Cryptonews

💰 HYPE Team’s Epic Dump Fest – Will $30 Hold? 😱

609K HYPE vanished into the OTC abyss via Flowdesk, while 900K HYPE lounged lazily on the Spot market, waiting for the next sucker. And just when you thought the party was over, two team members casually tossed another 75K HYPE into the market blender. Cheers! 🍻 Meanwhile, one lone wolf staked 75K HYPE-probably by accident.

Pollyanna or Propaganda? Trump’s Crypto Silence & a Laugh Riot!

In a shocking plot twist, the strategy paper didn’t even mention crypto-not even a whisper, not a “maybe” or a “what if?” Just silence. Like Aunt Edna’s phone calls. 📱🔕 But hold on, folks! Did you catch Trump’s recent CBS interview? He’s still got crypto on the brain! He’s all, “We don’t want China to be the king of Bitcoin, or it’s back to the Stone Age for us!” Oh, he’s got big plans-big, shiny plans-like making sure all Bitcoin mining happens in the good ol’ USA. 🇺🇸💰

🚀 Bittensor’s Halving: Will It Make You Richer Than Willy Wonka? 🍫

Bittensor, with its fancy “subnets” (think of them as golden tickets for AI services), is set to halve its TAO token issuance from 7,200 to 3,600 per day around December 14. 🎟️ Grayscale’s William Ogden Moore (what a mouthful!) calls it a “key milestone in the network’s maturation,” as if it’s finally growing out of its chocolate-stained overalls. 🥼

Shiba Inu Goes Fast & Furious: 34M Burned, Price Wobbles & Market Guesses 🤯🔥

All told, in the grand seven-day saga, a hefty 94,600,421 SHIB tokens vanished into the ether-though, just to keep things interesting, the weekly burn rate tumbled a hair-raising 9.46%, perhaps contemplating its own existential crisis. Such drama! Such flair! The weekly burn dance, a true rollercoaster for the discerning hodler.

The Great Crypto Freeze of November 2025: Are We All NFT’ered Out? 🤔❄️

This unexpected cooldown popped up during a time already whirling with market gyrations, supplying further evidence-like a lexicological minting machine-that the general populace has been opting for a more Scrooge-like approach, these days. Oh, and did you hear? While everyone else evacuates the crypto landscape, institutions are throwing bouquets at Bitcoin like it’s the long-lost Urth McDonald’s cow 🐄🎂.

