-

ADA was done by more than 4% in the last seven days.

Most metrics and indicators suggested that ADA might fail to test its support.

As a researcher with extensive experience in the cryptocurrency market, I’m closely monitoring the critical state of Cardano (ADA). Based on recent data and trends, I believe investors should remain cautious as ADA rests at a crucial support level.

Cardano [ADA] investors must remain cautious as the token was resting at a critical level.

The latest drop in price has caused ADA‘s token value to touch the level of support. If this level gives way, ADA may lose its rank among the leading ten cryptocurrencies.

Cardano’s critical state

The weekly trend for Cardano’s price showed a decline, with the token losing over 4% in value. Over the past day, there was a further decrease of approximately 1.6%.

As a crypto investor, I’d say: Based on current data from CoinMarketCap, Ada is priced at around $0.4383 for me, and its market capitalization exceeds $15.6 billion, positioning it as the tenth largest cryptocurrency by market size.

If ADA‘s position among the top 10 cryptocurrencies is threatened, it’s important to note that the token’s price has reached a significant support point.

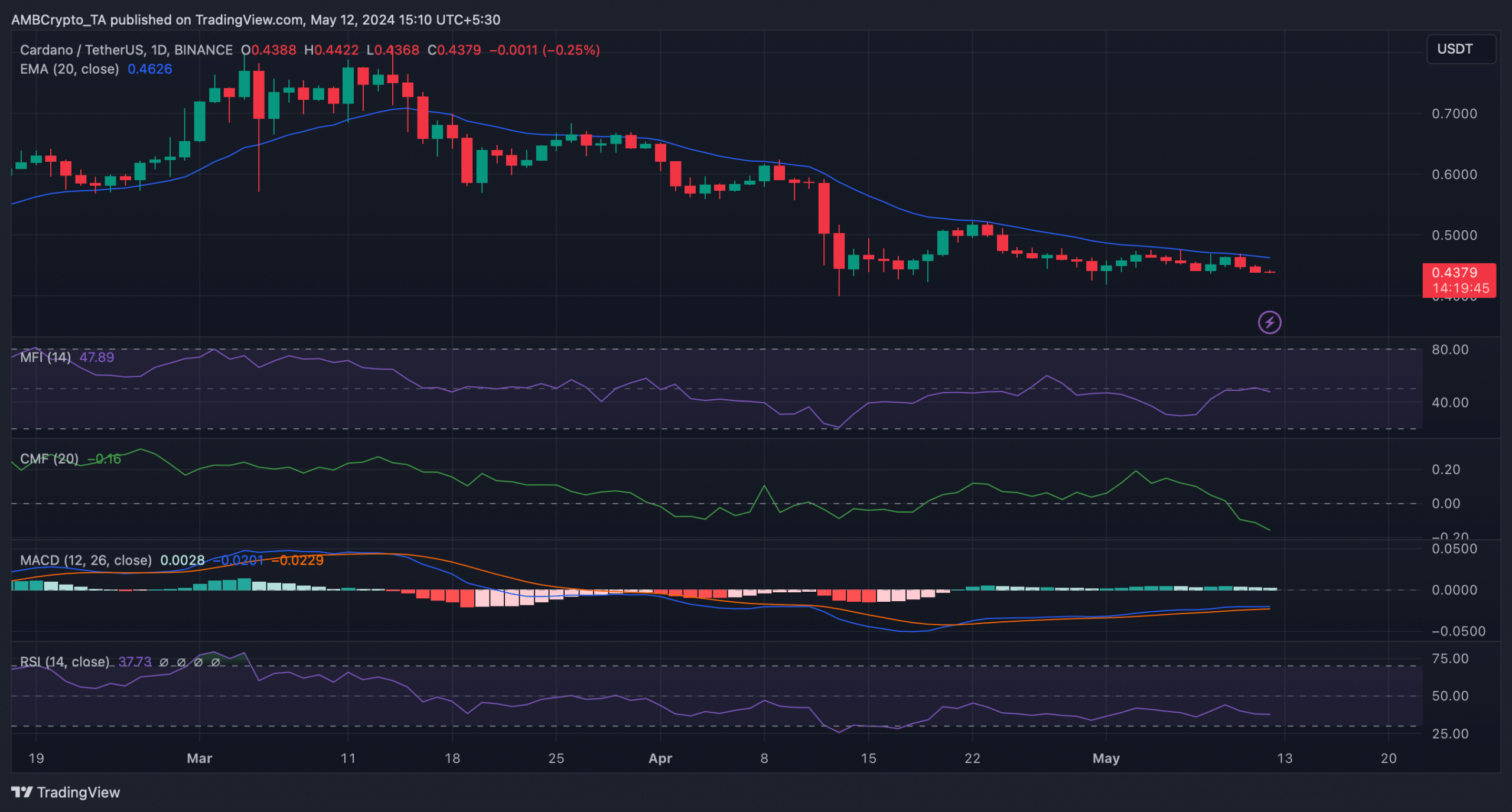

According to AMBCrypto’s evaluation of the daily chart for Cardano’s (ADA) token, it appeared poised to touch its support level of $0.4353.

