Is Bitcoin’s Roller Coaster Ride Poised for a Joyful Dip? 🎢💰

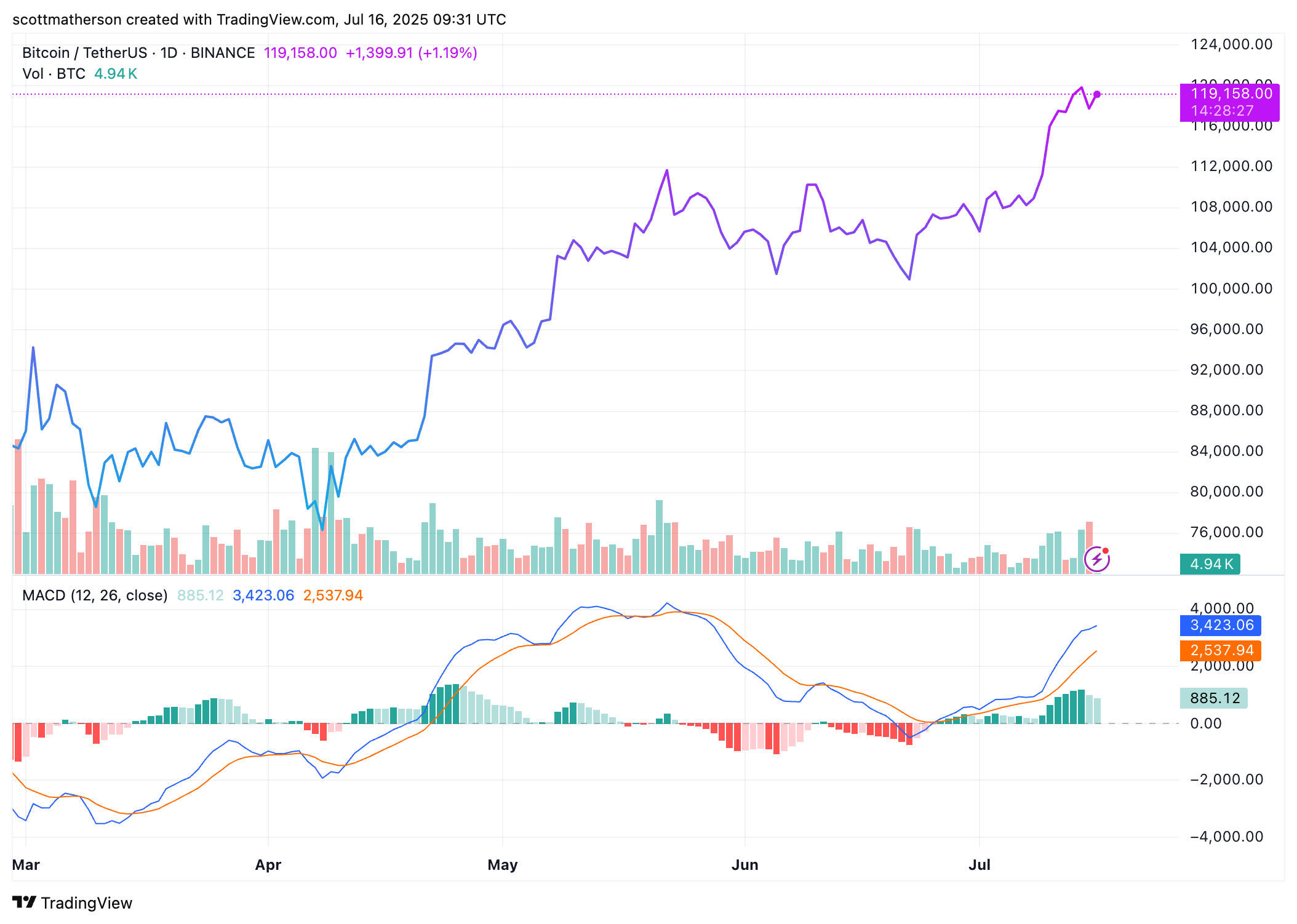

And where did this enchanted digital delight land? Ah, but it settled at a modest local bottom of $116,000, where bids, much like loyal subjects, re-emerged to give their beloved a boost. This performance, dear audience, has one critical act left. QCP Capital whimsically predicts that a plunge to $110,000 may just usher in a solid stage for our Bitcoin pal to gather strength. What foresight! 🤔