🚨 XRP ETF Approval: The Calm Before the Storm? 🌩️

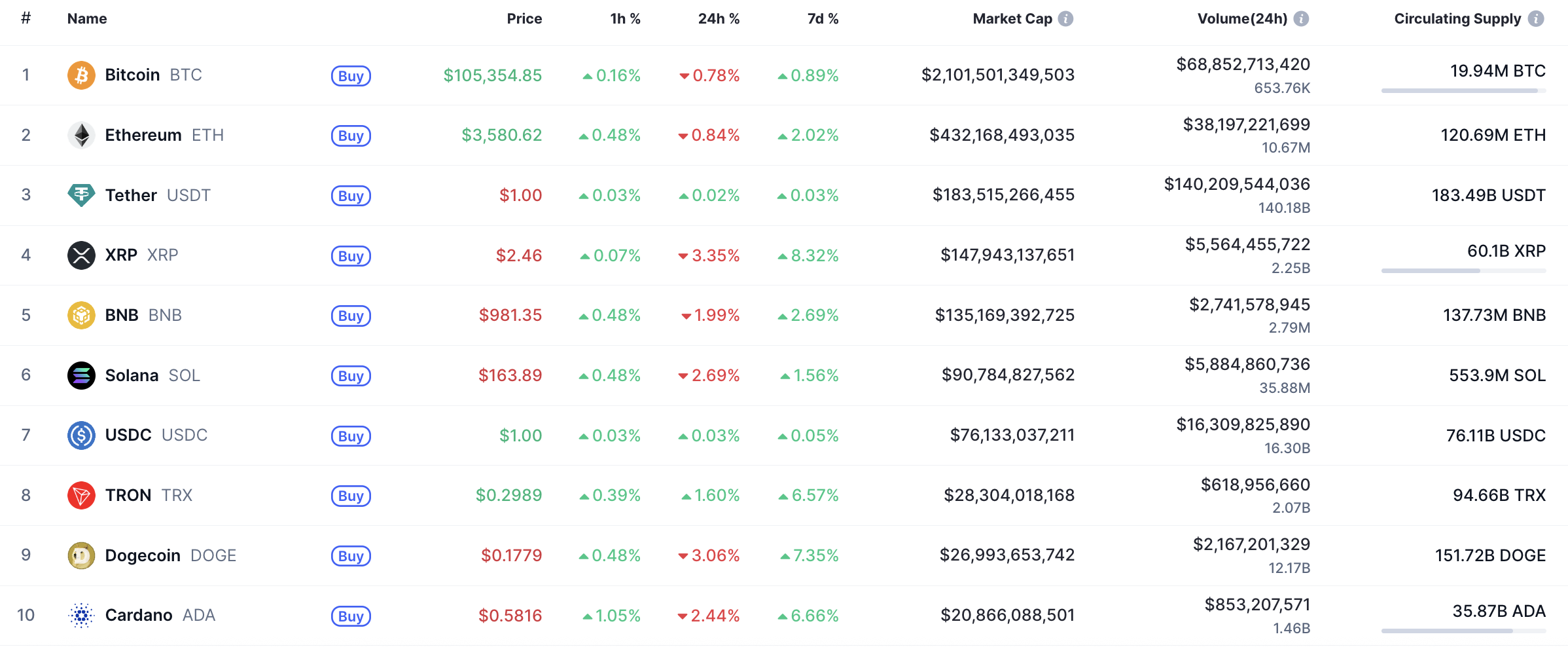

Ripple (XRP), that enigmatic token, traded at $2.45, a mere shadow of its former self, having tumbled 33% from its yearly peak. Oh, the drama of it all! Even the filing of Canary’s 8A with the SEC, usually a harbinger of launch, failed to lift its spirits. Bloomberg’s Eric Balchunas, ever the optimist, predicts trading to commence by Thursday. 🗓️