As a researcher observing the market trends, I’ve noticed that the price of this token has encountered the support level on two occasions over the past few weeks. Remarkably, it has passed the test each time by rebounding off the support instead of breaking through it.

As an analyst, I would interpret the current situation as follows: Should the price action align with previous occurrences, ADA‘s resistance may be tested around the $0.51 mark. Conversely, if the price fails to reach this level, potential risks could escalate.

Will ADA test its support?

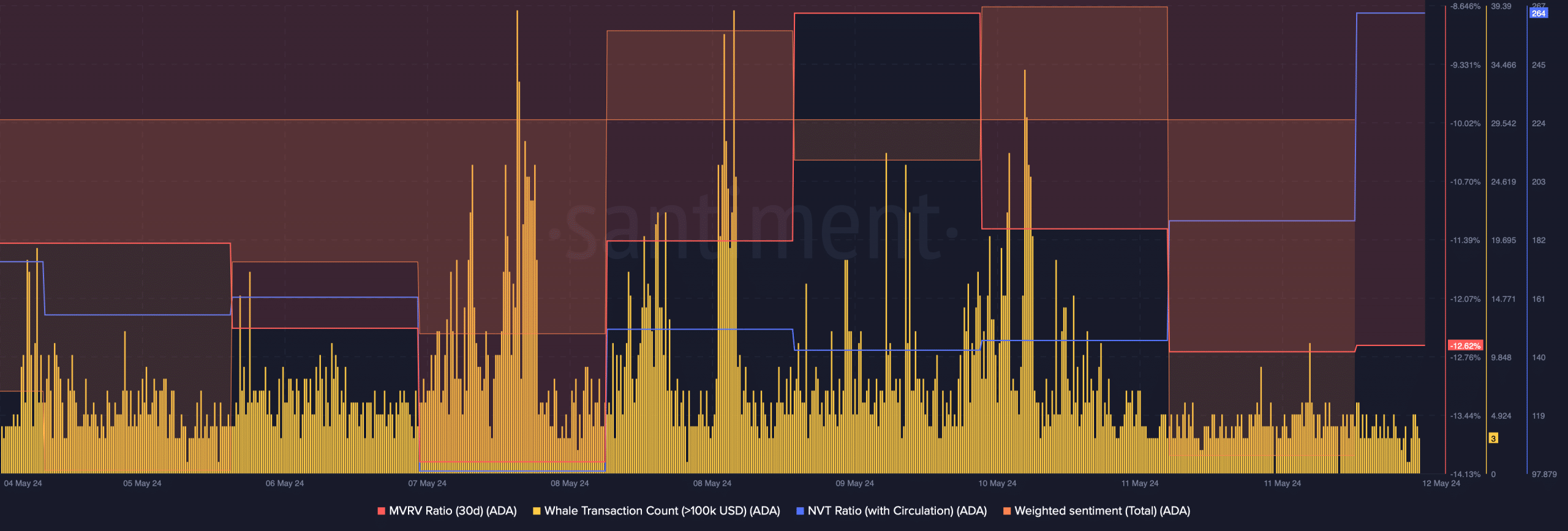

To find out if ADA would trigger support from ADA and cause a price increase, AMBCrypto examined the data provided by Santiment. We discovered that ADA’s MVRV ratio had decreased over the past week.

Following the price hike, the level of whale involvement with the token decreased noticeably. The Network Value to Transactions Ratio (NVT) for Cardano surged, implying that it was overpriced and potentially setting the stage for a subsequent decrease in value.

Furthermore, the token experienced a decrease in Weighted Sentiment, indicating that negative views held by investors were more prevalent in the market.

These metrics suggested that the possibility of ADA plummeting under its support was high.

As a crypto investor, I’m always eager to gain insights into a token’s potential behavior. To deepen my understanding of ADA‘s future direction, I examined its technical indicators with AMBCrypto. I discovered that the price was presently hovering below its 20-day Exponential Moving Average (EMA).

Both its Chaikin Money Flow (CMF) and Relative Strength Index (RSI) registered downticks.

As a crypto investor, I’ve noticed that the Money Flow Index (MFI) has begun to drop. This suggests that the token may be more prone to dipping below its support level.

Despite this, the MACD offered encouraging signs by indicating that bulls remained in charge of the market.

Read Cardano’s [ADA] Price Prediction 2023-24

As a researcher examining Hyblock Capital’s data related to the performance of Cardano (ADA), I sought to understand potential implications should the cryptocurrency fail to hold its support levels.

Based on our examination, if the slump persists, the price of Cardano could potentially drop down to $0.41 initially. At this point, ADA may find support and start recovering.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-05-13 05:11