-

ADA’s price might climb past $0.80 if historical data is anything to go by

Indications from the OI and liquidations suggested an initial decline below $0.46

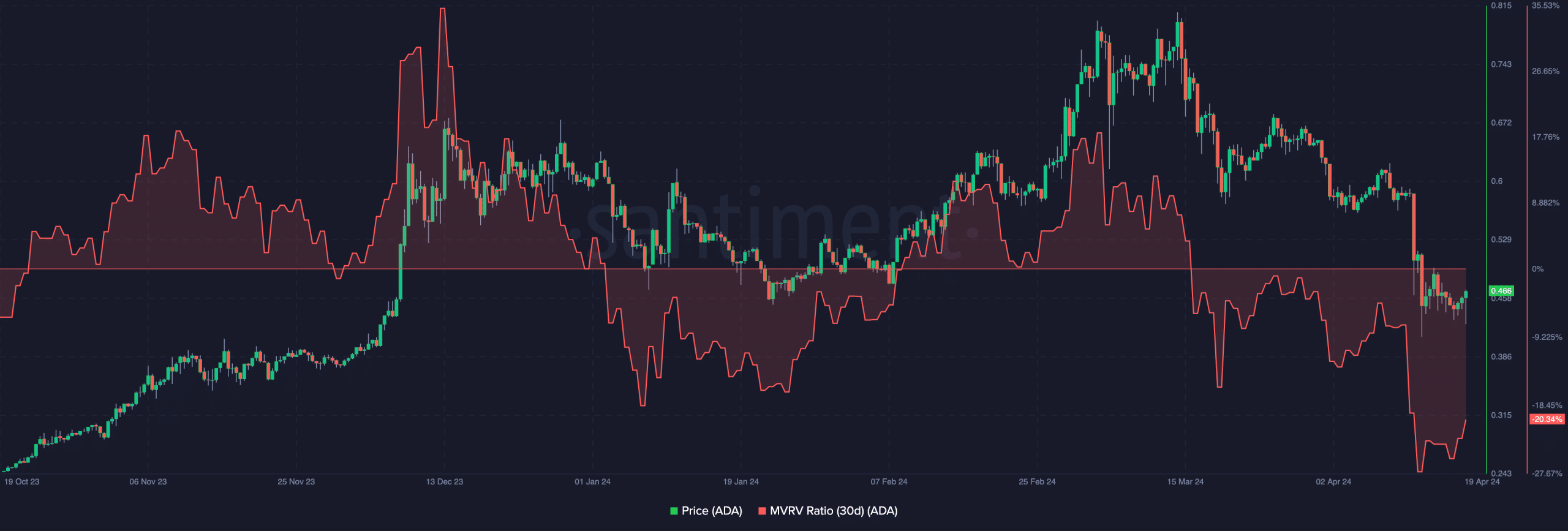

Based on the observation that the past can influence future events, AMBCrypto reasoned that Cardano‘s [ADA] price could experience a significant increase of approximately 75% in a brief time frame, according to their analysis of the Market Value to Realized Value (MVRV) ratio.

On the 18th of April, the 30-day MVRV ratio for Cardano reached a level of 22.04%. Previously, this metric had only been near this value back in January. As a result, ADA saw a significant price increase from $0.45 to $0.72 during that time.

Floodgates may soon be open

Alternatively, Cardano’s price surge in October 2023 wasn’t an isolated event. Similar to January, the MVRV ratio indicated a trend that caused ADA to rise from $0.24 to $0.43, reaching a new height.

Over the past month, the value of the cryptocurrency decreased by 23.60%. Yet, due to Bitcoin‘s [BTC] recent halving event, its price rose in tandem with many other altcoins.

Currently, one ADA is worth approximately $0.46, following a 3.41% increase over the past 24 hours. But, it remains to be seen how the price of Cardano will be affected once its halving event is completed.

About three weeks following the third halving in 2020, the value of ADA increased from its previous day’s trading price of $0.04 to reach $0.08. Should a comparable situation unfold, it is predicted that the token could be worth anywhere between $0.80 and $0.92 by the end of June.

