- Cardano flipped the HTF structure bearishly.

- The CMF indicator showed that buyers might be able to force a recovery.

As an analyst with extensive experience in cryptocurrency market analysis, I believe that Cardano (ADA) is currently trading within a bearish market structure. The repeated closes below the range low at $0.447 are a clear sign of selling pressure, which could potentially lead to further price declines.

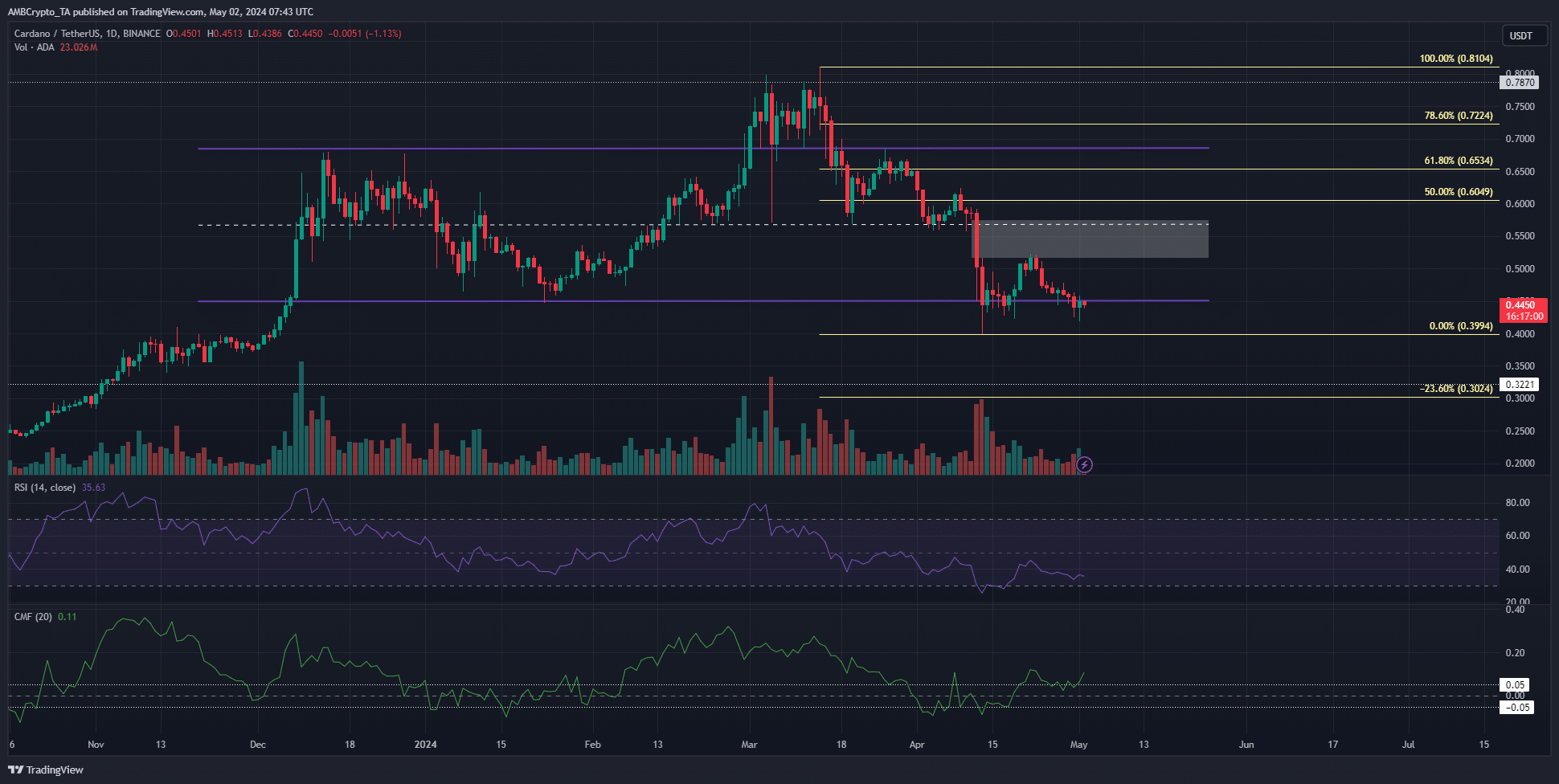

Since the beginning of January, the price of Cardano (ADA) has fluctuated between the $0.68 and $0.447 marks. During this time, there was a brief breakout in the first week of March that pushed the price above the upper boundary of this range. However, selling pressure soon resurfaced, causing the price to retreat back within the established range.

Based on AMBCrypto’s analysis, the market structure appears to be bearish, with Fibonacci levels suggesting a potential downturn for traders. However, it remains to be seen if we will experience another dip in price or if there will be heightened demand at the current support levels instead.

An argument for why the range lows might be flipped to resistance soon

As a researcher studying market trends, I’ve noticed that the price has reached new lows in the past month, dipping below the support level of $0.447 on several occasions during daily trading sessions. This consistent pattern suggests that a further decline may be imminent.

