BlackRock’s Bitcoin ETP: A London Spectacle! 💰

The FCA, ever the fickle friend, has shifted its stance, allowing retail investors to dabble in crypto-linked products. How progressive! Or perhaps just a little too late for the more adventurous. 😏

The FCA, ever the fickle friend, has shifted its stance, allowing retail investors to dabble in crypto-linked products. How progressive! Or perhaps just a little too late for the more adventurous. 😏

Chainlink price rebounded today, fueled by its reliable oracles compared to traditional data points. Notably, a DNS glitch in a single data center in Northern Virginia cascaded into global chaos, as AWS powers about 32% of the cloud market. Meanwhile, Chainlink oracles, decentralized and steadfast, continued to operate smoothly, like a well-oiled machine in a world of clowns 🧠.

Enter Trader Tardigrade, the cryptic oracle of X (formerly Twitter), who insists DOGE’s uptrend is “solid as a bulldog’s breakfast.” 🐾 His 4-hour chart analysis? A masterclass in understatement. The RSI isn’t just breaking out-it’s doing the Macarena above key support levels. If this coin were any more bullish, it’d start charging interest on optimism.

The $0.34-$0.39 resistance zone, that siren song of market psychology, looms as a crucible; failure to breach it might send FET spiraling back to $0.11, a ghost of its former self. 🧪

And then, like a plot twist from a bad sci-fi flick, along came Elon Musk. 🚀

According to this guy ZachXBT (who probably has a PhD in “I can trace money better than your GPS”), the hacker siphoned funds via Bridgers and then tried to launder them through Huione’s OTC desks. Genius move, right? Or is it just another Tuesday in crypto-land? 🤷

The GitHub repo is giving off major “I’m in this, trust me” vibes, with Yakovenko popping in and out of code commits like it’s nobody’s business. The community’s all abuzz, which makes sense, because who doesn’t love a good mystery involving crypto and a co-founder who might just have a hand in taking over the world?

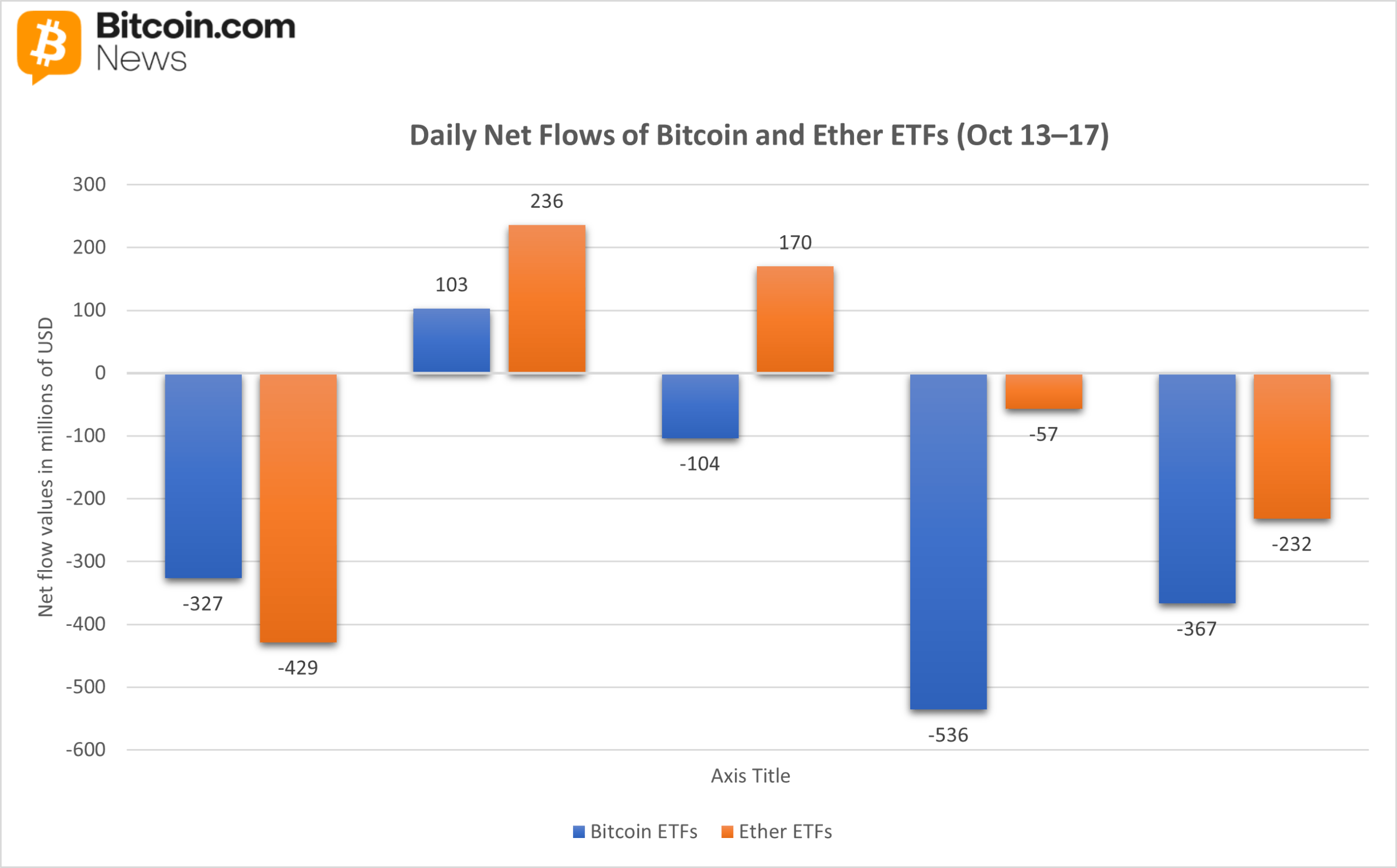

After two weeks of feeling like Warren Buffett’s long-lost cousin, crypto ETF investors suddenly remembered that volatility is a thing. Between Oct. 13 and 17, nearly every major product saw money fleeing faster than a toddler from broccoli. Both bitcoin and ether ETFs ended the week looking redder than a sunburned tourist in Miami.

Ah, the crypto exchange HTX, with its magnanimous gesture, has unveiled a scheme so grand, so audacious, it could only be dubbed “Sail Together.” 🛳️ A $100 million USDT airdrop, you say? How quaint. As if a mere financial bandage could heal the wounds inflicted by the $19 billion market wipeout that sent Bitcoin tumbling to depths unseen in months. 🩹📉

Why is this Friday so special? Well, it’s the first time since 2018 that CPI is released on a Friday. Because nothing says “excitement” like a surprise economic report on a day when most people are already over their coffee. ☕️📉