Solana’s DeFi Explosion: New Protocols Take the Lead!

New protocols like JTO, KMNO, and Jupiter [JUP] are now at the top, showing a shift in how users and developers are interacting with the network.

New protocols like JTO, KMNO, and Jupiter [JUP] are now at the top, showing a shift in how users and developers are interacting with the network.

Could this be the harbinger of the next great ascent, or merely a cruel jest of the market gods?

For the time being, Satoshi remains the reigning sovereign of the top cryptocurrency, boasting a formidable 1,123,500 BTC. This figure, of course, is derived from a pattern-based blockchain analysis, and is thus subject to the whims of fate and fortune. 🔍

The Donald Trump-inspired meme coin is making its way to Tron, as confirmed by the X account run by Fight Fight Fight LLC—a Delaware-based firm and one of the main entities behind the official TRUMP token. The update comes shortly after Tron’s founder, Justin Sun, announced that World Financial Liberty’s stablecoin USD1 had also launched on the Tron blockchain. TRUMP hasn’t been keeping pace with other digital assets lately; over the last 30 days, the token has dropped nearly 17% against the U.S. dollar. Currently priced at $8.49 per coin, TRUMP is also down 88.4% from its all-time high of $73.43 reached six months ago on Jan. 19, 2025. 📉😱

