ZCash Price Explosions: Why It’s Surging and What’s Next! 📈😲

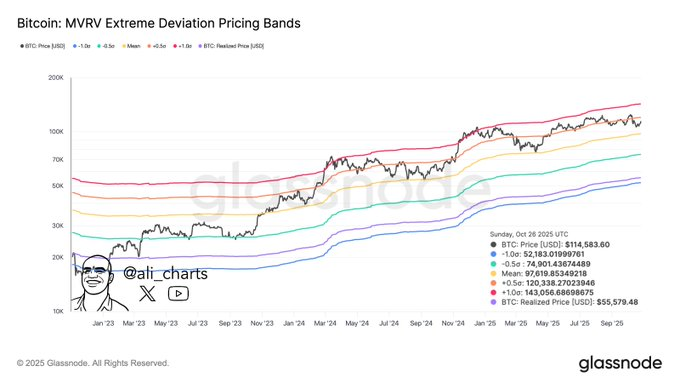

And get this, technical mumbo-jumbo like a rising RSI and a bullish MACD crossover are popping up like bad acne on a teenager’s chart, signaling “healthy” momentum. Meanwhile, the Fed’s been shaking things up elsewhere, sending folks scrambling for refuge in privacy coins like ZCash and Monero. It’s like everyone’s playing a game of financial hide-and-seek. Thanks to this circus, prices are climbing, and now’s the time to obsess over what ZEC might conjure next. Stay tuned, or risk feeling as out-of-the-loop as my dog during a thunderstorm. 💸