- ADA has plummeted a staggering 23.8% in a week, as it tiptoes towards a support zone that’s practically waving a white flag between $0.56 and $0.51.

- With whale transactions and network activity doing the limbo, investors are clearly feeling a bit cautious, but hey, history might just pull a rabbit out of its hat!

In the grand cosmic ballet of cryptocurrency, Cardano’s [ADA] price performance has been as predictable as a Vogon poetry recital. Sure, it’s up by 7.2% over the last two weeks, but let’s not get too excited—it’s like finding a penny in a black hole.

However, if we zoom out to the past month, we see a 10% nosedive that would make even the most seasoned skydiver cringe.

And if we focus on the past week, ADA has taken a delightful plunge of 23.8%, landing at a price of $0.716, which is about as comforting as a towel in a rainstorm.

Technical Outlook on ADA: Key Levels

Now, let’s don our technical analysis hats and peer into the crystal ball of ADA’s price chart. Spoiler alert: it’s not pretty.

On the 4-Hour chart, ADA recently stomped its way to a major resistance level at the $1.15 mark, only to be rejected like a bad date.

As ADA reached this lofty price, it was promptly shown the door, validating that resistance level with all the grace of a three-legged giraffe.

Now, the asset is expected to take a downward spiral until it finds another support level strong enough to reverse this bearish trend. Think of it as a rollercoaster ride, but without the fun.

Currently, ADA is flirting with a major support level between $0.56 and $0.51. If it reaches this level, we might just witness a bounce that could send it soaring back above $1, like a phoenix rising from the ashes—or at least a pigeon flapping its wings.

What On-Chain Metrics Suggest

Now, let’s shift gears and dive into the fundamentals, because who doesn’t love a good metric? It appears ADA is in for a long and winding road, much like a journey through the galaxy.

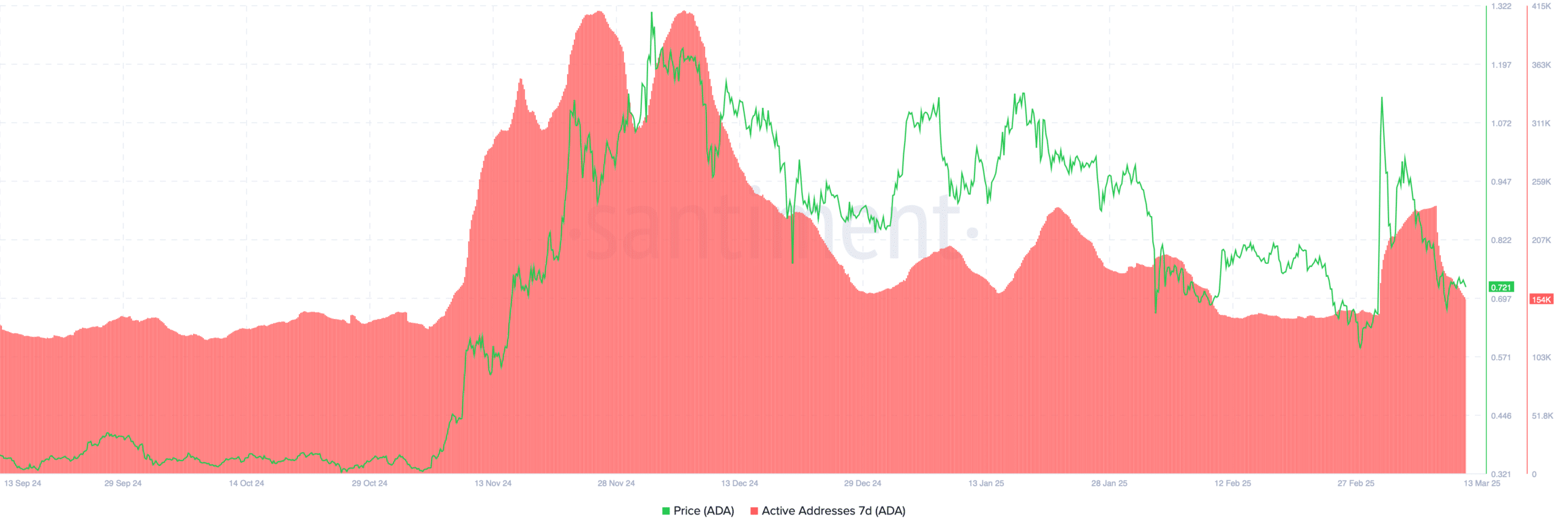

First up, we have the number of active addresses over a 7-day period. According to Santiment, this metric has been on a slow descent, much like a spaceship running out of fuel.

After peaking at over 400k addresses in November 2024, it has plummeted to a mere 141k earlier this month. It did see a brief uptick to 235k on March 9th, but alas, it seems to have resumed its downward trajectory, now sitting at 154k as of March 13th.

A drop in active addresses often reflects lower transaction demand, which could mean investors are as engaged as a cat in a room full of laser pointers—i.e., not very.

Furthermore, let’s take a gander at another key metric: whale transactions. Data from IntoTheBlock reveals that this metric has been steadily dropping since late last year.

As of now, ADA’s whale transactions are at a paltry 4.73k—a nearly 50% drop from the 9k transactions seen back in December. It’s like watching a parade where all the floats have decided to take a detour.

This decline in large-scale transactions could suggest

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Elden Ring Nightreign Recluse guide and abilities explained

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2025-03-13 21:15