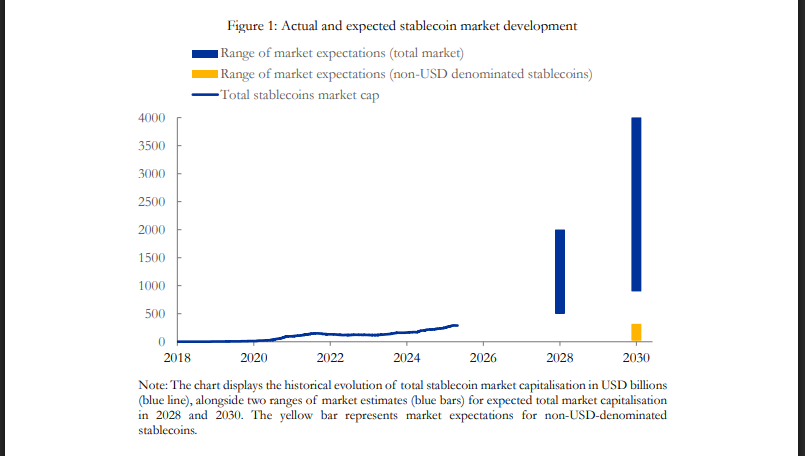

Stablecoins: The Silent Threat to Eurozone Banks No One Saw Coming

The heart of the concern? Simple, really: if more people and businesses decide to stash their cash in these digital tokens-those stablecoins tied to major currencies-traditional bank deposits could dwindle to nothing. And when the money runs dry, who’s going to fund those oh-so-necessary loans?