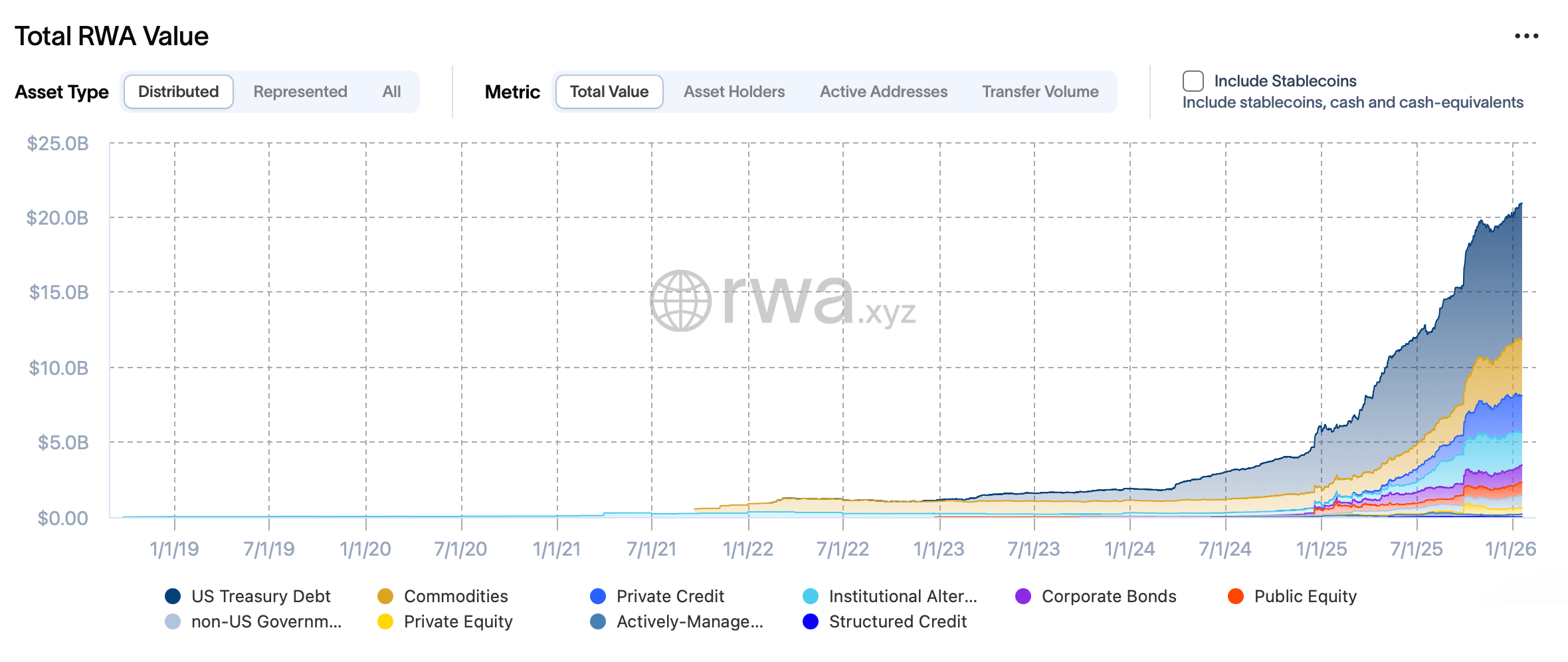

Tokenized Assets Hit $21B! Is This Crypto or Just Fancy Gold?

Tokenization, right? It’s like taking your grandma’s china and turning it into digital collectibles-only, instead of “collectible,” it’s actually useful. You turn assets like bonds or art into tokens on a blockchain, which, let’s face it, is a fancy computer ledger. Fractional ownership, quick transfers, automated payments-sounds like a dream, or a nightmare, depending on your patience. Anyway, RWAs are just traditional stuff-like gold or bonds-migrating onto the blockchain, blending the old with the new. Never thought I’d see the day, but here we are.