ wallets. Given this accumulation, it’s possible that the current price of $0.33 could represent a temporary bottom.

Nevertheless, it doesn’t automatically mean an immediate surge since substantial funds will be required to trigger a rise.

Read Cardano Price Prediction 2024 – 2025

If retail investors, who own about 70% of the total holdings and have approximately $26 billion invested in Cardano, don’t consider the current price level as a good opportunity to buy (a “dip”), it might be difficult for ADA to move beyond its current phase of market consolidation.

Regardless, this new development is a promising beginning, as the Relative Strength Index (RSI) has moved into oversold territory, implying that there could be beneficial chances for purchasing in the near future.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- BLUR PREDICTION. BLUR cryptocurrency

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-10-26 11:04