Bitcoin’s Belly Flop: 21% Crash and the Great Disappearing Volume 🚀💥

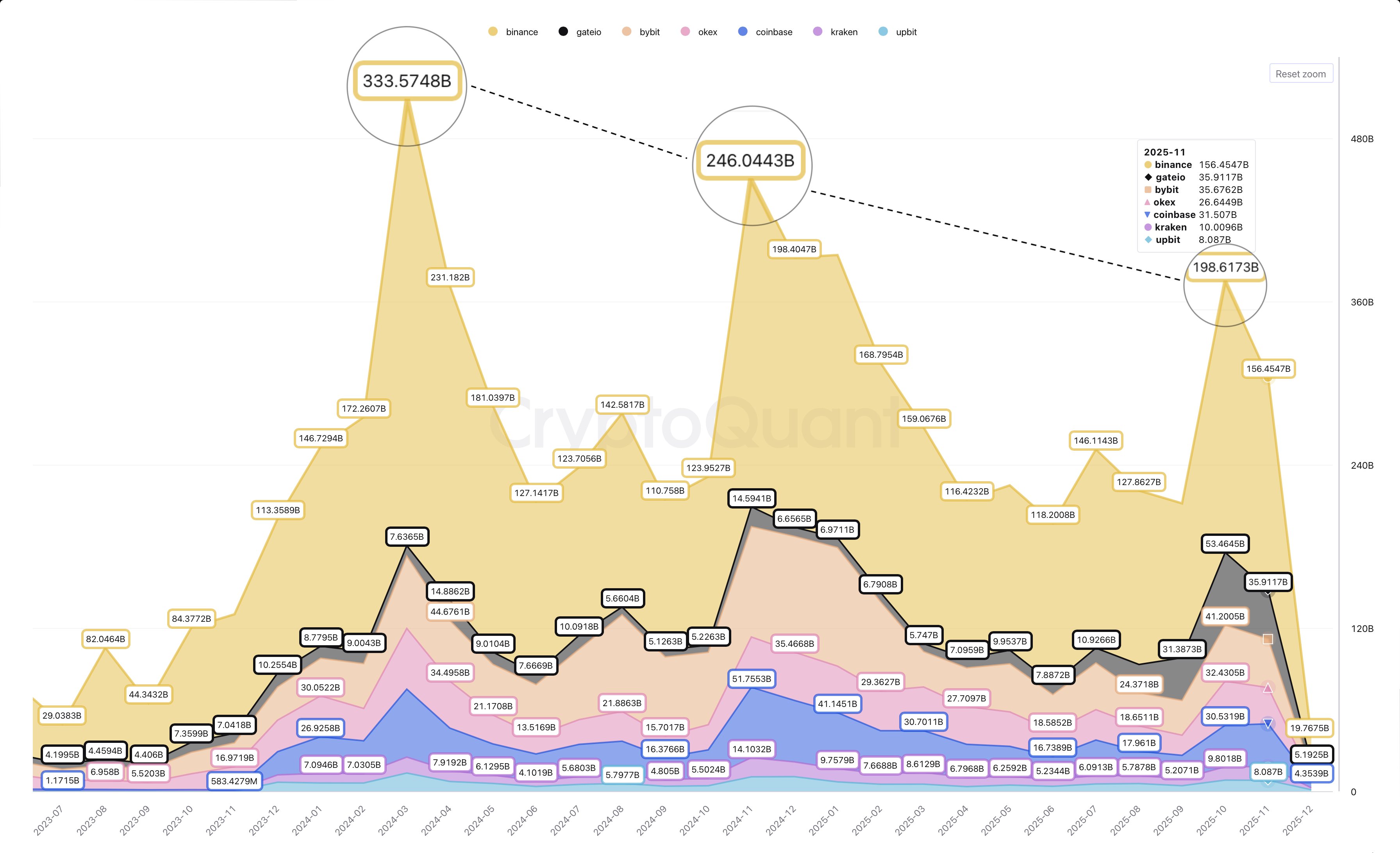

Ce “spot trading,” c’est comme la foire où tout le monde veut vendre sa barbe à papa… mais voilà, cette saison, moins de visiteurs veulent vendre, et ceux qui veulent acheter ont disparu comme par magie. En octobre, la faucille triomphante annonçait 198 milliards de dollars, mais en novembre, cette somme a fondu comme neige au soleil, tombant à 156 milliards. Et le bilan ne s’arrête pas là; d’autres échoppes comme ByBit, Gate.io, et OKX ont connu des descentes spectaculaires. La bourse, mes amis, ressemble de plus en plus à une fête sans invités, où même le DJ (le marché) semble fatigué de faire la fête. Et, pour couronner le tout, notre cher Darkfost, ce voyant un peu plus intelligent que le reste, prévoit une autre chute rougeâtre, comme la chemise de votre rival à la dernière réunion de famille – prévisible, mais toujours désagréable. 😜

LUNC’s Wild Ride: A Tale of T-Shirts, Trials, and Tokens! 🌪️💰

Pray, allow me to elucidate: Terra Classic, that most enigmatic of cryptocurrencies, has quite literally stormed the market with a price action that would make even the most stoic of investors blush. In but a single day, it skyrocketed 135 percent, a feat as remarkable as a spinster receiving two proposals in one morning! The trading volume, too, shot to record levels, as though the entire town had turned out for a grand assembly. 🌟📈

Bitcoin’s Bloody Ballet: Will Bulls Waltz or Stumble? 💃🩸

Consider, dear reader, the weight of this imbalance: 74% of the realized volume bathed in crimson, a mere 26% basking in the faint glow of profit. Capitulation, that old harbinger of doom, knocks at the door, its voice a whisper of despair. Yet, in the annals of history, such extremes are but the prelude to either resurrection or ruin-a coin toss in the void, where fate laughs at predictions. 🎭⚖️