Crypto ATM Scandal: $8M Vanishes in a Puff of Blockchain Smoke! 💸🤦♂️

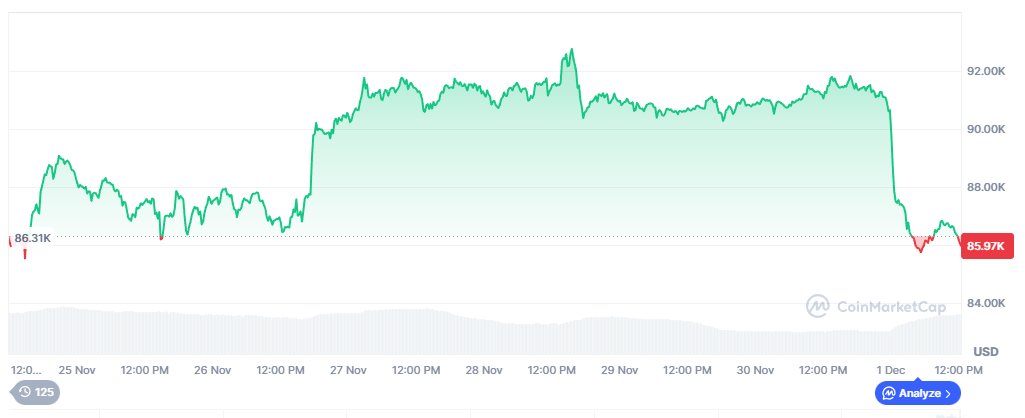

The Department of Financial Institutions (DFI), with a flourish of emergency cease-and-desist orders, declared CoinMe’s practices “unsafe and unsound”-a phrase as damning as a Chekhovian pistol in the first act. Issued on December 1, the order reads like a tragicomic opera, complete with unclaimed vouchers and expired dreams.