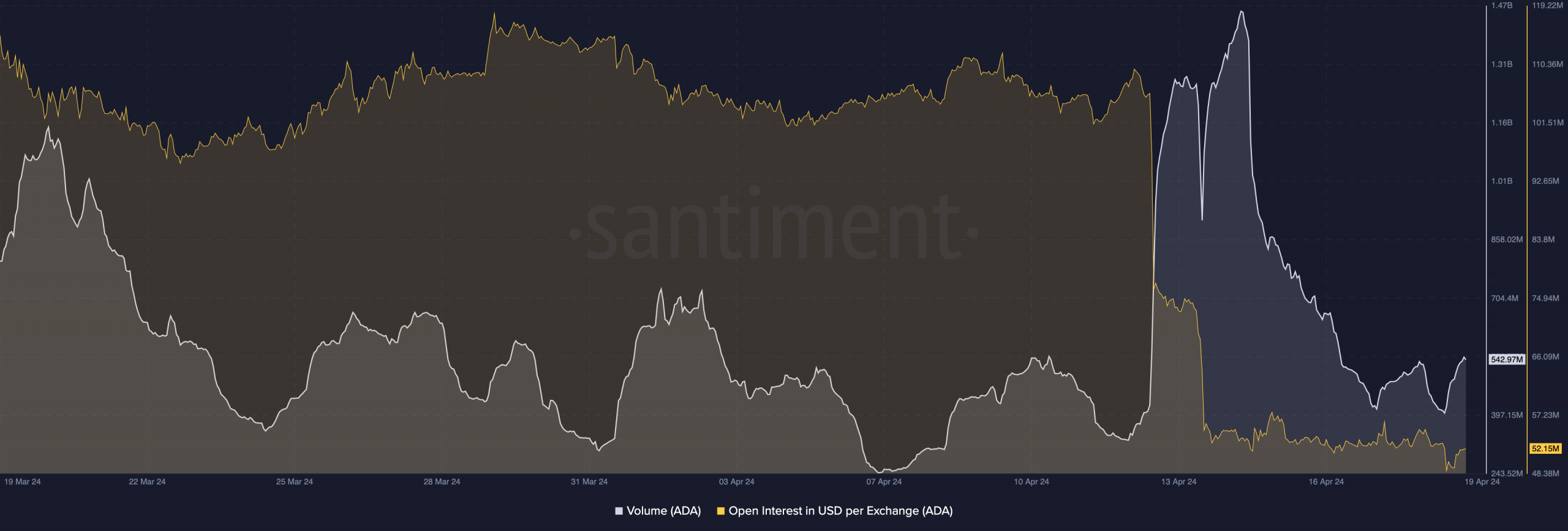

Prior to ADA‘s mid-term assessment, it is possible for the price to plateau or oscillate between $0.45 and $0.48. This price fluctuation may be due to the signals given by its trading volume.

Currently, the trading volume of ADA is at $542.97 million during my writing process. Although this figure signifies a growth, it appears insufficient to maintain a consistent upward momentum for Cardano.

If the volume of ADA exceeds $1 billion and its price continues to rise, the value could potentially reach $0.50. Conversely, if the volume decreases, ADA’s value may fall back to around $0.43.

Won’t be a straight path to the peak

AMBCrypto assessed Open Interest (OI) as another key performance indicator. The OI fluctuates according to the difference between open buy and sell orders. A rising OI signifies more active buying, indicating aggressive buyers in the market. Conversely, a falling OI implies that sellers are dominating the market, making them the more aggressive parties.

Although Cardano’s open interest wasn’t sufficient to cause a price surge, the ADA token’s value could stay relatively stable for a while before the anticipated rise occurs.

In the past day, contracts valued at $1.31 million have been terminated. Of this amount, $773 million were held as long positions and $534 million were short positions.

When a trader’s position is forcibly closed due to too much borrowed capital (leverage) or an insufficient account balance, this is called liquidation. It’s worth mentioning that liquidations can influence price movements. For instance, substantial open interest and short liquidations might push the price of a cryptocurrency up against its resistance level. However, in the case of ADA, there were more long positions being liquidated.

Read Cardano’s [ADA] Price Prediction 2024-2025

If a tiny Order-Increment (OI) is added, this could indicate that the price may fall to hit the support level. Consequently, the predicted 75% increase could occur at a significantly later stage once Cardano falls beneath $0.46.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-04-20 07:03