-

A previously solid support level is now a major resistance level for ADA

Market remains divided though, with uncertainty being the primary sentiment

As a seasoned analyst with years of market experience under my belt, I’ve seen countless price movements and trends that have left even the most ardent traders scratching their heads. The current situation with Cardano (ADA) is no exception.

Just like other cryptocurrencies, Cardano (ADA) didn’t escape the impact of the broader market’s drop. At the moment I am writing this, ADA was being traded around $0.3348, marking a decrease of about 1.8% in the last 24 hours.

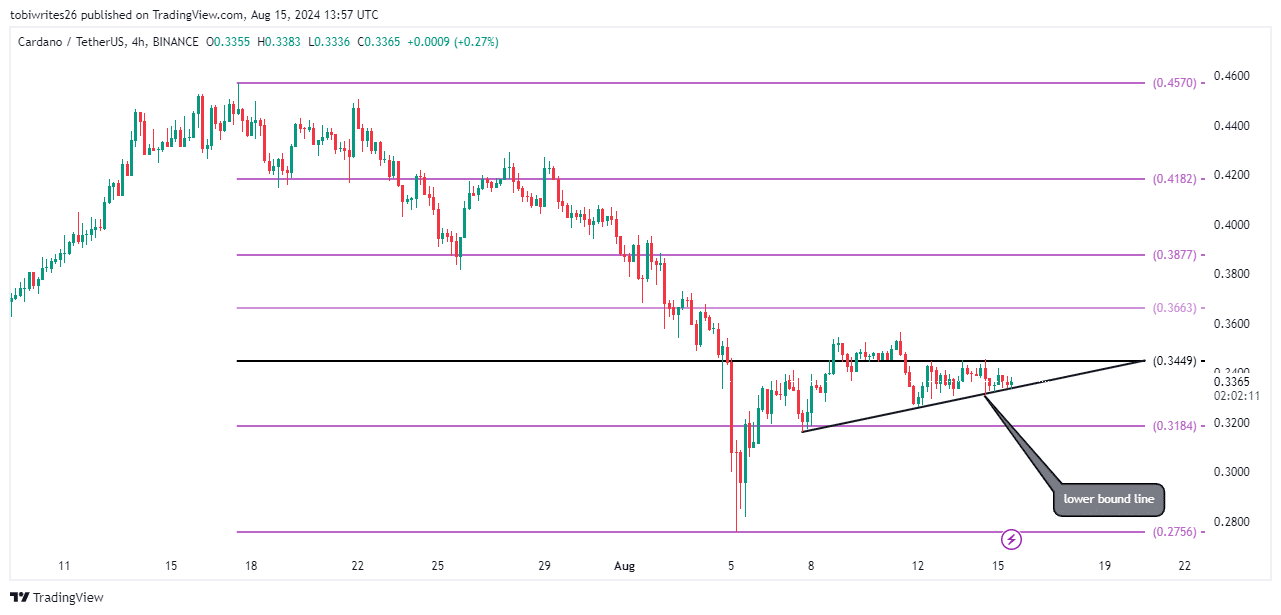

Can ADA break above the $0.3449 resistance?

Attempts by ADA to break through the previous resistance level of $0.3449, which had served as a solid base before falling on August 11, have so far been unsuccessful.

Despite three unsuccessful attempts, a bearish continuation pattern (depicted in black) is now visible on the graphs, suggesting increased selling activity might be imminent. If this occurs, the price may dip towards the $0.3184 support point.

If the daily Cardano (ADA) candle finishes below the lower edge of the bearish flag, a strong downtrend or bearish dominance is likely to follow. On the other hand, if the candle closes near or above the $0.3449 resistance level, the bulls may regain control.

It’s important to note that while AMBCrypto’s examination of several on-chain indicators produced a blend of signs, the direction Cardano (ADA) might take now remains uncertain.