On the daily chart, the market displayed a bearish setup. Moreover, the $0.52 fair value gap (represented by the white box) thwarted the bulls’ efforts to bounce back.

With a 1-day RSI of 35, there was a strong possibility of further price declines imminently.

It was quite unexpected that the CMF indicator reading came in at +0.11, indicating substantial purchasing activity in the market. This contrasted with the conclusions drawn from other technical analysis methods.

Two significant levels lie ahead for possible bullish reversals in the market: the Fibonacci extension level at $0.3, representing a 23.6% increase, and the larger-term HTF level at $0.32.

This downtrend needs to halt before bulls stand a chance

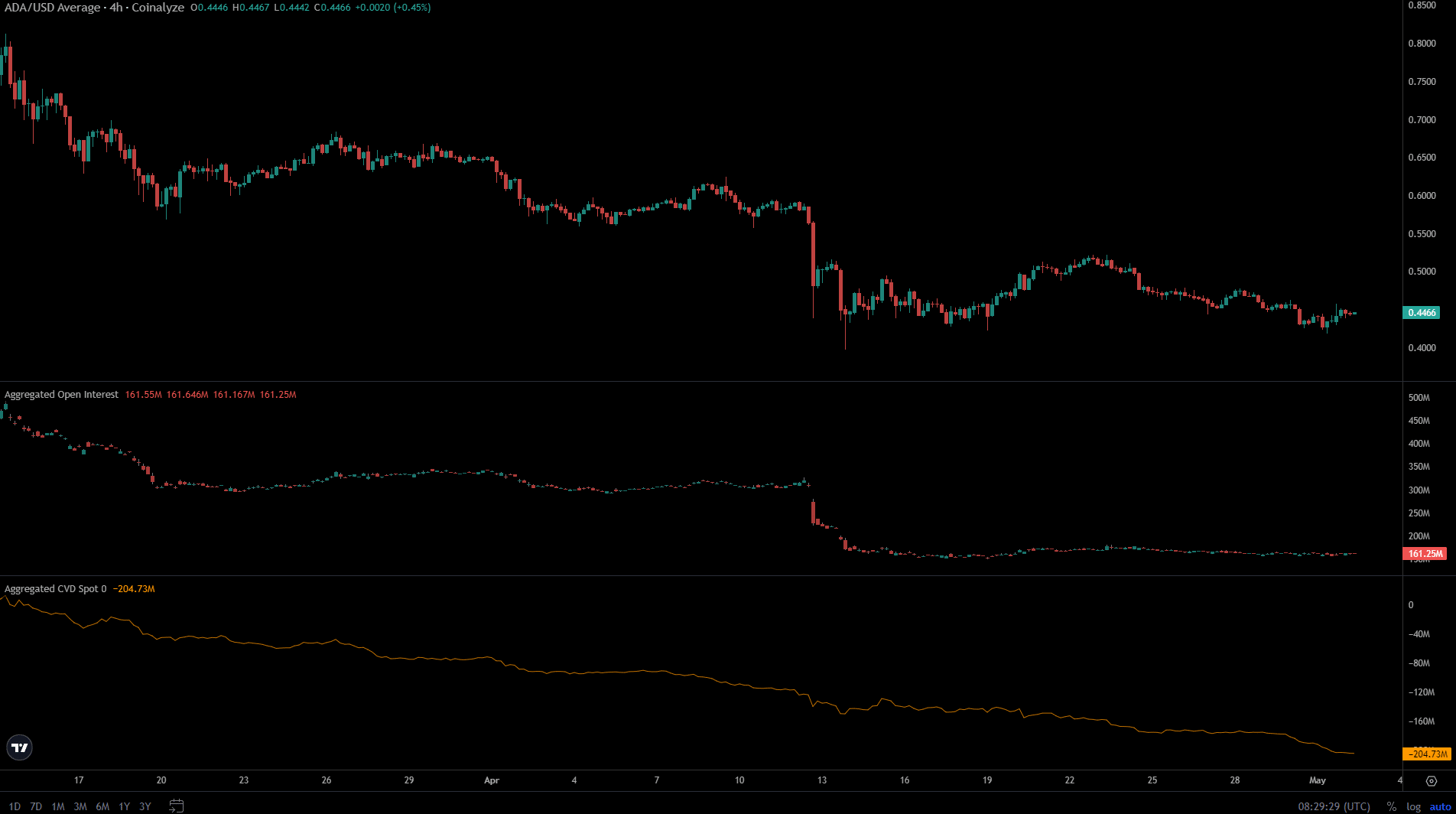

As a researcher studying market data, I’ve noticed that open interest in the market took a significant dip from $317 million on the 12th of April to $157 million by the 18th. Since then, this figure has remained relatively unchanged, with an open interest value of approximately $161.25 million as I write this report.

This showed a lack of speculative activity and bearish sentiment.

The area identified by CVD as the spot market revealed a decreasing demand during the entirety of April. A lateral shift in this indicator’s trend would signify the subsiding of intense selling pressure.

Until it does, we can expect prices to slowly bleed and descend.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-05-03 01:45