Key Takeaways (or as I like to call it, the “What the heck just happened?” section)

- ADA bounced back to $0.80 after a dramatic fall from grace at $0.71, like a phoenix rising from the ashes! 🔥

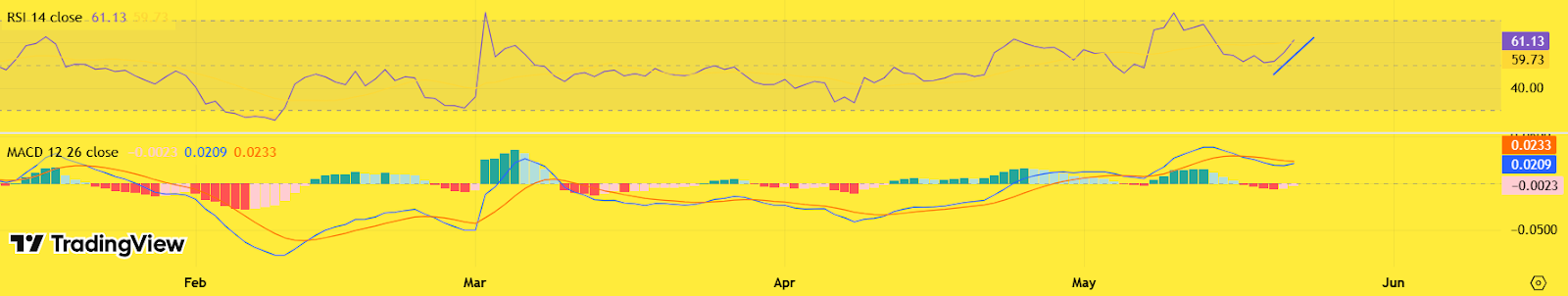

- Momentum flipped positive, with RSI > 60 and MACD showing a fresh bullish crossover. It’s like a party in the charts! 🎉

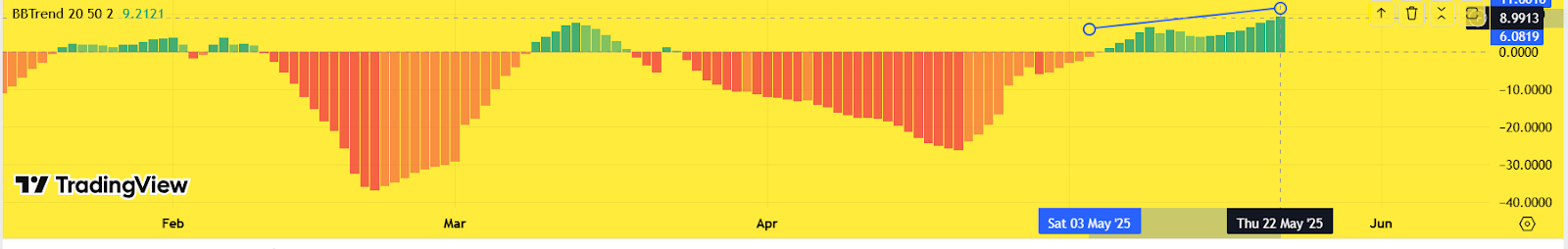

- BBTrend surged to +5.22, signaling strong volatility and breakout potential. Hold onto your hats, folks! 🎩

- Open interest hit $917M, marking its highest level in 2025. Traders are feeling confident—maybe too confident! 😜

Bitcoin just hit a fresh all-time high of $111,861 on May 22, pushing the Crypto Fear & Greed Index to 73 (Greed)—its highest reading in weeks. This surge in sentiment has triggered renewed momentum across major altcoins, with Cardano (ADA) reclaiming the $0.80 mark and flashing signs of a bullish continuation. Will momentum hold into next week? Or will it be a classic case of “what goes up must come down”? 🤔

ADA/USD Structure Recovery Backed by Momentum Shift (or “The Comeback Kid”)

Cardano’s price action has seen sharper turns than a rollercoaster in 2025. On March 2, ADA skyrocketed from $0.64 to $1.19—its biggest one-day spike this year, a gain of +85%. But then, like a bad sitcom, profit-taking led to a deep correction, bottoming out at $0.5114 on April 2, a -57% drop. Ouch! 😱

Since then, ADA has been rebuilding, climbing to $0.84 on May 10, then briefly correcting to $0.71 on May 19, before bouncing back above $0.80. It’s like watching a soap opera—will they or won’t they? 💔

This climb is supported by a bullish structure of higher lows. Price now trades above a rising trendline, with key support at $0.7526 (0.236 Fib) and resistance at $0.8533 (0.5 Fib). A break above this zone could open the door to $0.934 (0.618 Fib) in the short term. Fingers crossed! 🤞

Cardano price indicator setup has also shifted bullishly. RSI recovered from 45–48 on May 19 to above 61.13, reflecting improving buying strength. MACD completed a bullish crossover on May 21–22, with expanding green histogram bars signaling fresh momentum. It’s like a green light for go! 🚦

//image.coinpedia.org/wp-content/uploads/2025/05/22192458/AD_4nXcDyZcywfeOUtyBKJjjVfAyKg9unR5zwSYxfJkYLOon8SlXUDMsL0pXQqrkZxCGJuLCOWaiLsmUMrTfp9ScnIiC-BbK7EV-XhLvoVf719hfxBZH2cec8Nug1K0JQrDJTQdyOcpLZQ.png”/>

Volume trends further support the move. After a quiet start to May, spot and derivatives activity has surged, with open interest now at $917M—the highest in 2025. This signals rising conviction among traders and real capital inflow behind the price push. It’s like a stampede at a sale! 🏃♂️💨

Short-Term Forecast: Bullish, With Caution (or “Don’t Get Too Comfortable!”)

If ADA holds above the $0.75–$0.77 support band this week, a retest of the $0.85 level is likely. A clean breakout above $0.853 could accelerate gains toward $0.93–$0.94 in the next 7–10 days. But remember, folks, this is crypto—anything can happen! 🎭

However, failure to sustain above $0.75 would expose ADA to downside risk toward $0.72 or even $0.647 in a broader pullback. It’s like a rollercoaster—hold on tight! 🎢

Verdict: Bullish Bias with Near-Term Upside (or “The Glass is Half Full!”)

The technical and on-chain picture supports a bullish bias for ADA in the short term, especially if momentum sustains above key Fib levels. While resistance at $0.85 may cause temporary friction, the overall structure favors upside continuation, potentially targeting $0.93 within the next 10 days. So, grab your popcorn and enjoy the show! 🍿

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- SOL PREDICTION. SOL cryptocurrency

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

2025-05-22 17:08