Retail traders lean towards selling

As a long-time cryptocurrency enthusiast who has witnessed numerous market fluctuations, I find it concerning to see such a significant drop in ADA‘s daily active addresses as highlighted by the recent review from Santiment. Having closely observed the crypto landscape for years, I can attest to the fact that periods of decline often precede larger downtrends. The sharp decrease from 36,657 on August 8th to the 10,000-zone at press time is a red flag and serves as a reminder that we should always stay vigilant and adaptable in this ever-changing market.

The decrease in active addresses suggests less involvement from retail investors, implying an increasing pessimistic outlook that may lead to additional drops in the price of Cardano (ADA).

Furthermore, according to Coinglass, a significant portion of the $649,100 worth of positions liquidated over the past day were from long position holders, who incurred total losses amounting to approximately $549,810.

Closing long positions due to compulsion suggests a pessimistic market sentiment that might trigger more selling since vast amounts of Cardano (ADA) are being sold off to meet these obligations.

In spite of the present difficulties facing the market, it’s worth noting that long-term investors seem optimistic about ADA‘s potential for recovery, according to AMBCrypto’s findings.

Optimism among long-term holders

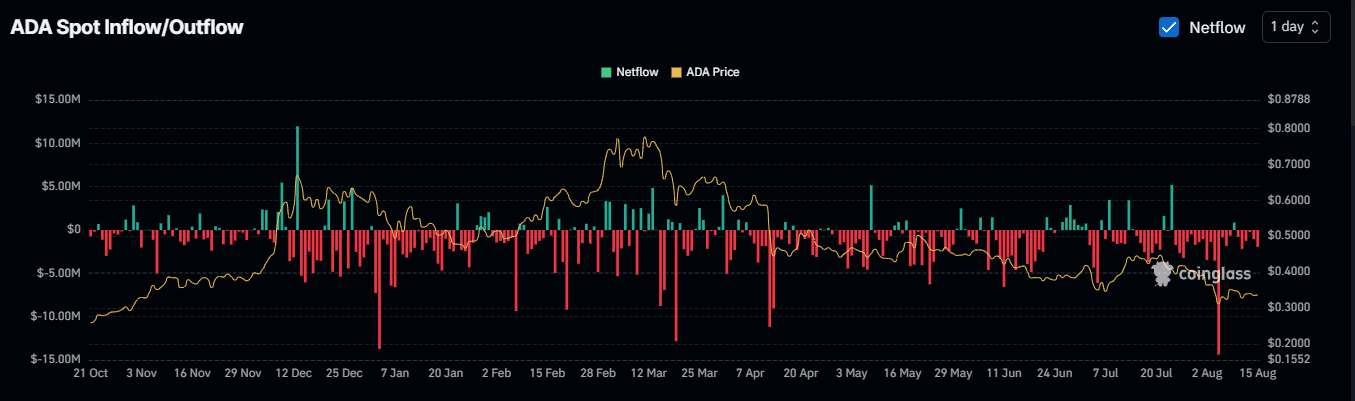

As a researcher studying cryptocurrency trends, I’ve noticed an interesting pattern based on data from Coinglass. Specifically, the daily netflow of ADA (Cardano’s native currency) shows a significant outflow from exchanges, amounting to approximately -$1.75 million in USD. This suggests that more ADA is being withdrawn from exchanges and held elsewhere compared to the amount being deposited.

In the last seven days, there’s been a collective outflow of approximately $-4.87 million from significant exchanges like Binance, Coinbase, and Bitfinex. Particularly noteworthy is that Bitfinex has contributed an individual outflow of about $-1.77 million.

The overwhelming majority of ADA transfers by long-term holders to personal wallets might indicate a move towards securing their assets. These types of transactions often signal confidence in the asset’s future price increase, as they decrease the amount of ADA readily available for trading on exchanges.

In summary, according to DeFillama, the value locked within ADA‘s DeFi protocols has been steadily increasing, suggesting a positive market trend. This growth is particularly noteworthy as more and more assets are being pledged, loaned, or invested in DeFi projects.

As a crypto investor, I find myself watching with bated breath as the path forward for Cardano seems unclear. However, the emergence of fresh trading points in the imminent future could potentially shed light on who will take the lead – the bulls or the bears – first.

Read More

2024-08-16 05:19