🚨 Bitcoin’s Bear Hug: Is Crypto Doomed or Just Drama? 🚨

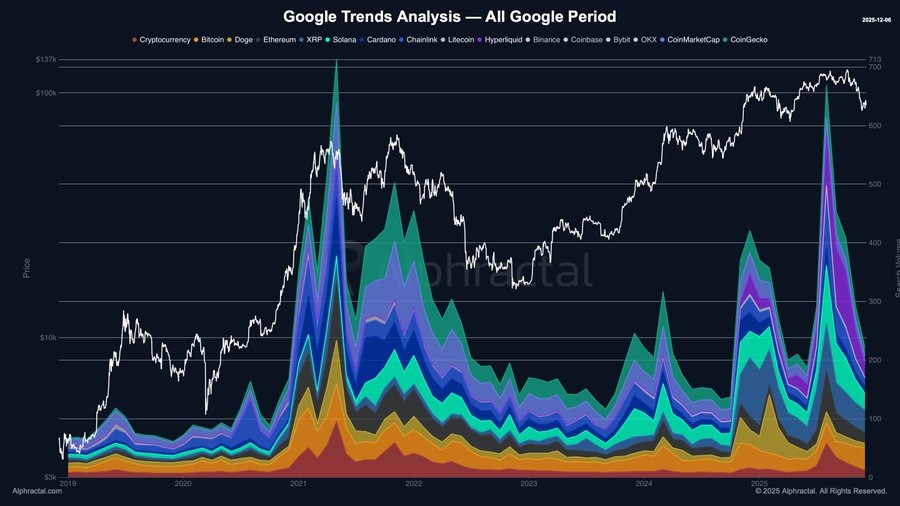

Interest is dropping faster than my New Year’s resolutions, and ETF flows are reversing like a bad breakup. So, is this a correction or the start of a bear market? Who knows? Probably neither. It’s just crypto being crypto. 🌪️