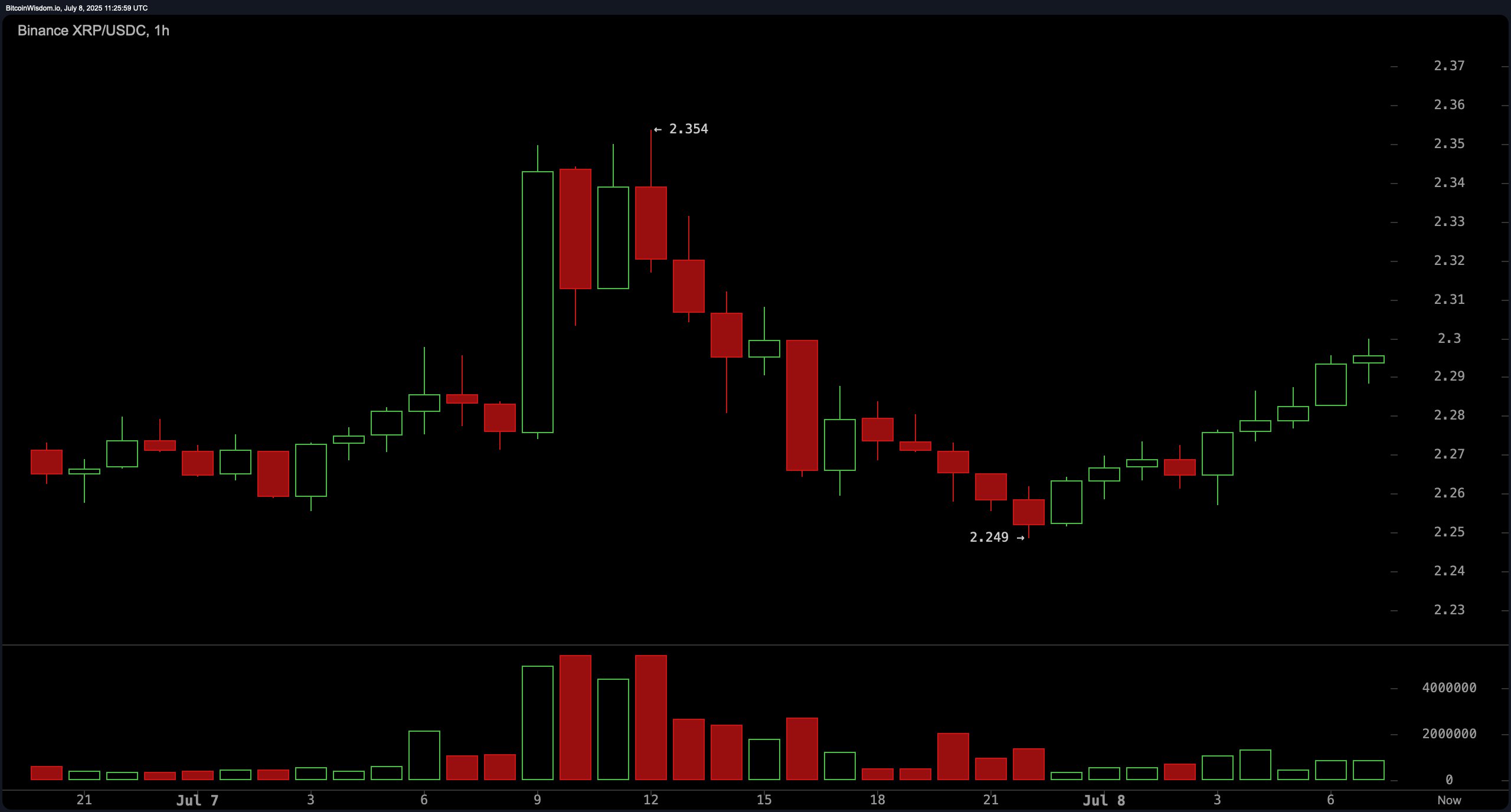

The one-hour chart looks like a soap opera marathon—XRP makes a dramatic exit at $2.354, only to slink back in at $2.249, before attempting a comeback. If you’re braver than my taste in karaoke, maybe you’d jump in around $2.28–$2.29 (pullback permitting). Should XRP strut above $2.31–$2.32 in a flurry of green candles and FOMO, that’s your cue for an adrenaline-fueled scalp. Targets: $2.33–$2.35, stop-loss sensibly tucked nearby at $2.26—because, in crypto, you need seatbelts.

This volume (imagine enough coins to turn Scrooge McDuck green with envy) is sitting right at breakeven. Almost everyone’s in the red — it’s like a crypto version of a DMV line: nobody’s happy, everyone’s stuck, but nobody’s leaving. That 1.29% of total supply? Heavy enough to keep SHIB glued in place. The diamond paws are holding the fort. For now.

H.C. Wainwright has actually thrown away its price target for Core Scientific, probably in the same way most people throw away their January gym pledges. Why bother? Now, whatever drama happens at CoreWeave will waltz straight over to CoreSci, hand in hand—clingy much?

