CZ’s Wild Tokenization Dreams: Crypto, AI, and Banks on the Brink?

So, CZ (aka Changpeng Zhao, but who has time for that?) dropped some hot takes at Davos, because where else would you discuss the future of finance while sipping $20 coffee?

So, CZ (aka Changpeng Zhao, but who has time for that?) dropped some hot takes at Davos, because where else would you discuss the future of finance while sipping $20 coffee?

Coinbase, ever the dramatic hero, has established an advisory board to confront the existential threat of quantum computing. A noble quest, indeed, though one wonders if they’ve considered the simpler solution: not building a system reliant on “secure” cryptography that could crumble like a soufflé in a hurricane.

Indeed, the whispers grow louder by the day that XRP is fashioning the very rails upon which trillions shall travel. The transformation, it appears, is already afoot. A certain crypto analyst, known as Xfinancebull, has divulged a most intriguing video from the annals of X, wherein Ripple’s esteemed CEO, Mr. Brad Garlinghouse, revealed at the illustrious gathering in Davos (in the year 2026, no less) that his firm has been engaged in clandestine collaborations with banks across the globe. Their mission? To unite the realms of tokenization and DeFi through the XRP Ledger, thus creating a conduit between the venerable traditions of finance and the audacious innovations of on-chain markets.

Pi Network began a seven-day mainnet community governance vote, focusing on upgrades like Version 23 (v23) for faster speed, better security, and on-chain KYC. As voting opened, over 15.8 million verified users tried to access the Pi App & Wallet at the same time, causing temporary overloads. The app, clearly a victim of its own success, responded with a waiting message that might as well have been written by a bureaucratic entity from another dimension.

Behold, the 1-hour chart reveals XRP trapped in a falling wedge, a sly fox in the world of technical analysis. This contraption, often spotted near the tail end of downtrends, has seen our hero brush against its lower edge before rebounding, bolstered by a surge in volume. It’s like watching a mouse outwit a cat-briefly.

Yet lo! The tension now eases, as if the market had swallowed a tranquilizer and a slice of humble pie. A relief rally? Perhaps. But what madness follows?

In typical fashion, the team decided to hit the brakes on operations, which naturally sent everyone scrambling to sell their beloved tokens faster than you can say “liquidity withdrawal.”

Lo, Bitcoin lingers below the $90,000 mark, a mere shadow of its October 2025 glory, when it touched the stars at its all-time high. Scaramucci, once bold in his vision, had foretold a $170,000 pinnacle by late 2025. But alas, the fickle hand of Washington, with its glacial pace, has dashed his hopes. “We, the faithful of the Bitcoin cult,” he laments, “were blinded by our zeal, believing the chains of regulation would shatter. Yet, they remain, unyielding and cold.”

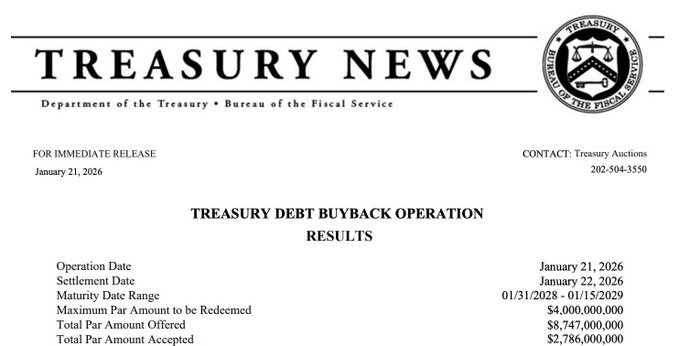

These buybacks, oh what a cunning game! They manage liquidity with the precision of a masterful conductor, yet also stir the crypto market, that ever-elusive siren, into a frenzy of speculation. One might say the Treasury is playing a game of financial chess, where every move is a calculated jest.

Behold, the proletariat of finance has found its champion! On the 20th of January, GTreasury, that stalwart of treasury management, took to the digital soapbox of X to proclaim Ripple Treasury as the antidote to the maladies of traditional banking. “Legacy treasury sleeps,” they cried, “but the wheels of commerce never cease!” A gap, they say, that costs dearly in idle cash and fees-a gap ripe for revolution.