MSTR: Fraud or Fortune? Bitcoin’s Wild Ride!

Yet analysts and traders argue that MSTR’s strategy may still offer unique leveraged Bitcoin exposure, fueling a split in market sentiment. 🤯📉

Yet analysts and traders argue that MSTR’s strategy may still offer unique leveraged Bitcoin exposure, fueling a split in market sentiment. 🤯📉

Even with today’s rally, things are getting spicier than a Jerry Lewis roast. Two momentum divergences and a long liquidation map that looks like a demolition derby 🏎️ suggest the next move might be… unpredictable. Will ASTER keep dancing or trip over its own feet? 🕺

From Tuesday to Friday, Dogecoin tumbled four days in succession, a masochistic dance of decline, closing the week with a 10.49% wound to its pride (and portfolio). The market, reeling from October’s $19 billion liquidation carnage-a flash crash that vaporized $1 trillion like a peasant’s dream-remained a theater of existential dread. Open interest in crypto futures, once a bloated titan, now limped forward like a drunkard, while the Fear and Greed Index, at a frigid 18, whispered of “extreme fear.” A fitting anthem for our times, one might say.

Reports from the high-energy meeting in Minsk on November 14 paint a picture of Lukashenko all but declaring war on the dollar, not with weapons, but with computers and electricity. It seems that surplus energy is now Belarus’s golden ticket, and crypto-mining is the game they’re playing. Maybe next they’ll mine a few bitcoins and call it “national treasure.” 🏆

The burning question in the sophisticated salons of Pimlico is whether this little dance of digits can prance from $1,000 to $1,010 and who knows, perhaps beyond. The charts hint at such possibility, but, like a tricky matrimonial arrangement, it all hinges on a single level finally relenting in the face of undeniable pressure. 💀📈

Ethereum (ETH) and Bitcoin (BTC)? They’ve been on a three-week losing streak, hitting their lowest levels in months. It’s like they forgot how to moon! 🌕→🌑

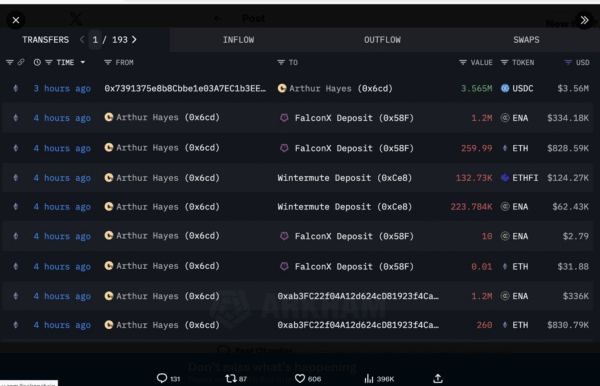

In the shadow of impending doom, Arthur Hayes-once the architect of digital gold-now stands as a harlequin of despair, unloading his ETH, ENA, and ETHFI with the ferocity of a man fleeing a burning cathedral of financial dreams.

Maybe they’re hiding. Short-term holders are nibbling at the bait, and derivatives are as steady as a rock in a still pond. But is it enough to make waves? 🪨

Yes, strong Taker Buy dominance and heavy long positioning among top traders indicate rising conviction in a trend shift. Translation: “They’re buying like it’s Black Friday at the crypto mall.” 🛍️

It seems Mr. Hayes is quite the fan of Zcash lately! In yet another one of his optimistic (read: bullish) declarations, he has revealed that Zcash now holds the second-largest position in his fund, right behind Bitcoin. And, of course, he doesn’t shy away from the claim that ZEC could outshine XRP in the race for market cap supremacy.