Bitcoin Near Buy Zone as Whales Panic… Again?

Key Takeaways

Key Takeaways

The villain of this tale, a shadowy figure cloaked in anonymity, wielded 280 million USDC like a samurai’s sword, slashing through the MachineShareOracle with the precision of a man who’d read every line of code and then scoffed. With 170 million USDC in hand, they manipulated the DUSD/USDC Stableswap pool as though it were a puppet, dancing to their tune until the strings snapped and 1,299 ETH vanished into the ether.

At $3,162, Ethereum yawns through the day, down 1.3% in the last 24 hours. Over the week, it’s shuffled between $3,119 and $3,379, like a tired cowboy limping between saloons. It’s up 3.6% in a month, sure, but let’s not forget its August high of $4,946-a memory as faded as a barnboard’s paint.

Crypto markets across Europe are bracing for a new era of tax scrutiny starting January 2026, courtesy of the EU’s latest directive, DAC8. This gem of a rule forces crypto platforms to report user transactions directly to tax authorities, effectively turning them into involuntary snitches. The rapid rise of digital assets has left regulators scratching their heads, and this move aims to shed light on the shadowy corners created by decentralised networks and cross-border crypto shenanigans.

This little brainwave, my dears, is destined to be the pièce de résistance at the 2026 BRICS summit, hosted by India later this year. One can already envision the champagne corks popping and the diplomatic small talk reaching new heights of insincerity.

The Juicy Bits (with a dash of Dahl-esque delight):

India’s esteemed central bank has crafted a proposal with a flair so grand, it may well transform the realm of trade and travel payments, as one might transform a simple potage into a culinary masterpiece.

In an event that rightly should’ve included confetti and face paint, a governance proposal was passed to lower the INJ token’s long-term supply while tweaking the network’s token economics as if it were some fancy new recipe. The conclusion came on January 19, after a mere four days, with 99.89% of voters giving their ascent. Like a troupe of actors agreeing on the ending line, the changes are thrusting INJ into a deflationary tango. 🕺💃

In a ventriloquism performance that would impress even Pythagoras, big AI data centers have whispered promises of enduring power contracts, offering gold-laced coins to ensure their voracious appetites have electricity flowing day and night. This courtship has aged miners, forcing them to juggle coal with oven gloves and, in some cases, cast them away to other realms.

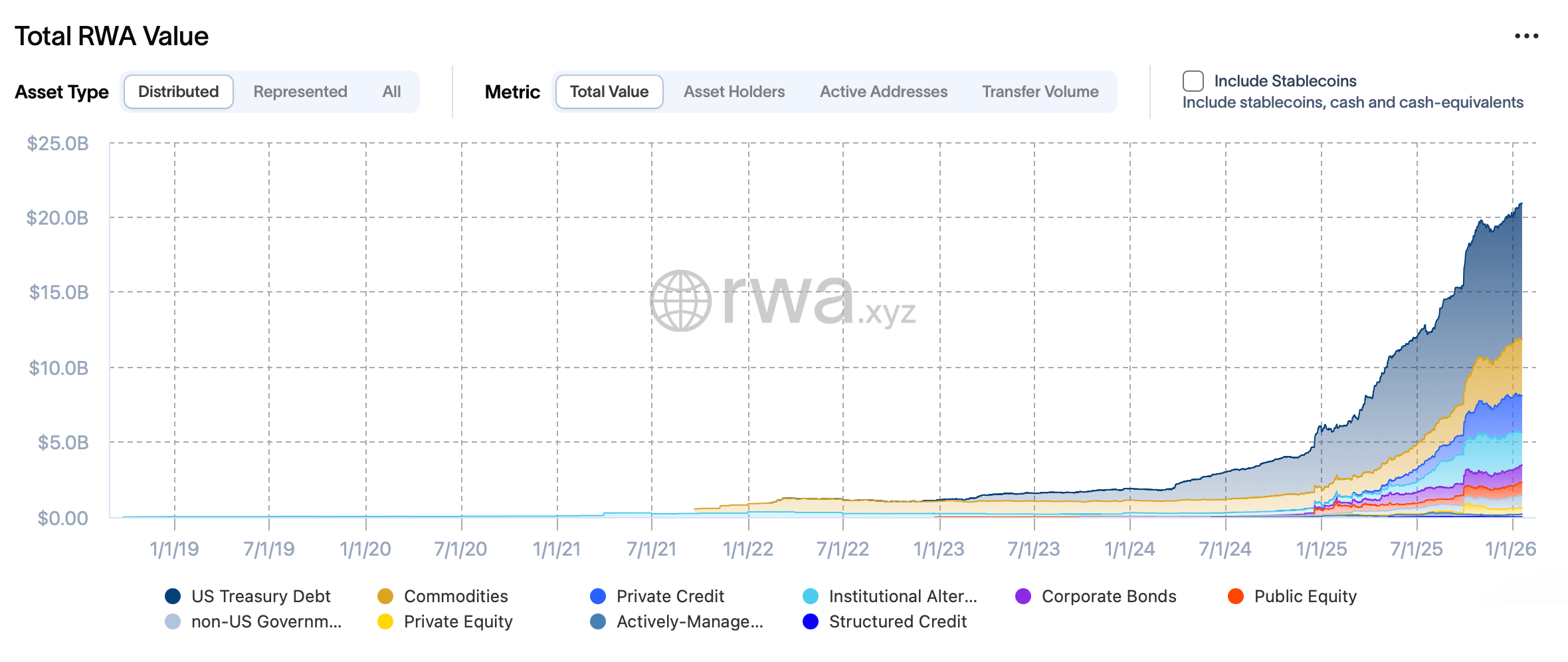

Tokenization, right? It’s like taking your grandma’s china and turning it into digital collectibles-only, instead of “collectible,” it’s actually useful. You turn assets like bonds or art into tokens on a blockchain, which, let’s face it, is a fancy computer ledger. Fractional ownership, quick transfers, automated payments-sounds like a dream, or a nightmare, depending on your patience. Anyway, RWAs are just traditional stuff-like gold or bonds-migrating onto the blockchain, blending the old with the new. Never thought I’d see the day, but here we are.