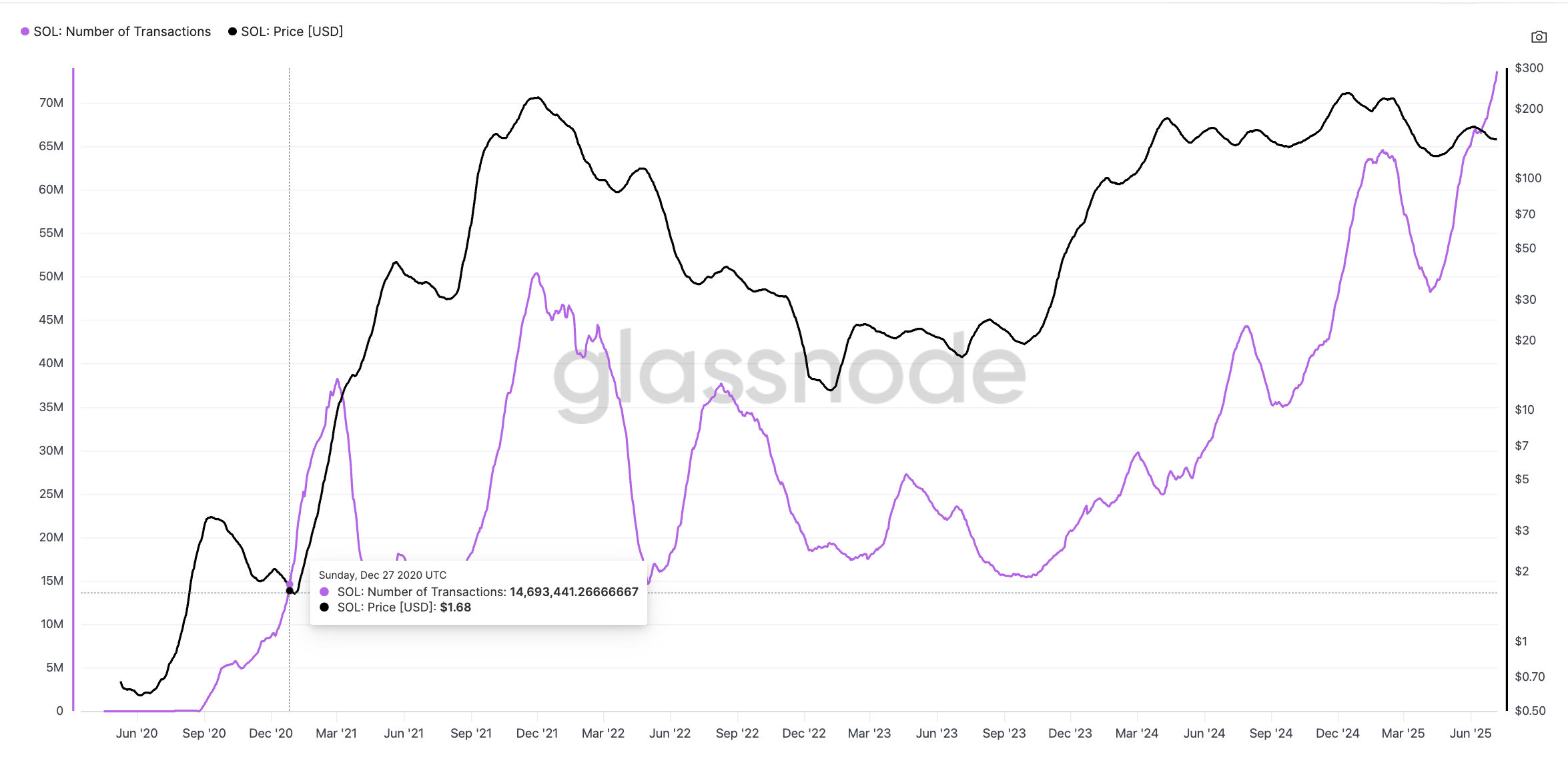

This increase in transaction volume suggests that more investors are getting involved, and perhaps the whales are just getting ready for the next leg of their grand adventure. 🐳 With a strong push above its clustered moving averages, including the 50, 100, and 200 EMA bands, XRP has produced a clear technical setup on the price chart that is rarely observed without a bit of follow-through momentum. It’s like setting up a perfect jump in a video game—exciting, but you still need to press the button at the right time.

Sources within the dialogue (because, of course, everyone has a source) hint that the Commission’s trading-and-markets division isn’t exactly in the mood to linger. One brave soul who spoke to CoinDesk shared the opinion that the SEC might be feeling the heat to approve these things faster than the original plan. You see, that Rex Shares product got the green light last week, and, well, that’s definitely not going to sit well with anyone who was hoping to delay things until October. The pressure is real, folks, and it’s totally not because of competition… or is it? 😎

