-

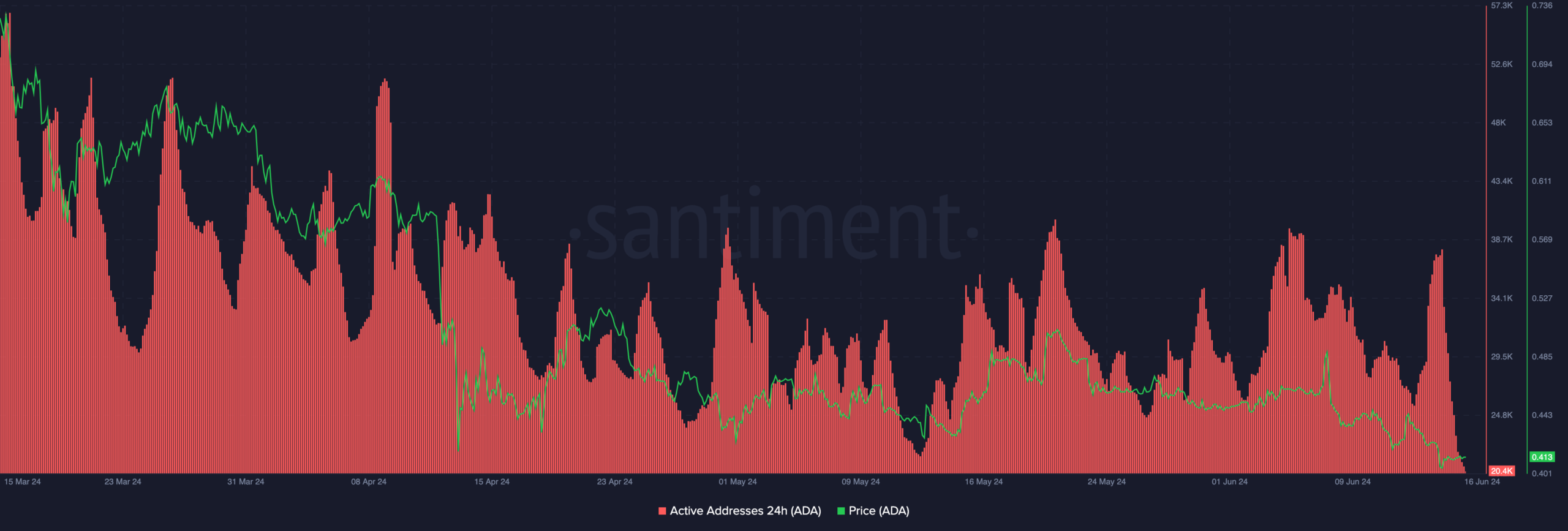

The number of active addresses dropped to the lowest figure in the last 90 days.

Amid bearish sentiment, technical analysis indicated that ADA could fall to $0.40.

As an experienced analyst, I’m concerned about the recent downturn in Cardano’s (ADA) on-chain activity and its potential impact on the token’s price. The number of active addresses has dropped to a three-month low, indicating decreased user engagement with the network. This trend could be attributed to market participants preferring other blockchains over Cardano.

The level of activity on the Cardano [ADA] blockchain has dropped to a three-month minimum based on on-chain metrics, as indicated by an analysis of the blockchain’s daily active addresses conducted by AMBCrypto.

As a researcher studying blockchain analytics, I would describe active addresses as follows: Within a 24-hour period, the active address count represents the distinct number of users who have engaged in transactions by sending or receiving cryptocurrencies on a given blockchain.

As of now, I’ve observed that the number of actively used addresses on Cardano within the past 24 hours has surpassed 20,400 – a threshold not seen in the previous three-month period.

Cardano’s future hangs in the balance

As an analyst, I would interpret this decline as a sign that market participants were preferring to interact with other blockchains instead of Cardano in recent times. Contrary to my earlier assessment where I reported an improvement in activity just a few days ago.

As an analyst, I’ve noticed that the latest data indicates a brief duration for the previous price surge of ADA. Additionally, the current downward trend may potentially influence ADA’s pricing.

An analysis of Santiment’s data reveals a significant connection between the price movements and network activity of ADA. Currently, ADA is trading at a price of $0.41, representing a 14.25% decline over the past month.

If the downward trend persists, the cost of ADA could potentially reach as low as $0.40. In a extremely pessimistic scenario, the price may even dip to $0.38.

