Is Ethereum’s $3K Rejection a Spark for ETH’s Next Breakout? 🚀💰

Ethereum [ETH] just took a 2% hit and got rejected hard at a key resistance level, and suddenly $3,000 is looking more like a local top than a launchpad. 🤦♂️

Ethereum [ETH] just took a 2% hit and got rejected hard at a key resistance level, and suddenly $3,000 is looking more like a local top than a launchpad. 🤦♂️

The headline CPI, a beast awakened from its slumber, rose to 2.7% year-over-year, a feat not seen since the distant days of February. The core CPI, a sly and cunning creature, ticked higher to 2.9% annually, leaving the pundits to ponder the meaning of it all 🤔.

With an influx of ETFs, lingering supply woes after the halving, and policies shifting like a playful breeze, the long-term prospects for Bitcoin seem favorable—like a well-placed wager at a farcical comedy! 😏

Ah, Dogecoin [DOGE], the seesaw of the cryptocurrency playground, gallantly surged in early July, reclaiming the sacred ground of $0.19. Like a phoenix, it rose, pulling along the fevered hopes of many who dared dream of withering away toward $0.25.

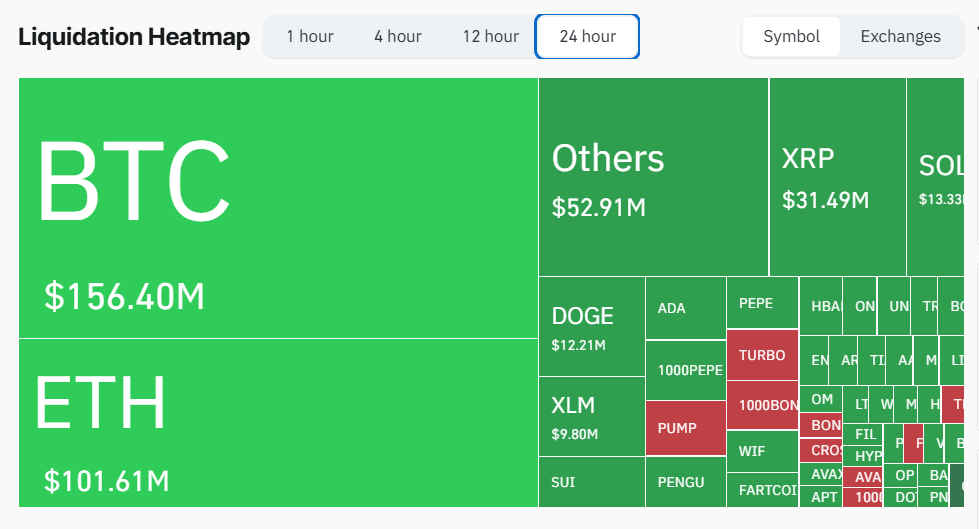

Our dear friend Bitcoin (BTC) is leading the charge, if by ‘charge’ you mean taking a nosedive and obliterating the hopes of short traders everywhere. The liquidation heatmap from Coinglass looks more like a crime scene than a market report.

Enter the stage: Caffeine, unveiled amid whispers of disbelief in a San Francisco soiree dubbed “Hello, Self-Writing Internet” on that fateful day in July 2025. It invites users into the wonderland of decentralized apps—no coding sorcery required. A true marvel, indeed! 🪄

In the sweltering days of late June and early July, Bit Digital orchestrated a grand portfolio ballet, pirouetting from Bitcoin to Ethereum. They now possess one of the most impressive corporate Ethereum treasuries globally, holding over 100,600 coins worth a staggering $301 million—quite the upgrade from their meager stash of 280 Bitcoins, reinvested into this new obsession.

As per the illuminating prose of the Bitfinex Alpha report, this recent ascension is orchestrated by an ensemble of dynamics: an audacious demand for ETFs, a fervent accumulation from the grass roots, and a canvas painted with strokes of macroeconomic conundrums. Together, they craft a grand tapestry wherein Bitcoin is not merely a speculative plaything but a venerable hedge with undeniable fortitude. Who would have thought?

According to Radio New Zealand (because, of course, this all happens in New Zealand), Julia is being accused of stealing her mom’s secret stash of money, which, surprise surprise, wasn’t stashed in a bank account. Nope, Helen thought she was too smart for that and kept it hidden in various plastic bags around the house. Classic move, right?

Instead of publicly displaying almost 90 wallet addresses on its websites as was previously done, the current procedure now in operation has replaced this practice.