-

ADA’s trading volume increased sharply while its price dropped

A few of the metrics and indicators hinted at a bull rally on the charts

As an experienced analyst, I see a mixed picture for Cardano (ADA) based on the latest price action and technical indicators. While ADA’s trading volume increased sharply during a period when its price dropped, a few metrics and indicators hinted at a potential bull rally.

Cardano‘s [ADA] daily chart showed improvement over the past 24 hours, displaying a green trend after several days of negative progression. Potentially, more favorable developments could be in store for ADA as it approaches a potential bullish breakout, given certain conditions are fulfilled.

Let’s see what ADA must do in order to remain bullish on the price charts.

Cardano sees more green

I analyzed the price trend of Cardano and noticed a significant decrease of over 9% within the span of seven days leading up to its most recent price hike. However, there was a notable improvement in the token’s value over the past 24 hours, with an appreciation of more than 6%.

In my current update, Cardano is priced at approximately $0.3552 in the market. Its market value surpasses twelve billion dollars.

Despite this finding from IntoTheBlock’s data analysis, approximately 75% of investors remained without funds, representing a total of around 3.37 million individual ADA wallet addresses.

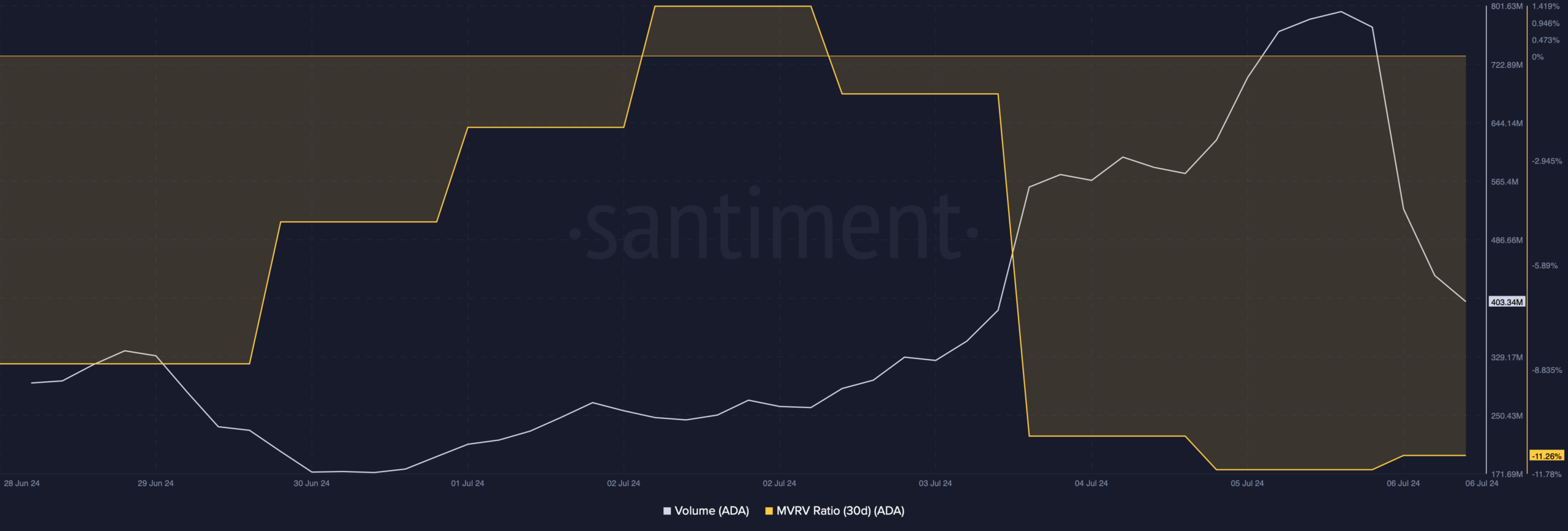

As a researcher studying market trends, I’ve observed that the price drop led to a decrease in the MVR Realized Value (MVRV) ratio as well. Coincidentally, the trading volume for this asset surged during this downward trend – an observation often viewed as a bearish sign.

Despite the current metrics and market conditions, there’s a possibility that a bullish trend may emerge for the token based on recent developments in its 12-hour chart.

