The Great Crypto Circus: Outflows, Fights, and a Low Supply Surprise 🤡

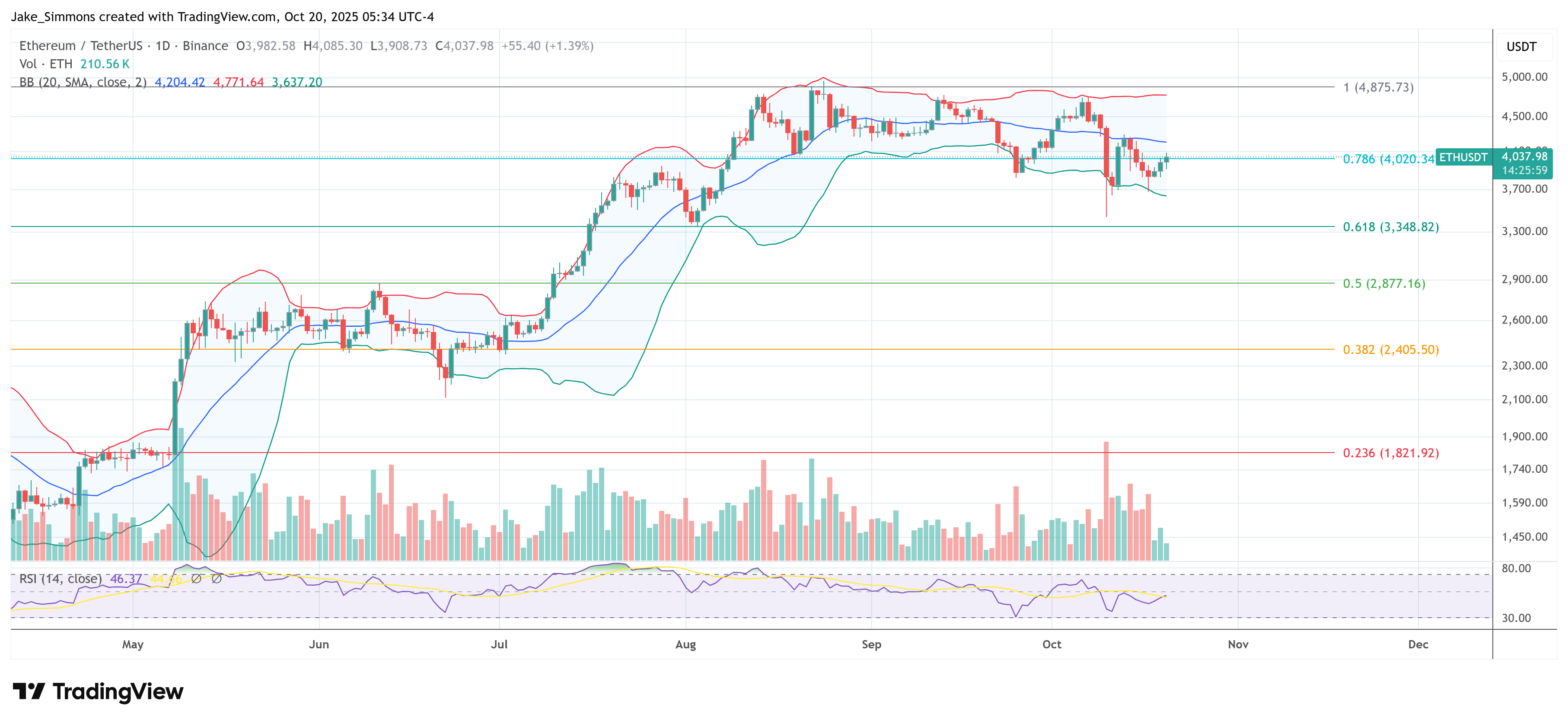

All these tears and tantrums follow a weekend tempest that swept through crypto, wiping out over $19 billion worth of leveraged fools playing the game with fire. The culprit? An unexpected, eyebrow-raising act by none other than Donald Trump-yes, that Trump-who declared a 100% tariff on Chinese imports, sending markets into a frenzy of panic and low liquidity. The kind of chaos where morals and rationality go out the window faster than you can say “pump and dump.”