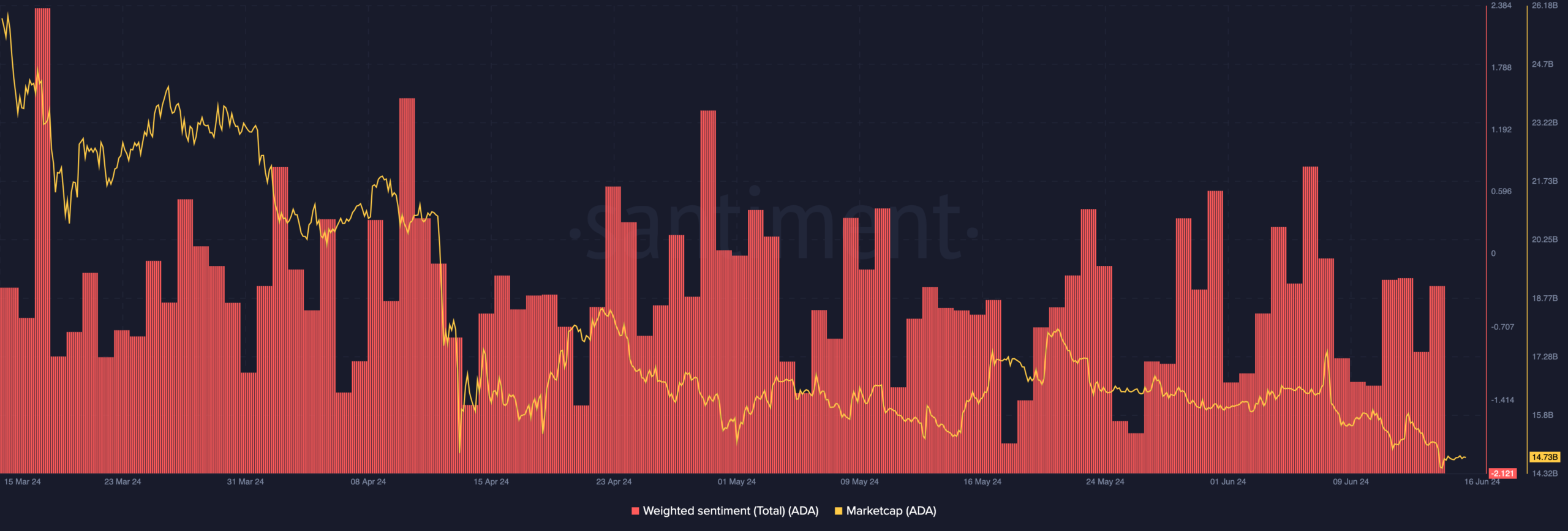

As a crypto investor, I frequently examine various indicators to gauge the potential price movements of a token. One such important metric is the Weighted Sentiment, which reflects the collective sentiment of market participants regarding a particular project online. Instead of merely focusing on the numbers, consider this as my personal assessment of the emotional tone surrounding the project in the digital community.

As a researcher studying sentiment analysis for cryptocurrencies, I’ve found that a negative value in this context indicates a predominantly bearish tone among conversations regarding Cardano. This means that the majority of comments and discussions surrounding this cryptocurrency have been pessimistic or critical.

We observed an intriguing correlation: the sentiment score reached a three-month minimum, aligning with the decline in active addresses. If this trend doesn’t reverse soon, it might raise concerns about Cardano (ADA).

ADA’s price may not escape $0.40

One potential outcome may result in Cardano dropping out of the top 10 cryptocurrencies by market capitalization. Currently, its market cap stands at $14.73 billion.