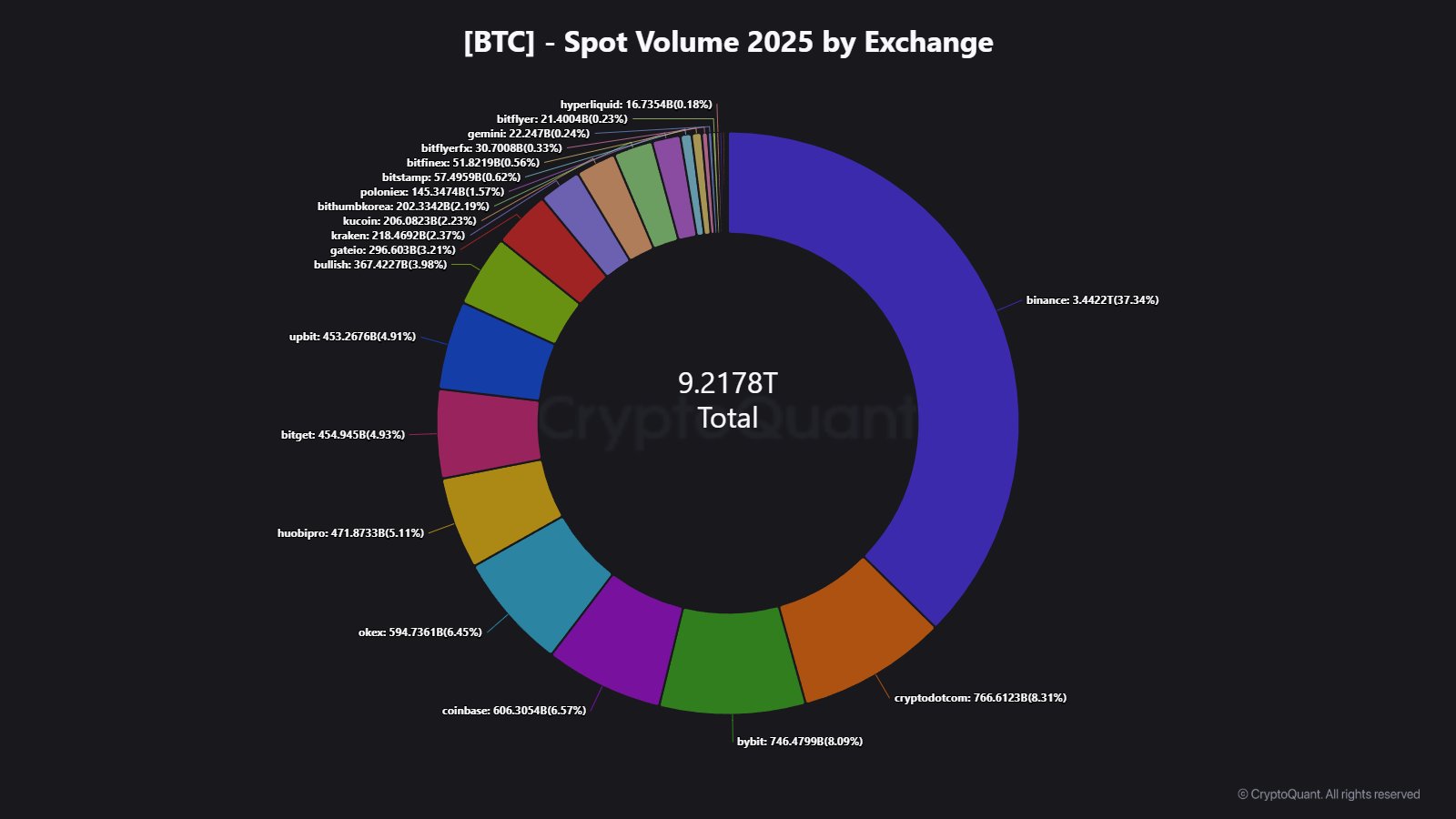

Trailing behind in the shadow of this giant are Bybit, Crypto.com, Coinbase, and OKX. Together they make up about 29% of the market. “Oh, 29%, that’s cute,” one might say, perhaps while gently patting them on the back. But in this game of sharks, 29% is nothing but a mere snack for Binance’s insatiable appetite. Still, they’re the biggest fish in the second-tier pond, so let’s give them credit for surviving this long. Their bite, however, doesn’t even remotely match Binance’s gargantuan chomps.