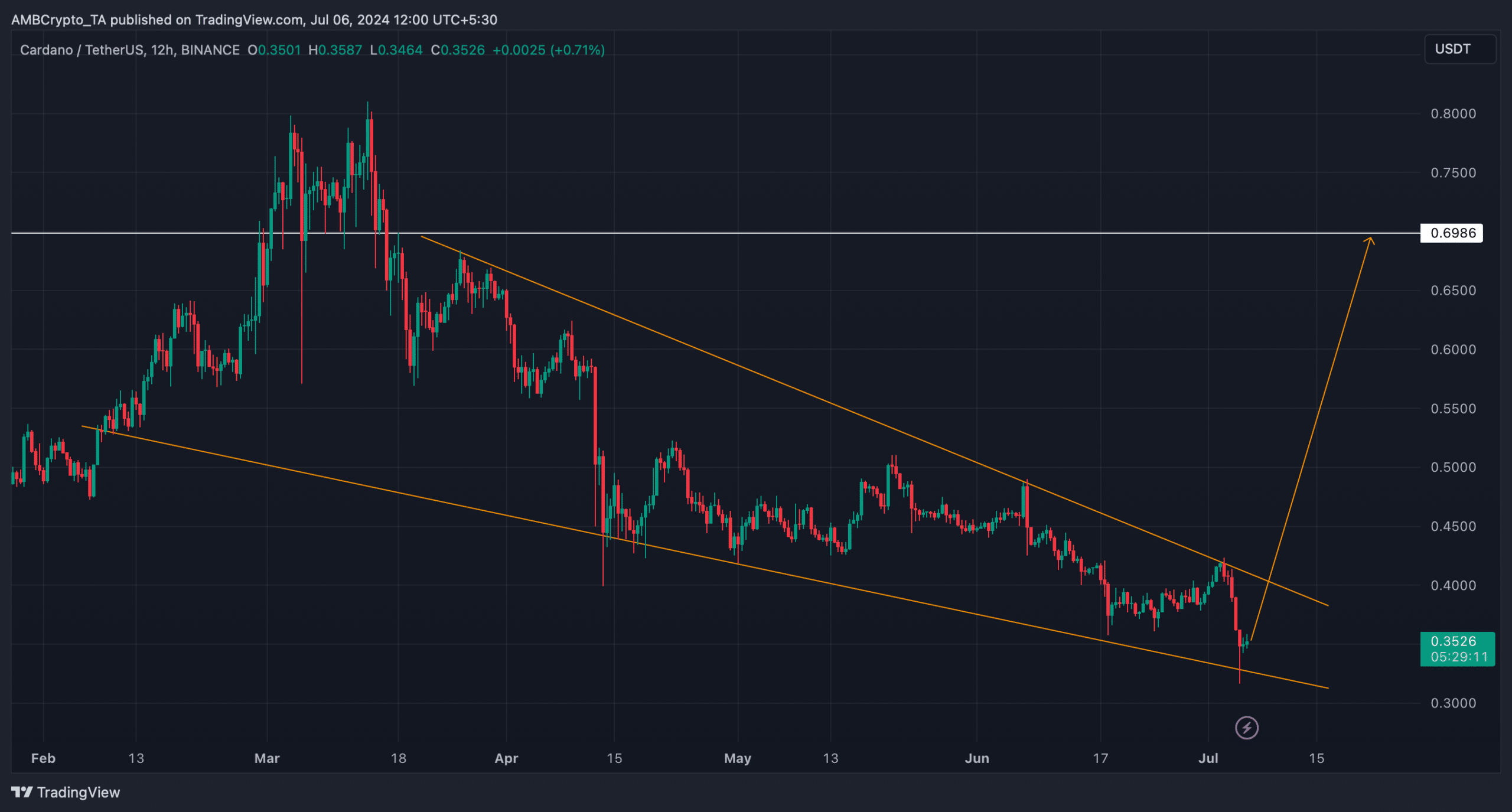

According to AMBCrypto’s assessment, Cardano’s price has been confined to a declining wedge formation since March. Currently, it is approaching the lower boundary of this pattern for potential testing.

To initiate a significant price increase for ADA, it is essential that the cryptocurrency forms three to four consecutive green candlesticks on the chart. Once this occurs, it would be no surprise if ADA experienced substantial growth, potentially reaching back towards its previous highs in the upcoming weeks or months.

Odds of ADA breaking out

When AMBCrypto looked at Hyblock Capital’s data, an interesting relationship could be seen too.

Based on our findings, when the Cumulative Liquidation Level Delta of ADA changes to green, the price of ADA tends to increase. Conversely, when this metric becomes red, the price of the token typically decreases.

At present, despite the metric being displayed in red, its value is decreasing. Translated, this means that ADA could instigate an uptrend or bull run on the price graphs imminently.