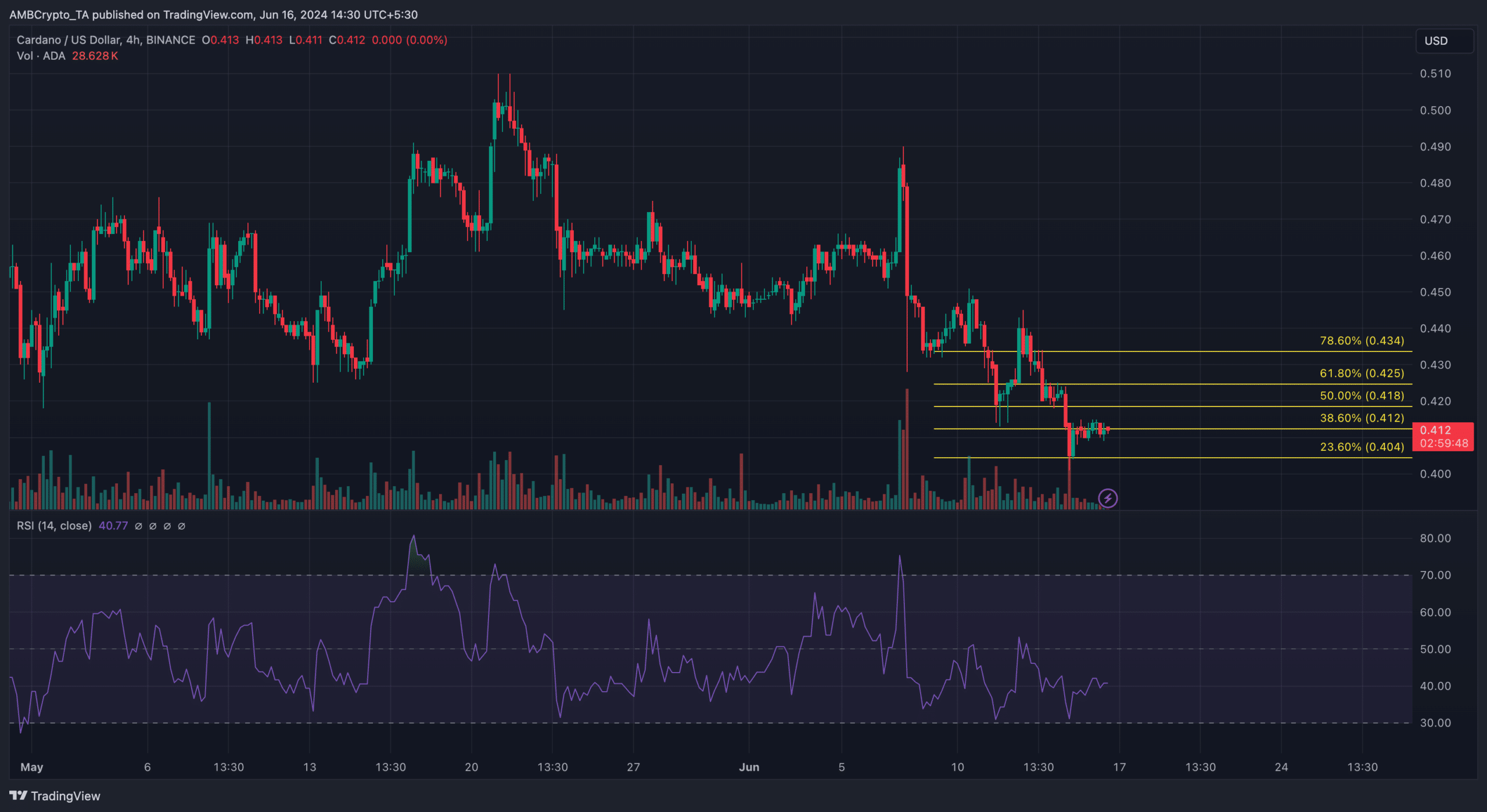

From an technical standpoint, further information was given on ADA‘s potential future performance. Specifically, AMBCrypto analyzed its Relative Strength Index (RSI) as a means of evaluation.

The Relative Strength Index (RSI) quantifies the momentum of an asset’s price movement. When the RSI is above 30, it signals that the asset has been bought more than sold recently and could be overbought. Conversely, a reading below 30 implies the asset has been sold more than bought, suggesting potential oversold conditions.

At the current moment, the Relative Strength Index (RSI) for the ADA/USD pair is reading 40.77 on the chart. With this value falling below the neutral mark of 50.00, it indicates that the price trend has been experiencing downward momentum recently. Furthermore, the Fibonacci retracement levels provide additional evidence supporting this bearish outlook.

Is your portfolio green? Check the Cardano Profit Calculator

As an analyst, I’d interpret this indicator’s reading by saying: This particular level on the price chart functions as a potential support or resistance point for the ADA token. At present, the 23.6% Fibonacci retracement level lies at $0.40. Consequently, there’s a likelihood that ADA may experience a short-term correction and retrace back to this price point.

However, if the price rebounds, the next target could be $0.43 where the 78.6% Fib level resided.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-16 23:04