XRP’s Wild Ride: Will $1.75 Save the Day or Is It a Gogol-esque Farce? 🌪️💰

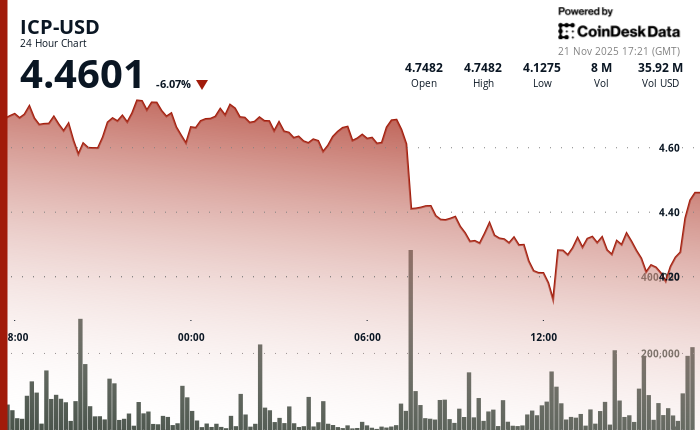

The broader cryptocurrency market has endured a month so dire, one might think it penned by Gogol himself! Double-digit declines have swept through like a plague, and XRP, alas, has not been spared. In the past week alone, its price plummeted more than 15%, briefly dipping below $1.90-a fall so dramatic, it could rival the antics of Akaky Akakievich’s overcoat. 🧥💸