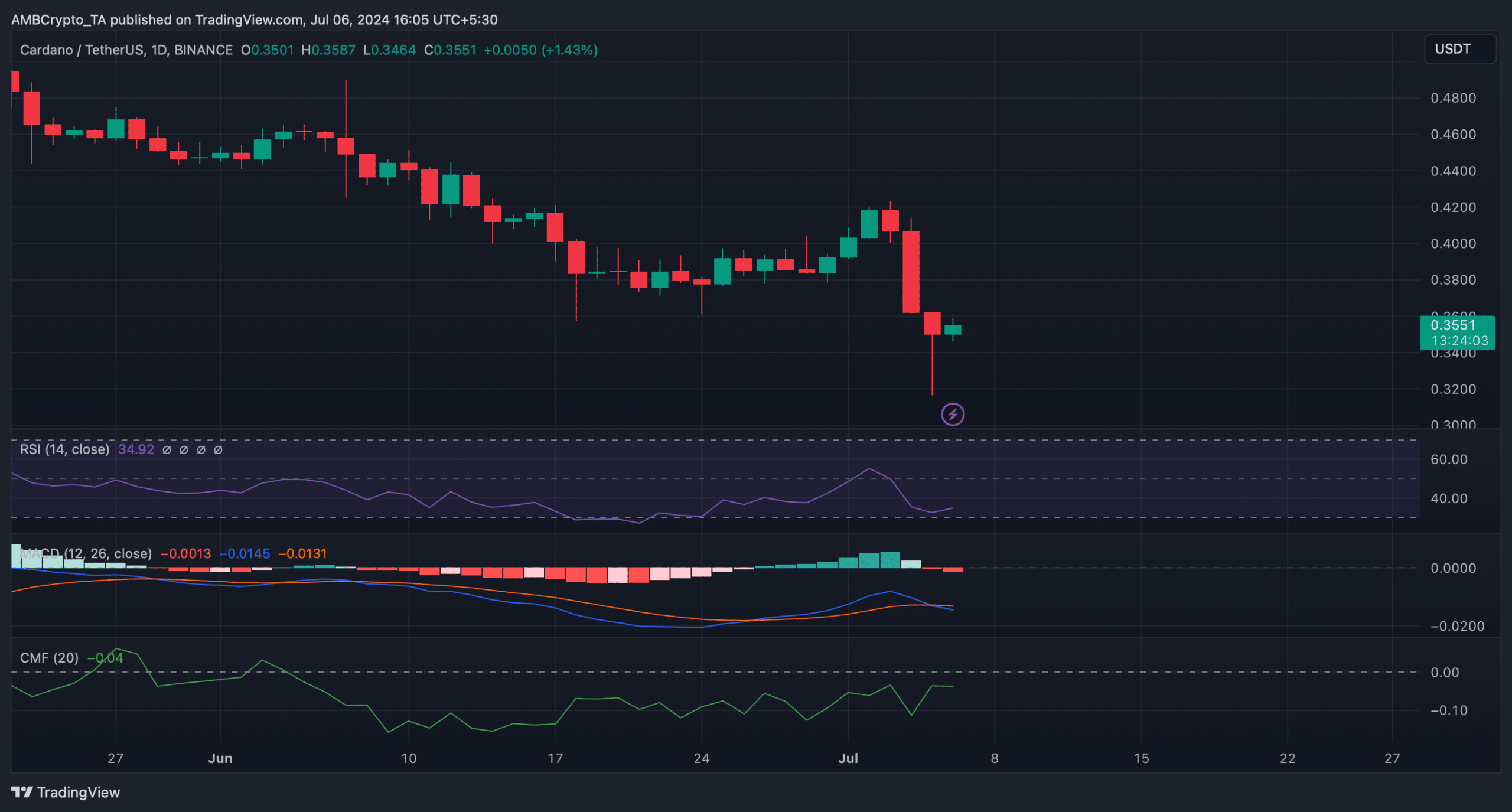

As a market analyst, I observed that the Relative Strength Index (RSI) displayed a bullish sign when it rebounded following its dip into the oversold territory.

Despite the bullish signal from some indicators, the overall trend remained bearish based on other indicators. For example, the MACD exhibited a bearish crossover.

Lastly, the Chaikin Money Flow indicator (CMF) has dipped below the neutral threshold. Consequently, this development could impede the potential advance of ADA‘s price in the near term and potentially even prolong that trend for several days or more.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-07-07 06:15