-

Most ADA transactions ended in a loss, prompting speculation that the price might drop again

Price-DAA was below 0.50, indicating that it could be time to buy the token

As a seasoned crypto investor with years of experience in the market, I have seen my fair share of market volatility and price movements. The recent trend of Cardano (ADA) ending up in losses for most transactions has raised concerns among investors about the token’s potential price drop. However, I believe that this could be an opportunity to buy the dip.

In the past week, Cardano‘s [ADA] value has decreased by approximately 5.42%, making it one of the worst performing tokens among the top 20 in the market. Despite this setback, some investors see this as an opportunity to purchase the token at a potentially lower price.

For a more enlightening perspective, AMBCrypto conducted an extensive examination of Cardano’s blockchain activity. Currently, the value of ADA hovers around $0.45. The recent price decline has led to significant changes in transactions recording profits or losses on the Cardano platform.

Cardano stops giving and keeps taking

Based on Santiment’s latest data, there were 0.827 times more on-chain transactions involving profits than losses as of now. This figure suggests that a larger number of crypto traders have locked in profits compared to those who incurred losses.

As an analyst, I’d rephrase it as follows: The bullish trend for ADA‘s price movement would have been the expected outcome based on the available data. However, upon closer examination of the transactions, only 82.7% resulted in profits, whereas every on-chain transaction that incurred a loss was accounted for.

Historically, this metric has tended to align with the asset’s price. For example, when the ratio reached 0.722 in February, the price of ADA was around $0.57. Approximately a few weeks later, the price surged on the charts to approximately $0.73.

Back in April 13th, I witnessed a striking resemblance to the current situation. The decline in the ratio caused a surge in ADA‘s price from $0.43 to $0.52. However, given its historical trends, there’s a possibility that Cardano could experience a more significant drop.

Should the situation hold true, the price of ADA could potentially fall to $0.42. On the other hand, it’s quite likely that ADA will experience a 20% surge instead, resulting in a new price point of $0.50 within a short timeframe.

An entry level has appeared

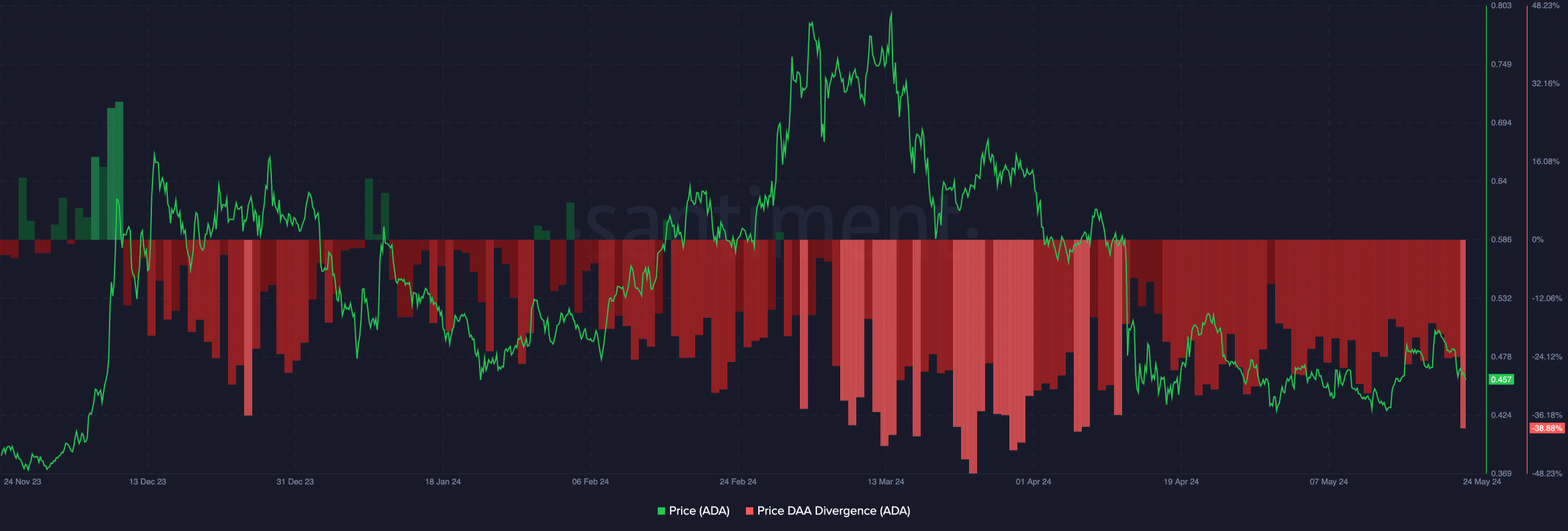

The price-Daily Active Addresses (DAA) discrepancy serves as a predictor for ADA‘s value assessment. DAA represents the number of unique addresses transacting on the network daily, providing insight into its activity level.

As a crypto investor, I look at the price in relation to the DAA (Daily Active Addresses) metric to identify profitable entry and exit points. Currently, the price-DAA spread stands at a significant discount of -38.88%. From a trading perspective, a buy signal emerges when this ratio drops below 0.50.

On the other hand, a sell signal appears when the divergence is at 0.90 or above. Since the ratio was 0.388, it seemed to be a sign that it could be time to start Dollar Cost Averaging (DCA) Cardano’s native token before the price pumps.

It’s worth mentioning that this measurement doesn’t provide the complete picture for predicting Cardano’s future direction.

As a crypto investor, I’ve noticed that the on-volume data shows an increase in this metric, suggesting higher trading activity. This could imply more buyers and sellers in the market. However, based on the price chart, it seems that there have been more transactions resulting in sales rather than accumulation of coins.

Read Cardano’s [ADA] Price Prediction 2024-2025

If the current situation continues, there’s a possibility that ADA may experience another downturn as previously stated. But if the decline becomes particularly severe, ADA could potentially rebound and reach its annual high once again.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-05-25 12:39